Pipe Tops Aur Pipe Bottoms Candle Stick Pattern

Muqadma

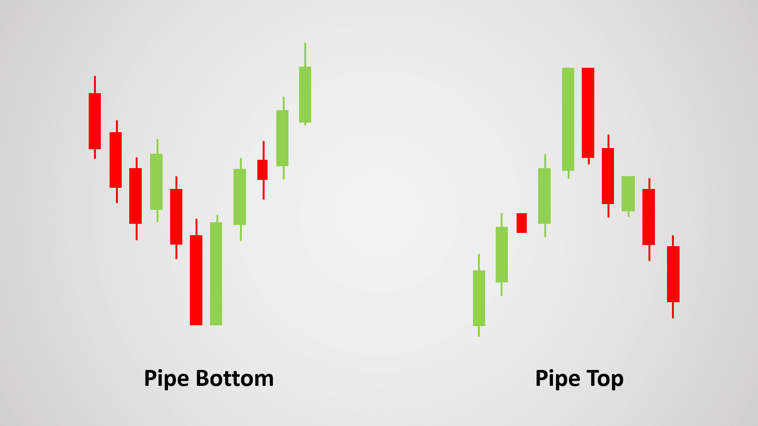

Candlestick patterns stock market aur forex trading mein analysis ke liye bohot zaroori hote hain. In patterns se traders ko market ke movement ko samajhne aur future ke trends ka andaza lagane mein madad milti hai. Aaj hum do khas candlestick patterns par baat karenge: Pipe Tops aur Pipe Bottoms. Ye patterns trend reversal ko indicate karte hain aur traders ke liye bohot valuable ho sakte hain.

Pipe Tops Pattern

Pipe Tops pattern ek bullish trend ke baad appear hota hai aur ye indicate karta hai ke market mein bearish reversal hone wala hai. Is pattern mein do consecutive candles hoti hain jinka high level almost equal hota hai aur dono candles ke beech mein ek chhoti si shadow hoti hai.

Pipe Tops Ki Pehchaan

Pipe Tops Ka Tajzia

Pipe Tops pattern ek strong indication hota hai ke market mein bullish trend khatam hone wala hai aur bearish trend shuru hone wala hai. Jab ye pattern confirm ho jata hai to traders short selling ya apni positions ko exit kar sakte hain taake losses se bacha ja sake.

Pipe Bottoms Pattern

Pipe Bottoms pattern ek bearish trend ke baad appear hota hai aur ye indicate karta hai ke market mein bullish reversal hone wala hai. Is pattern mein bhi do consecutive candles hoti hain jinka low level almost equal hota hai aur dono candles ke beech mein ek chhoti si shadow hoti hai.

Pipe Bottoms Ki Pehchaan

Pipe Bottoms Ka Tajzia

Pipe Bottoms pattern ek strong indication hota hai ke market mein bearish trend khatam hone wala hai aur bullish trend shuru hone wala hai. Jab ye pattern confirm ho jata hai to traders buying ya apni positions ko hold kar sakte hain taake profits kamaya ja sake.

Pipe Tops Aur Pipe Bottoms Ki Ahmiyat

Pipe Tops aur Pipe Bottoms patterns ki ahmiyat trading mein bohot zyada hoti hai. In patterns ke through traders market ke trend reversals ko pehchan kar sakte hain aur apni trading strategies ko accordingly adjust kar sakte hain. In patterns ko samajhne aur use karne se traders ko significant profits kamane ka mauka milta hai aur market risks ko bhi minimize karne mein madad milti hai.

Candlestick patterns trading mein bohot zaroori hoti hain aur inka sahih istemal kar ke traders apni trading performance ko improve kar sakte hain. Pipe Tops aur Pipe Bottoms patterns ke zariye traders market ke trend reversals ko accurately pehchan sakte hain aur apni strategies ko adjust kar ke significant profits kama sakte hain. Ye patterns trading ki duniya mein ek valuable tool hain jo traders ko informed decisions lene mein madadgar sabit hote hain.

