Breaking line pattern

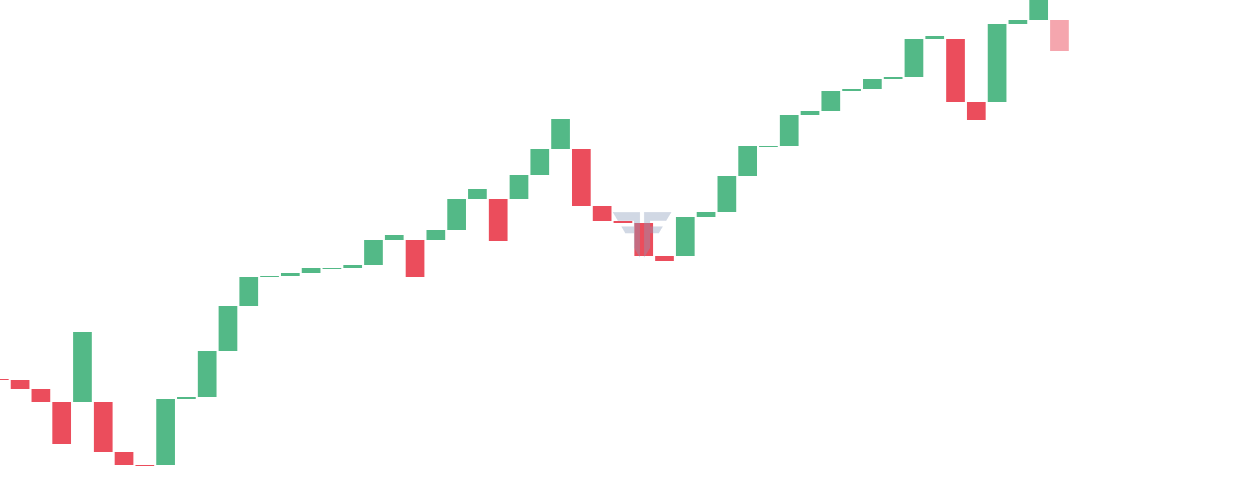

Breaking line pattern is waqat creat hota hai jab market continue downward movement kerty huey jah aik bearish candle complete hony ky bahd next candle kuch gap ky sath down sy start ho ker bullish candle is terha sy creat ho ky last bearish candle ky more than fifty percent per close ho jaey tou aesy main jo pattern creat hota hai usko Breaking line pattern kethy hain aur jab yeh pattern complete hota hai tou isky bahd market ki hundred percent movement ka uptrend start ho jata hai aur wahan per buy ki trade open ker ky ham bahot achi earning ker sakty hain.

Trading Strategy with Breaking line pattern

Forex market hamesha kisi na kisi pattern ki base per movement ker rehi hoti hai agar Ham tamam patterns ko achi terha samajh lain tou forex market main hamari liay trade kerna asan ho jata hai ky jab pattern ki base per market movement ker rehi hoti hai tou aesy time per Ham pattern ky knowledge ky mutabiq trade open ker ky bahot achi earning ker sakty hain

Timeframe for Breaking line pattern

Is pattern me apko trade buy ki avail krni chye aor apka stoploss beolw the support honq chye yeh aik confirm trade bn sakti hai trrading market ma candlestick chart ko bahot powerful smjha jata hai Forex trading business sab sy bara technical tool trading chart he hai trading chart ky ander different time frame hain lkn agr ap higher time frame use kren gay to iski achi predictions milen gi aor double boot on pattern agr 4h ya is sy bary trading chart py bny to yeh zeyada perfect ho ga.

Breaking line pattern is waqat creat hota hai jab market continue downward movement kerty huey jah aik bearish candle complete hony ky bahd next candle kuch gap ky sath down sy start ho ker bullish candle is terha sy creat ho ky last bearish candle ky more than fifty percent per close ho jaey tou aesy main jo pattern creat hota hai usko Breaking line pattern kethy hain aur jab yeh pattern complete hota hai tou isky bahd market ki hundred percent movement ka uptrend start ho jata hai aur wahan per buy ki trade open ker ky ham bahot achi earning ker sakty hain.

Trading Strategy with Breaking line pattern

Forex market hamesha kisi na kisi pattern ki base per movement ker rehi hoti hai agar Ham tamam patterns ko achi terha samajh lain tou forex market main hamari liay trade kerna asan ho jata hai ky jab pattern ki base per market movement ker rehi hoti hai tou aesy time per Ham pattern ky knowledge ky mutabiq trade open ker ky bahot achi earning ker sakty hain

Timeframe for Breaking line pattern

Is pattern me apko trade buy ki avail krni chye aor apka stoploss beolw the support honq chye yeh aik confirm trade bn sakti hai trrading market ma candlestick chart ko bahot powerful smjha jata hai Forex trading business sab sy bara technical tool trading chart he hai trading chart ky ander different time frame hain lkn agr ap higher time frame use kren gay to iski achi predictions milen gi aor double boot on pattern agr 4h ya is sy bary trading chart py bny to yeh zeyada perfect ho ga.

تبصرہ

Расширенный режим Обычный режим