Re: Long term trade and short term trade ..

Assalamualaikum dear friends

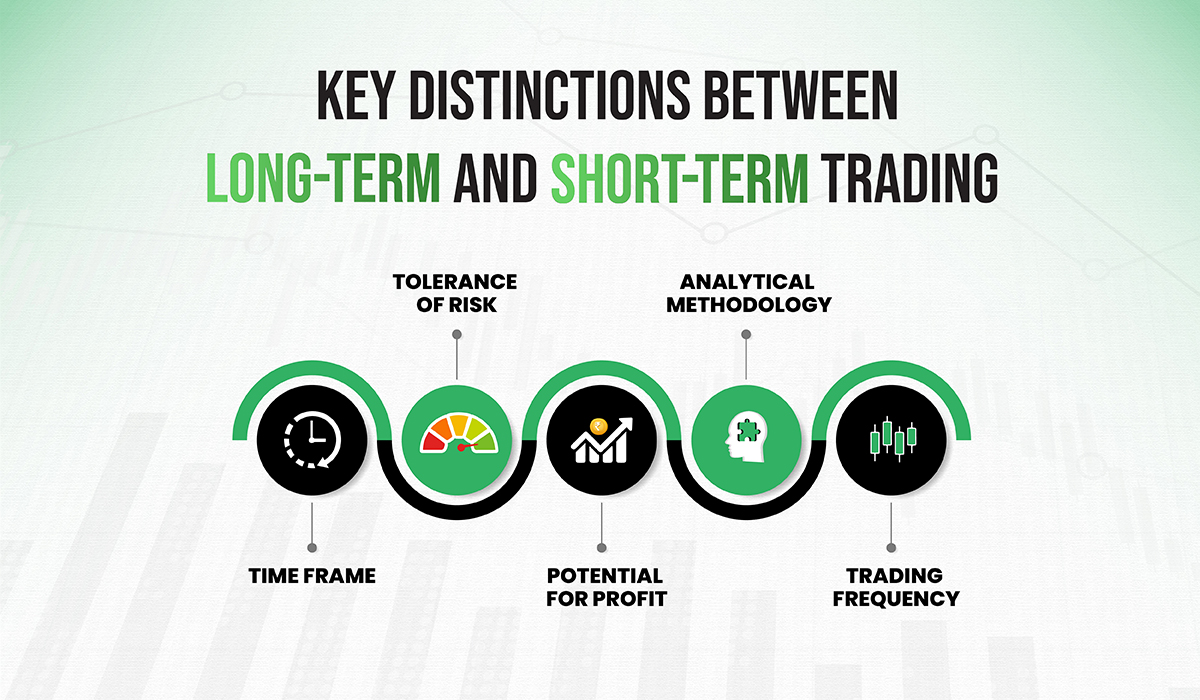

Forex me ham lon term or short term dono trades lga skty Han....lkn beginers k liye day trading krna hi zyada zest rehta ha q k unka itna experience or knwldge high ni hota

Jb k long term trading k liye high level ka knwldge or experience chiye hota ha ...long term trading k benefits boht Han q k long term trading se high profit gain hota ha ....lkn isk sth sth market ki direction change hony se loss b boht face krna pr skta ha ...isliye long term trading ki trf expert traders hi move krty Han Jo market or trend ki direction ki different indicators k sth understand kr skty Han or apni trade k risk ko reduce krna janty hon

Assalamualaikum dear friends

Forex me ham lon term or short term dono trades lga skty Han....lkn beginers k liye day trading krna hi zyada zest rehta ha q k unka itna experience or knwldge high ni hota

Jb k long term trading k liye high level ka knwldge or experience chiye hota ha ...long term trading k benefits boht Han q k long term trading se high profit gain hota ha ....lkn isk sth sth market ki direction change hony se loss b boht face krna pr skta ha ...isliye long term trading ki trf expert traders hi move krty Han Jo market or trend ki direction ki different indicators k sth understand kr skty Han or apni trade k risk ko reduce krna janty hon

تبصرہ

Расширенный режим Обычный режим