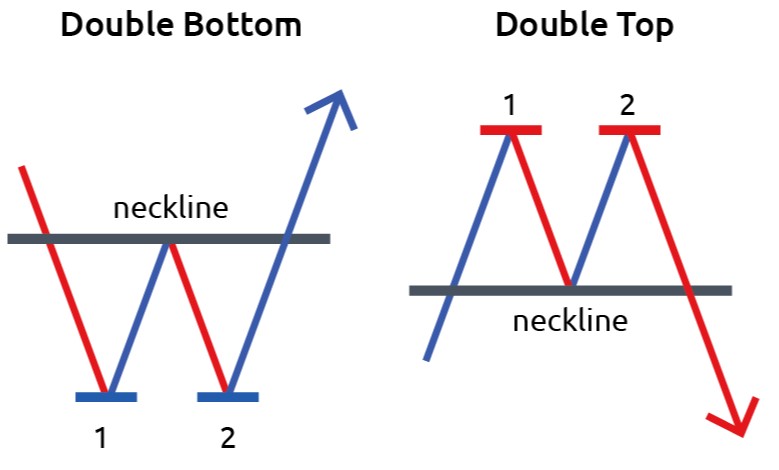

Technical analysis key base par hi traders market key top aur bottom lines ko identify kar sakty hey es key ley sab se best aur perfect trading indicators ka intekham karna bahot ehmeyat rakty hey, market key top aur bottom lines ko 2 hi indicators esy hey jo key behtar tareeqy se identify karny ki quality rakty hey, ye 2 indicators ye hey,

1. Support and resistance level

2. RSI indicator.

1. Support and resistance level

2. RSI indicator.

:max_bytes(150000):strip_icc()/dotdash_Final_Trading_Double_Tops_And_Double_Bottoms_Jun_2020-01-ac00fe2588824f3f80e286a1905e6252.jpg)

تبصرہ

Расширенный режим Обычный режим