Brief Description.

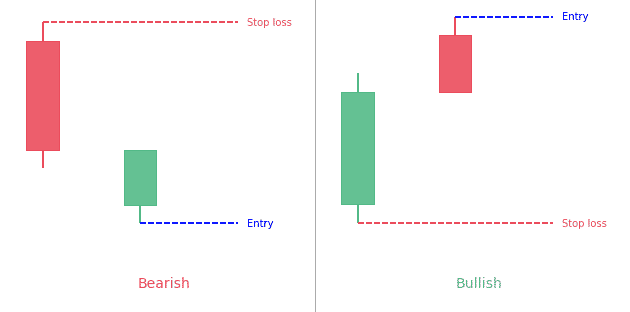

On Neck candlesticks chart pattern ka taluq 2 candlesticks se hota hai. Pehli candlestick lambi bearish hoti hai jo market mein girawat ko show karti hai aur doosri candlestick chhoti bullish ya neutral hoti hai jo pehli candlestick ke niche close hoti hai. Yeh pattern aksar bearish trend ke continuation ka ishara deta ha Basically yea short-term continuation pattern hota hai jo financial markets mein zyada tar downtrend ke dauran dekha jata hai. Is Traders is pattern ka use karte hain taake short-term opportunities ko samajh sakein aur apne trades plan karein.

Structure of Trading Partner.

On the Neck pattern main 2nd candlestick pehli candlestick ke body ke bilkul near close hoti hai, toh isay "On Neck" kehte hain. Yeh pattern aksar market mein uncertainty ko show karta hai jahan buyers aur sellers mein tug-of-war hoti hai. Pehli candlestick ka lamba bearish body price mein girawat ko zahir karta hai, lekin doosri candlestick ka chhota bullish body ye signal deta hai ke price temporarily ruk gaya hai. Yeh pattern tab banta hai jab market ke sentiments abhi bearish hote hain, magar kuch bullish interest bhi hota hai.

Trading Strategy.

