?What are lots in forex

AOA,

Lot size forex trading mein bohat kuch pemaiesh ki aik standardised unit hai jisay kisi khaas tijarat ke hajam ya size ko bayan karne ke liye istemaal kya jata hai. bohat kuch tijarat mein kharidi ya baichi gayi currency ki raqam ki numaindagi karta hai. ghair mulki currency ( forex ) ke tajir mukhtalif laat size paish karte hain jinhein market mein daakhil honay ke liye istemaal kya ja sakta hai .

lot in forex trading ya exchange mein lot position ke hajam ke liye pemaiesh ki aik ikai hai, forex market mein account bees currency ki aik muqarara raqam. hajam hamesha Lot size mein zahir hota hai, aur position trade ka size barah e raast khatray ki satah ko mutasir karta hai. forex mein aik laat ka hajam jitna ziyada hoga, khatrah itna hi ziyada hoga. risk assessment ( risk managment ) mein aik aisa model shaamil hota hai jo aap ko ghair mulki zar e mubadla ki market mein standard laat ki ziyada se ziyada miqdaar ka takhmeenah account ke khatray ki satah, utaar charhao ( stop nuqsaan ki satah ) aur kaafi khatraat ke sath honay walay lyorij ki bunyaad par durust tareeqay se hisaab karne ki ijazat deta hai. is model ke baray mein jan-nay ke liye mazmoon parheen, usay kaisay istemaal kya jaye, aur kis terhan tajir ki position size calculator madad kar sakta hai .

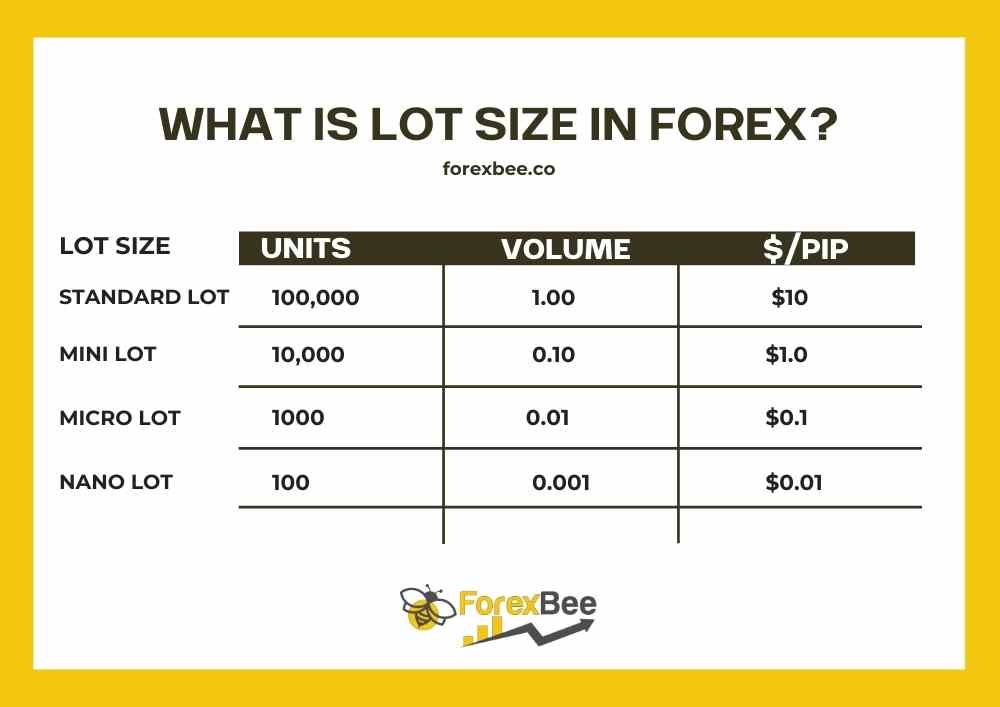

– Standard lot: yah jo standard lot ye ek largest lot size hai forex trading par. aghr hum isko equal kre 100,000 units jo k iski base currency hai. For example, aghr ap trading EUR/USD, is par standard lot jo k humre 100,000 euros k equal hai.

– Mini lot: yah jo mini lot isko one-tenth kaha jata hy standard lot ky. aghr hum isko equal kre 100,000 units jo k iski base currency hai. For example, aghr hum trading EUR/USD, yah ek mini lot hai jo k 10,000 euros k barabar hai.

– Micro lot: micro lot isko one-tenth kaha jata hai mini lot hoti hai. yah equal to 1,000 units jo k iski base currency hai. For example, aghr ap is par trading kre tu EUR/USD, a micro lot be same equal hota hai 1,000 euros.

تبصرہ

Расширенный режим Обычный режим