Assalamu Alaikum Dosto!

Bearish Meeting Line Pattern

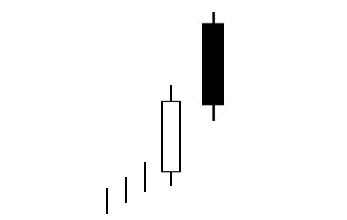

Bearish meeting line pattern jo k bullish meeting line pattern k opposite direction main banta hai, two days candles par mushtamil hota hai. Ye pattern prices k top ya high price main banta hai, jo k bearish trend reversal pattern ka kaam karta hai. Pattern dekhne main same bearish belt-hold line pattern aur piercing line pattern se mushabehat rakhta hai. Ye teeno patterns prices k leye beariah trend reversal pattern ka kaam karta hai, jab k ye pattern bullish continuation pattern "Bullish Thrusting Line Pattern" se bhi formation main melta hai, jo k bullish trend continuation pattern hai. Ye pattern bearish aur bullish candles se mel kar bana hai, jiss main bearish candle bullish candle se ooper gap main open hoti hai, lekin gap ka humen iss waja se clear pata nahi chalta q k ye gap bearish candle ki real body se cover hota hai.

Candles Formation

Bearish meeting line candlestick pattern prices k top ya upper prices par low demand ki waja se banta hai, jahan par do candles prices ki trend change ka aik positive signal deta hai. Pattern ki dono candles strong real body main banti hai, aur market ki current supply aur demand ki akasi karti hai. Pattern main shamil candles ki formation darjazel tarah se hoti hai;

1. First Candle: Bearish meeting line candlestick pattern ki pehli candle aik bullish candle hoti hai, jo k market main maojood current trend ki akasi karti hai. Ye candle prices ko higher side par push karti hai, jiss main candle ka close price open price se upper side par hota hai. Ye candle shadow samet ya shadow k bagher bhi ho sakti hai.

2. Second Candle: Bearish meeting line candlestick pattern ki dosri candle aik real body wali bearish candle hoti hai. Ye candle open pehli candle k top par gap main hoti hai, jab k close same pehli candle k close price par hota hai. Bearish candle market main current bullish trend ka khatma karti hai, aur prices ko aik new semat deti hai, jo k bearish trend reversal hota hai.

Explaination

Bearish meeting line pattern two days k candles par mushtamil aik bearish reversal pattern hai, jis me pehle din ki candle aik long bullish candle hoti hai, jo k market me pehle trend k mutabiq banti hai, jab k dosre din ki candle aik long bearish candle hoti hai, jo k open to bullish candle se upper gap main hai, lekin close pehle candle k same close price par hota hai. Pattern main shamil dono candles ka close prices in-line same point par hota hai. Dosre din ki candle bearish trend k aghazz k sath sath bullish trend k ikhtetaam ka bhi bahis batti hai. Ye pattern Bullish meeting line pattern ka opposite hai aur uptrend main banta hai. Jab k pattern dekhne main same bullish thrusting line pattern jaisa hai. Pattern ki dosri candle ka close point lazmi pehli candle k same close price par hona chaheye.

Trading

Bearish meeting line pattern jahan traders ko sell ka signal deta hai, wahan dosri taraf ye trend reversal hone par humen market se exit hone k bare main bhi batata hai. Ye pattern uptrend me banta hai, jahhan pe prices bohut high area par trade kar rahi hoti hai. Pattern pe trade karne se pehle prices ka uptrend aur trend confirmation lazmi confirm hona chaheye. Agar pattern k baad teesri candle bhi bearish banti hai, to ye position market me sell ki entry ka hoga. Pattern ki confirmation indicators jaise RSI, CCI indicator aur stochastic oscillator par value overbought zone main hone se confirm hota hai. Stop Loss pattern k sab se higher point ya bearish candle k high price se do pips above rakhen.

تبصرہ

Расширенный режим Обычный режим