Bullish Hammer Candlestick Pattern: Ek Tafseeli Wazahat

Bullish Hammer ek khas candlestick pattern hai jo market ke reversal signal ko indicate karta hai. Yeh pattern aksar bearish trend ke baad banta hai aur iska matlab hota hai ke price ne neeche ki taraf bohot zyada move kiya hai, lekin phir usne upar ki taraf bhi strong reversal dikhaya hai. Is pattern ka istemal traders market ke reversal ko pehchannay ke liye karte hain, jisme price ke neeche se upar tak ke move ko samjha jaata hai.

Bullish Hammer Ka Structure:

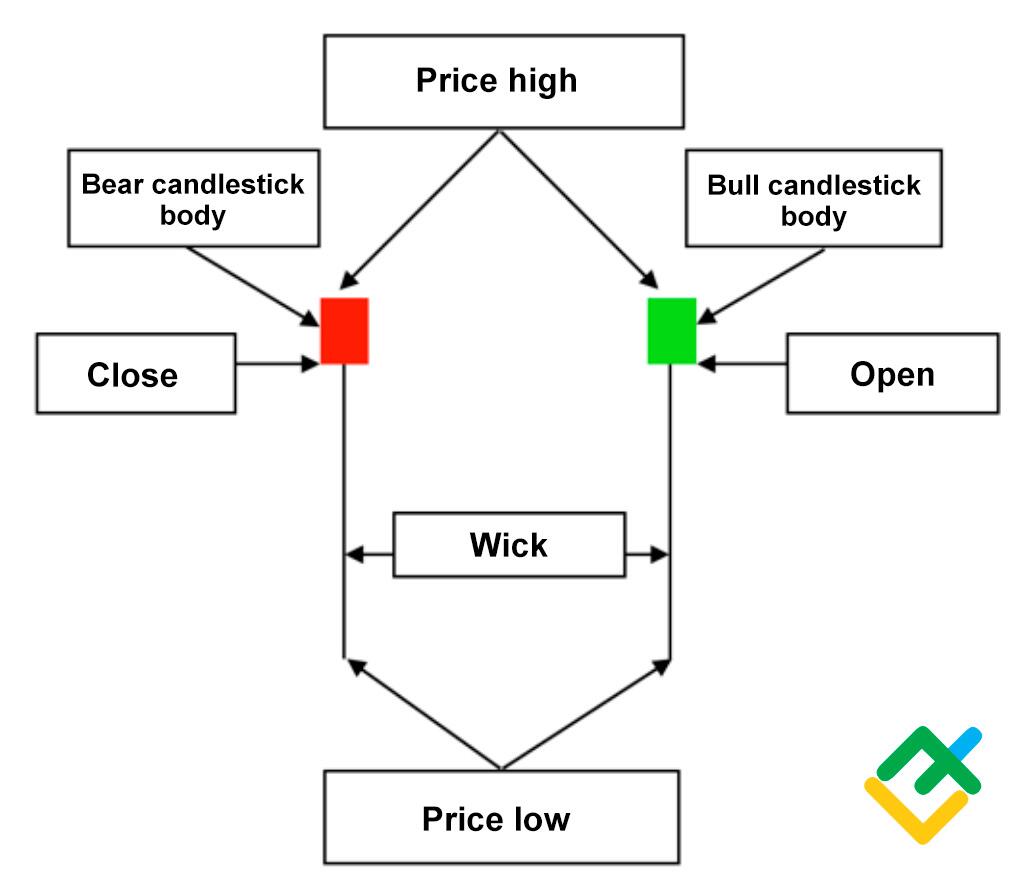

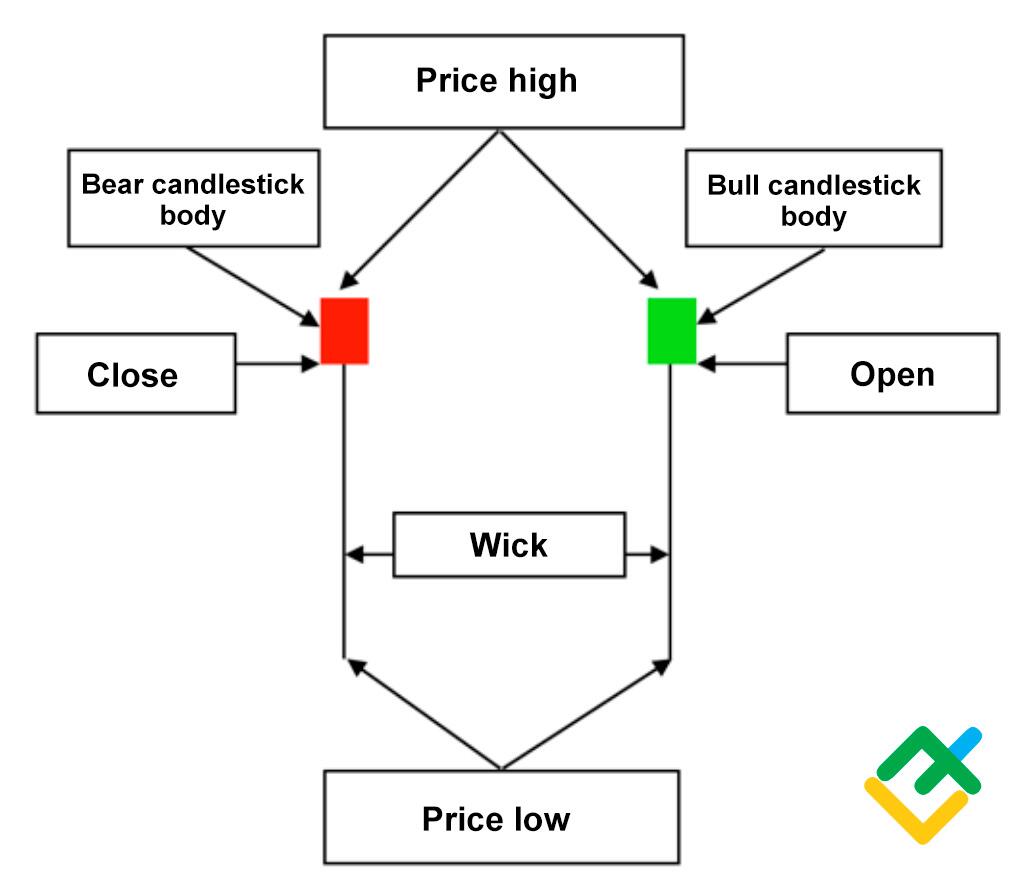

Bullish Hammer candlestick pattern ka structure kuch is tarah ka hota hai:

1. Body (Jism): Is pattern ka body (candlestick ka asli part) chhota hota hai aur yeh neeche ki taraf close hota hai. Yeh body usually white (green) ya black (red) ho sakti hai, lekin zyada significance iska tail hoti hai.

2. Lower Shadow (Tail): Sabse khaas cheez jo bullish hammer ko pehchaan deti hai, wo hai iska lamba lower shadow ya tail. Yeh shadow body ke mukable mein kaafi lamba hota hai, jo ke price ke neeche ki taraf ki movement ko dikhata hai. Iska matlab hota hai ke market ne neeche ki taraf bohot girawat dekhi, lekin phir wapis upar chali gayi.

