Taaruf

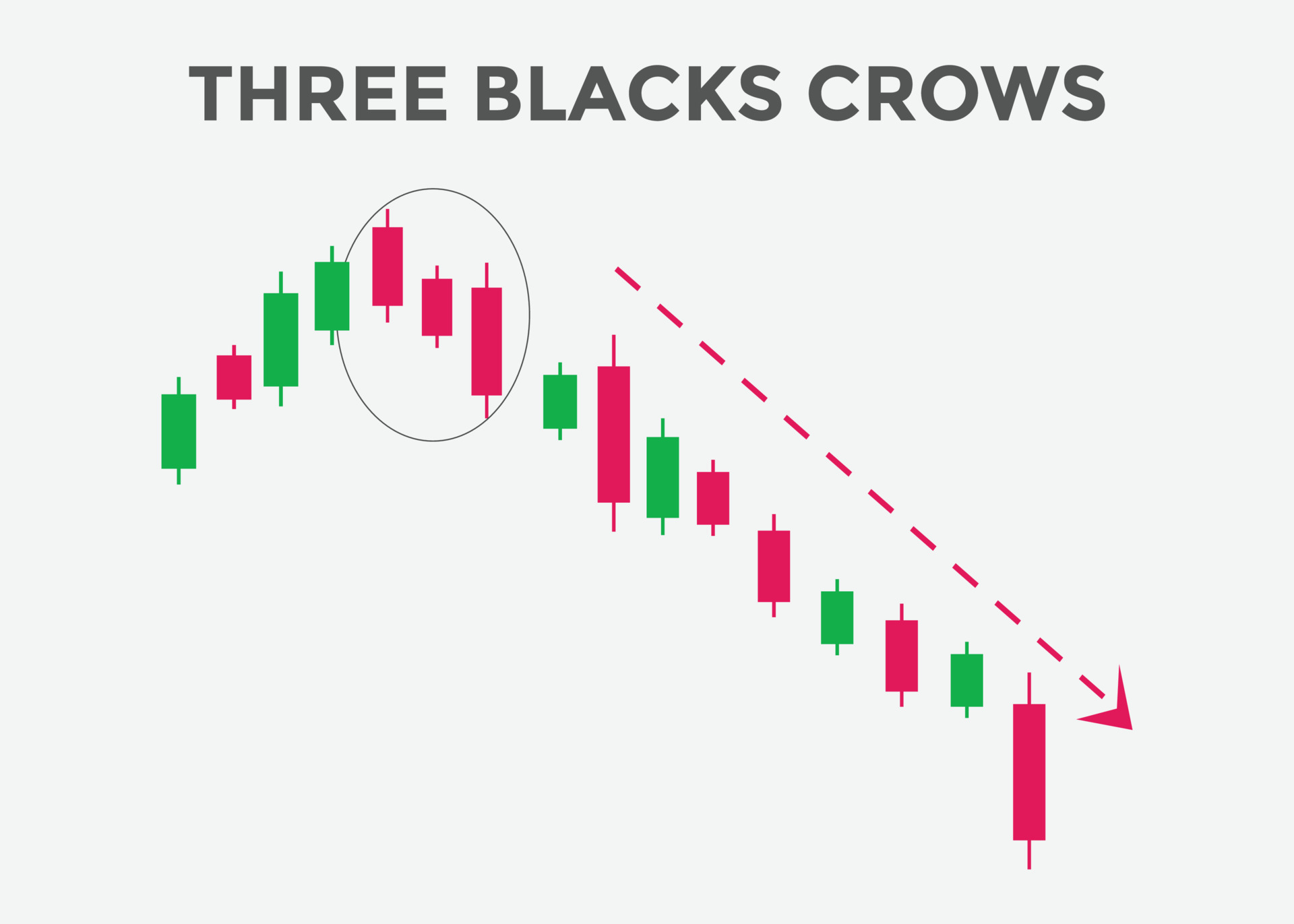

Three Black Crows candlestick pattern ek bearish reversal pattern hai jo aksar market ki bullish trend ke baad dekha jata hai. Ye pattern teen consecutive black (ya red) candlesticks par mashoor hai, jo ke market ki tension aur investors ke bearish jazbat ka izhar karti hai. Is pattern ka samajhna trade ke liye bohot zaroori hai, khaas kar un logo kay liye jo technical analysis main maharat rakhte hain.

