Slam!

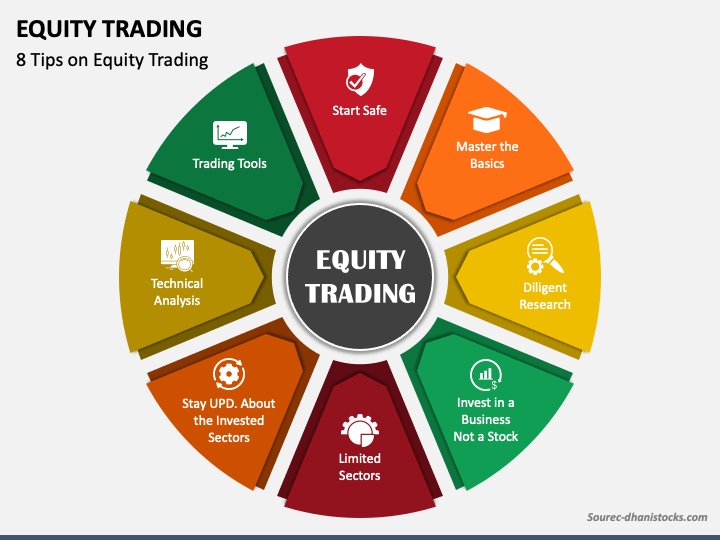

Umeed krta hu ap khriyat se hon gy. Forum pr ziada se ziada mehnat kr k bht kuch seekh rhy hon gy. Achi achi post kr k ziada se ziada bonus hasil krny k liye struggle kr rhy hon gy. Dosto trading k ander account ma equity ka option mjood hta h. Plz seniors members isy details k sath explain kr den.

Umeed krta hu ap khriyat se hon gy. Forum pr ziada se ziada mehnat kr k bht kuch seekh rhy hon gy. Achi achi post kr k ziada se ziada bonus hasil krny k liye struggle kr rhy hon gy. Dosto trading k ander account ma equity ka option mjood hta h. Plz seniors members isy details k sath explain kr den.

تبصرہ

Расширенный режим Обычный режим