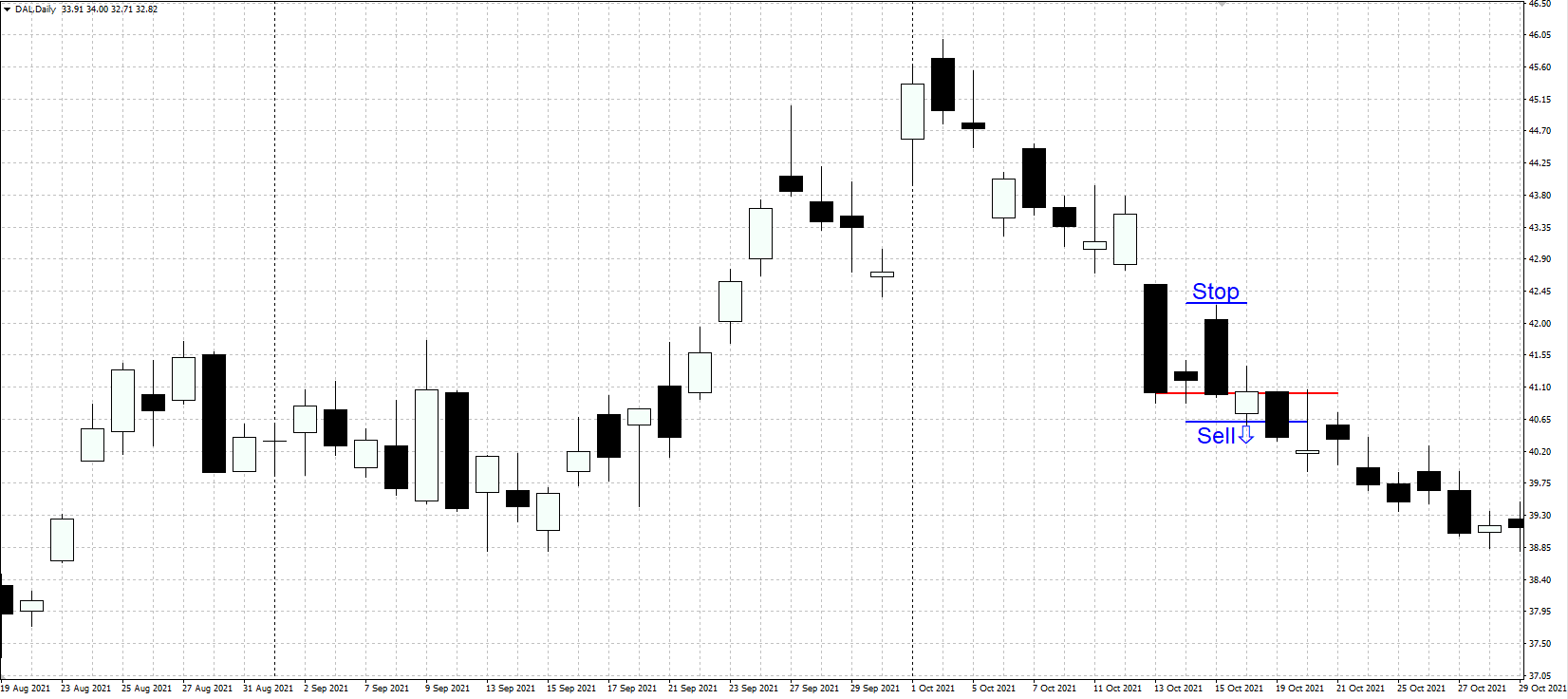

Traders aksar Neck candlesticks chart agar price ooper break kare, toh yeh sign hota hai ke downtrend khatam ho sakta hai. Is pattern ke analysis ke liye, volume ka observation bhi zaroori hota hai. Agar volume high ho pehli candlestick ke dauran aur low ho doosri candlestick mein toh yeh bearish continuation ke liye zyada reliable hota hai.

pattern ko price action ke sath mila ke dekhte hain. Jab yeh pattern appear hota hai, to aksar iska matlab hota hai ke price girne wala hai. Is pattern ke baad agar price neeche break kare, toh yeh short-selling ka mauqa de sakta hai.

On Neck candlesticks chart pattern ka taluq 2 candlesticks se hota hai. Pehli candlestick lambi bearish hoti hai jo market mein girawat ko show karti hai aur doosri candlestick chhoti bullish ya neutral hoti hai jo pehli candlestick ke niche close hoti hai. Yeh pattern aksar bearish trend ke continuation ka ishara deta ha Basically yea short-term continuation pattern hota hai jo financial markets mein zyada tar downtrend ke dauran dekha jata hai. Is Traders is pattern ka use karte hain taake short-term opportunities ko samajh sakein aur apne trades plan karein.

Structure of Trading Partner.

On the Neck pattern main 2nd candlestick pehli candlestick ke body ke bilkul near close hoti hai, toh isay "On Neck" kehte hain. Yeh pattern aksar market mein uncertainty ko show karta hai jahan buyers aur sellers mein tug-of-war hoti hai. Pehli candlestick ka lamba bearish body price mein girawat ko zahir karta hai, lekin doosri candlestick ka chhota bullish body ye signal deta hai ke price temporarily ruk gaya hai. Yeh pattern tab banta hai jab market ke sentiments abhi bearish hote hain, magar kuch bullish interest bhi hota hai.

Trading Strategy.

Traders aksar Neck candlesticks chart agar price ooper break kare, toh yeh sign hota hai ke downtrend khatam ho sakta hai. Is pattern ke analysis ke liye, volume ka observation bhi zaroori hota hai. Agar volume high ho pehli candlestick ke dauran aur low ho doosri candlestick mein toh yeh bearish continuation ke liye zyada reliable hota hai.

pattern ko price action ke sath mila ke dekhte hain. Jab yeh pattern appear hota hai, to aksar iska matlab hota hai ke price girne wala hai. Is pattern ke baad agar price neeche break kare, toh yeh short-selling ka mauqa de sakta hai.

تبصرہ

Расширенный режим Обычный режим