Pattern ki Pehchaan

Three Black Crows pattern ki pehchaan us waqt ki jaati hai jab teen consecutive candlesticks market ke niche ki taraf band hoti hain, aur har ek candlestick pichli candlestick ki closing se neeche band hoti hai. Har candlestick ka body bada aur shadow chhota hota hai, jo market ki selling pressure ko dikhata hai.

Candlestick ki Takhleeq

- Pehli Candlestick: Ye bullish trend ka last candlestick hota hai jo ke market ki taqat ko bayan karta hai.

- Dusi Candlestick: Ye pehli candlestick se neeche banta hai aur bearish closing dikhata hai.

- Teesri Candlestick: Ye dusri candlestick se bhi neeche band hota hai, jo ke continuation ko darshata hai.

1. Behtar Trading Signals

Three Black Crows pattern traders ko behtar signals faraham karti hai ke market bearish ho raha hai. Ye pattern jab dekha jata hai to ye logon ko ye jaag rahi hoti hai ke wo apne positions ko manage karein ya profit booking karein.

2. Kharidari Ka Fursat

Jab ye pattern achey tarikon se confirm ho jata hai, toh traders ko short selling ya derivatives trading mein fursat mil sakti hai. Is se wo market ke girne ka faida uthate hain.

3. Portfolio Management

Ye pattern portfolio management mein madadgar hoti hai. Agar koi trader bullish positions rakhta hai, toh ye pattern unhain is taraf ishara karta hai ke wo apne investment ko manage karein aur market ke bearish trend ka faida uthayen.

Nuqsan

1. Fake Signals

Kabhi kabar, ye pattern fake signals bhi de sakta hai. Agar market ki volatility zyada ho toh ye logo ko galat faislay tak le ja sakta hai. Isliye, always confirm this pattern with other indicators.

2. Trade Timing ka Masla

Is pattern ko samajhne ke liye accents bohot zaroori hain. Kabhi kabhi traders samaj nahi pate ke kab trade lena hai aur kab nahi, jo unhein ghalat entry ya exit points tak le ja sakta hai.

3. Overconfidence

Doosre traders ke liye, is pattern ka analysis karne par overconfidence aa jata hai, jo trading decisions ko affect karta hai. Wo samajhte hain ke wo hamesha is pattern se faida uthayenge, jo ek galat fehmi hoti hai.

Analysis Aur Examples

Example 1: Aksar Ka Tajarba

Maanlein ke aapne market ko observe kiya hai aur ye pattern dekha. Ab aap is pattern ko samajh kar apne trading decisions ko badal sakte hain. Agar ye pattern aata hai, toh aap short selling ke liye entry kar sakte hain.

Example 2: Indicator ke Sath

Achi trading practice ye hai ke ye pattern ko kisi aur indicator, jaise moving averages ya RSI, ke sath istemal karein. Agar aap dekhte hain ke Three Black Crows pattern ke sath RSI bhi overbought hai, toh ye aur bhi zyada confirm hota hai ke market gir sakta hai.

Real-life Example

Bohot se traders ne 2020 ke financial crisis ke doran ye pattern dekha, jis se unhon ne behtar decisions liye aur losses ko avoid kiya. Ye pattern na sirf stocks, balki forex aur commodities mein bhi dekha gaya hai.

Strategies for Entry and Exit

Entry Strategy

- Confirmation: Ye zaroori hai ke aap is pattern ka confirmation dekhein. Jaise hi teesri candlestick close hoti hai, agar volume high hai toh ye trade lene ke liye acha sahara hai.

- Stop Loss: Kabhi kabar stop loss ko hamesha apne entry point se thoda upar rakhein, taake market agar wapas upar chala jaye toh aap ka loss limited rahe.

- Profit Booking: Agar aapne short position li hui hai aur market gir raha hai, toh profit booking ka time zaroori hota hai. Aksar traders is pattern ke baad profit lete hain jab market me choti rally hoti hai.

- Trailing Stop Loss: Ye ek acha method hai jisse aap profit ko lock kar sakte hain. Agar market aapke favor mein ja raha hai, toh stop loss ko market price ke sath adjust karein.

Three Black Crows candlestick pattern ek helpful tool hai jo traders ko market ke bearish trend ke baare mein agah karta hai. Is pattern ka samajhna aur better trading strategies ko banana aapki trading success ko doom kar sakta hai. Lekin, ye bhi zaroori hai ke aap sahi confirmation aur risk management strategies ka istemal karein.

تبصرہ

Расширенный режим Обычный режим