Introducation

Dear friends umeed krta ho kay ap sub thai hun ga Forex mein bohat say indicators hota hein jab be hum treading karta hein tu bohat say indicators ko use krta hein RSI be asa he ek indicator hay jis mein ka alag chota sa chart open ho jata hay Forex ka chart mein he

Uses Of RSi

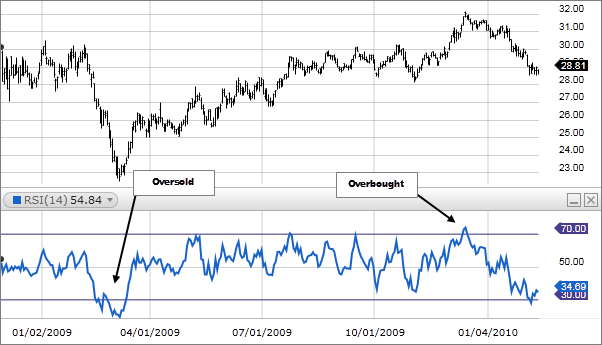

Relative strength index ek indicator hay is ko be hum market ko analysis karna ka lyia use krta hein humay rsi ek bahut help dati hay market ko analysis krna ka chyia or is ka ek best uses ya hay ka jab be market rsi ka chart mein 70 upper ko touch kra tu market lazmi sell ki treaf jati hay asa mein humay sell ki tread lani chyia or jab market necha say 30 ko touch karti hay tu market lamzi buy ki tareef move karti hay asa mein humay buy ki treading lani chyia or is chart ko humay 1hr ya 4 hr ka time frame pr use krni chyia ta kay humay acha profit ho or humari tread successful bna.

Over Sold.

Rsi ka chart mein jab be market girti hui 30 say necha chle jay tu ous time market oversold hoti hay humay is time wait karna chyia kay market move krti hui or be necha ja skti hay or whn say ak time ata hay kay merket buy ki treaf move karti hay asa mein humay analysis kar kay ek achi strategy say tread buy kr lagni chyia ta kay humay acha say acha profit hasil ho.

Over Bought.

Asa he Rsi chart jab be uper jata huya buy mein 70 chart ko cross kr la tu asa he ek time ata hay jhn say market downward move hoti hay asa mein humay analysis krna chiye take jab be market downward move hone laga tu humay tread sell ki lani chyia ta kay humay acha profit ho.

Dear friends umeed krta ho kay ap sub thai hun ga Forex mein bohat say indicators hota hein jab be hum treading karta hein tu bohat say indicators ko use krta hein RSI be asa he ek indicator hay jis mein ka alag chota sa chart open ho jata hay Forex ka chart mein he

Uses Of RSi

Relative strength index ek indicator hay is ko be hum market ko analysis karna ka lyia use krta hein humay rsi ek bahut help dati hay market ko analysis krna ka chyia or is ka ek best uses ya hay ka jab be market rsi ka chart mein 70 upper ko touch kra tu market lazmi sell ki treaf jati hay asa mein humay sell ki tread lani chyia or jab market necha say 30 ko touch karti hay tu market lamzi buy ki tareef move karti hay asa mein humay buy ki treading lani chyia or is chart ko humay 1hr ya 4 hr ka time frame pr use krni chyia ta kay humay acha profit ho or humari tread successful bna.

Over Sold.

Rsi ka chart mein jab be market girti hui 30 say necha chle jay tu ous time market oversold hoti hay humay is time wait karna chyia kay market move krti hui or be necha ja skti hay or whn say ak time ata hay kay merket buy ki treaf move karti hay asa mein humay analysis kar kay ek achi strategy say tread buy kr lagni chyia ta kay humay acha say acha profit hasil ho.

Over Bought.

Asa he Rsi chart jab be uper jata huya buy mein 70 chart ko cross kr la tu asa he ek time ata hay jhn say market downward move hoti hay asa mein humay analysis krna chiye take jab be market downward move hone laga tu humay tread sell ki lani chyia ta kay humay acha profit ho.

تبصرہ

Расширенный режим Обычный режим