Muqadma

Candlestick patterns stock market aur forex trading mein analysis ke liye bohot zaroori hote hain. In patterns se traders ko market ke movement ko samajhne aur future ke trends ka andaza lagane mein madad milti hai. Aaj hum do khas candlestick patterns par baat karenge: Pipe Tops aur Pipe Bottoms. Ye patterns trend reversal ko indicate karte hain aur traders ke liye bohot valuable ho sakte hain.

Pipe Tops Pattern

Pipe Tops pattern ek bullish trend ke baad appear hota hai aur ye indicate karta hai ke market mein bearish reversal hone wala hai. Is pattern mein do consecutive candles hoti hain jinka high level almost equal hota hai aur dono candles ke beech mein ek chhoti si shadow hoti hai.

- First Candle: Pehli candle bullish hoti hai jo ke ek strong uptrend ko represent karti hai. Is candle ka body bara hota hai aur shadow chhoti ya bilkul nahi hoti.

- Second Candle: Dusri candle bearish hoti hai jo pehli candle ke high ke qareeb se open hoti hai. Ye candle pehli candle se chhoti hoti hai aur iske shadow bhi chhoti hoti hain.

Pipe Tops Ki Pehchaan

- High Points: Dono candles ke high points almost barabar hote hain.

- Trend: Ye pattern ek strong bullish trend ke baad appear hota hai.

- Volume: Pehli candle mein high volume hota hai jab ke dusri candle mein volume decrease hota hai.

Pipe Tops Ka Tajzia

Pipe Tops pattern ek strong indication hota hai ke market mein bullish trend khatam hone wala hai aur bearish trend shuru hone wala hai. Jab ye pattern confirm ho jata hai to traders short selling ya apni positions ko exit kar sakte hain taake losses se bacha ja sake.

Pipe Bottoms Pattern

Pipe Bottoms pattern ek bearish trend ke baad appear hota hai aur ye indicate karta hai ke market mein bullish reversal hone wala hai. Is pattern mein bhi do consecutive candles hoti hain jinka low level almost equal hota hai aur dono candles ke beech mein ek chhoti si shadow hoti hai.

- First Candle: Pehli candle bearish hoti hai jo ke ek strong downtrend ko represent karti hai. Is candle ka body bara hota hai aur shadow chhoti ya bilkul nahi hoti.

- Second Candle: Dusri candle bullish hoti hai jo pehli candle ke low ke qareeb se open hoti hai. Ye candle pehli candle se chhoti hoti hai aur iske shadow bhi chhoti hoti hain.

Pipe Bottoms Ki Pehchaan

- Low Points: Dono candles ke low points almost barabar hote hain.

- Trend: Ye pattern ek strong bearish trend ke baad appear hota hai.

- Volume: Pehli candle mein high volume hota hai jab ke dusri candle mein volume decrease hota hai.

Pipe Bottoms Ka Tajzia

Pipe Bottoms pattern ek strong indication hota hai ke market mein bearish trend khatam hone wala hai aur bullish trend shuru hone wala hai. Jab ye pattern confirm ho jata hai to traders buying ya apni positions ko hold kar sakte hain taake profits kamaya ja sake.

Pipe Tops Aur Pipe Bottoms Ki Ahmiyat

Pipe Tops aur Pipe Bottoms patterns ki ahmiyat trading mein bohot zyada hoti hai. In patterns ke through traders market ke trend reversals ko pehchan kar sakte hain aur apni trading strategies ko accordingly adjust kar sakte hain. In patterns ko samajhne aur use karne se traders ko significant profits kamane ka mauka milta hai aur market risks ko bhi minimize karne mein madad milti hai.

Candlestick patterns trading mein bohot zaroori hoti hain aur inka sahih istemal kar ke traders apni trading performance ko improve kar sakte hain. Pipe Tops aur Pipe Bottoms patterns ke zariye traders market ke trend reversals ko accurately pehchan sakte hain aur apni strategies ko adjust kar ke significant profits kama sakte hain. Ye patterns trading ki duniya mein ek valuable tool hain jo traders ko informed decisions lene mein madadgar sabit hote hain.

تبصرہ

Расширенный режим Обычный режим