3. Upper Shadow (Wick): Upper shadow kaafi chhota hota hai ya kabhi kabhi bilkul nahi hota. Yeh iska matlab hai ke price upar jaane ke baad wahan tik nahi paaya aur neeche aane laga.

Bullish Hammer Ka Signal:

Jab bullish hammer bearish trend ke baad banta hai, to yeh ek potential reversal signal hota hai. Yeh indicate karta hai ke sellers ki control thodi der ke liye thama gayi hai aur buyers ne market mein entry ki hai.

Is pattern ko samajhne ka ek tareeqa yeh hai ke agar bullish hammer ka close opening price ke nazdeek ya usse zyada ho, to yeh ek strong signal hota hai ke price upar jaa sakti hai.

Bullish Hammer Ka Interpretation:

Market Reversal: Jab market ek downtrend mein hota hai aur bullish hammer banata hai, to yeh is baat ka ishara hota hai ke market neeche ki taraf chali gayi thi, lekin buyers ne price ko upar push kiya.

Support Zone: Bullish hammer aksar support zone par banta hai, jahan buyers apni buying activity ko shuru karte hain. Yeh zone wo level hota hai jahan price pehle bhi ruk chuki hoti hai.

Trading Strategy:

1. Confirmation: Bullish hammer ko aksar ek confirmation candle ke saath use karte hain. Matlab, agar bullish hammer ke baad ek green candle banti hai, to isse signal milta hai ke reversal ka trend strong ho sakta hai.

2. Stop Loss: Traders is pattern ko use karte hue apna stop loss us price level ke neeche rakhte hain jahan bullish hammer ki low hoti hai. Isse agar market reverse na ho, to losses ko control kiya ja sakta hai.

3. Target: Target price ko pehle ke resistance level ya price level tak set kiya jaata hai jahan market pehle ruk chuki ho.

Conclusion:

Bullish hammer ek ahem candlestick pattern hai jo market ke reversal ki taraf ishara karta hai. Is pattern ko samajhna aur sahi time par use karna traders ko market mein profit kamane mein madad karta hai. Lekin yeh zaroori hai ke is pattern ko kisi aur technical indicators ke saath confirm karte hue use kiya jaaye, taki risk ko kam kiya jaa sake aur profit potential zyada ho.

Bullish Hammer ek khas candlestick pattern hai jo market ke reversal signal ko indicate karta hai. Yeh pattern aksar bearish trend ke baad banta hai aur iska matlab hota hai ke price ne neeche ki taraf bohot zyada move kiya hai, lekin phir usne upar ki taraf bhi strong reversal dikhaya hai. Is pattern ka istemal traders market ke reversal ko pehchannay ke liye karte hain, jisme price ke neeche se upar tak ke move ko samjha jaata hai.

Bullish Hammer Ka Structure:

Bullish Hammer candlestick pattern ka structure kuch is tarah ka hota hai:

1. Body (Jism): Is pattern ka body (candlestick ka asli part) chhota hota hai aur yeh neeche ki taraf close hota hai. Yeh body usually white (green) ya black (red) ho sakti hai, lekin zyada significance iska tail hoti hai.

2. Lower Shadow (Tail): Sabse khaas cheez jo bullish hammer ko pehchaan deti hai, wo hai iska lamba lower shadow ya tail. Yeh shadow body ke mukable mein kaafi lamba hota hai, jo ke price ke neeche ki taraf ki movement ko dikhata hai. Iska matlab hota hai ke market ne neeche ki taraf bohot girawat dekhi, lekin phir wapis upar chali gayi.

3. Upper Shadow (Wick): Upper shadow kaafi chhota hota hai ya kabhi kabhi bilkul nahi hota. Yeh iska matlab hai ke price upar jaane ke baad wahan tik nahi paaya aur neeche aane laga.

Bullish Hammer Ka Signal:

Jab bullish hammer bearish trend ke baad banta hai, to yeh ek potential reversal signal hota hai. Yeh indicate karta hai ke sellers ki control thodi der ke liye thama gayi hai aur buyers ne market mein entry ki hai.

Is pattern ko samajhne ka ek tareeqa yeh hai ke agar bullish hammer ka close opening price ke nazdeek ya usse zyada ho, to yeh ek strong signal hota hai ke price upar jaa sakti hai.

Bullish Hammer Ka Interpretation:

Market Reversal: Jab market ek downtrend mein hota hai aur bullish hammer banata hai, to yeh is baat ka ishara hota hai ke market neeche ki taraf chali gayi thi, lekin buyers ne price ko upar push kiya.

Support Zone: Bullish hammer aksar support zone par banta hai, jahan buyers apni buying activity ko shuru karte hain. Yeh zone wo level hota hai jahan price pehle bhi ruk chuki hoti hai.

Trading Strategy:

1. Confirmation: Bullish hammer ko aksar ek confirmation candle ke saath use karte hain. Matlab, agar bullish hammer ke baad ek green candle banti hai, to isse signal milta hai ke reversal ka trend strong ho sakta hai.

2. Stop Loss: Traders is pattern ko use karte hue apna stop loss us price level ke neeche rakhte hain jahan bullish hammer ki low hoti hai. Isse agar market reverse na ho, to losses ko control kiya ja sakta hai.

3. Target: Target price ko pehle ke resistance level ya price level tak set kiya jaata hai jahan market pehle ruk chuki ho.

Conclusion:

Bullish hammer ek ahem candlestick pattern hai jo market ke reversal ki taraf ishara karta hai. Is pattern ko samajhna aur sahi time par use karna traders ko market mein profit kamane mein madad karta hai. Lekin yeh zaroori hai ke is pattern ko kisi aur technical indicators ke saath confirm karte hue use kiya jaaye, taki risk ko kam kiya jaa sake aur profit potential zyada ho.

تبصرہ

Расширенный режим Обычный режим