Pennant Chart Pattern details

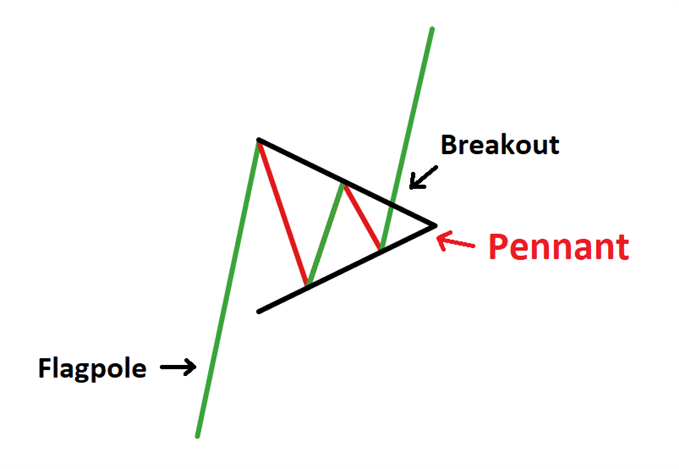

Pennant chart pattern bhi ek technical analysis pattern hai jo trading mein istemal hota hai taake potential continuation signals ko pehchana ja sakein. Yeh pattern, flag pattern ki tarah, ek strong price movement ke baad aata hai, lekin pennant pattern mein consolidation phase ek symmetrical triangle shape mein hoti hai. Pennant chart pattern ko continuation pattern mana jata hai aur yeh bullish aur bearish dono trends mein mil sakta hai.

Pennant Pattern ke Ajza

Flagpole: Ek strong aur sharp price movement jo ya to upward ya downward hoti hai.

Pennant

Ek symmetrical triangle-shaped consolidation phase jo flagpole ke baad aati hai. Yeh generally horizontal hoti hai.

Breakout: Woh nuqta jahan price pennant se nikal kar ek nayi movement shuru karti hai, jo pehle wale trend ke continuation ko indicate karti hai.

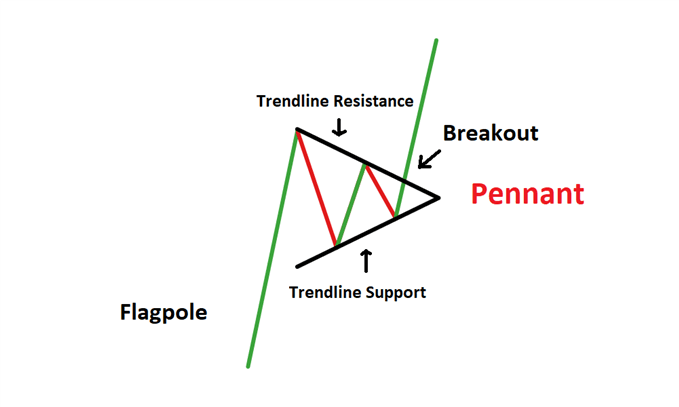

Pennant Pattern ko Pehchanne ke Tips

Trend Direction

Pennant pattern ek strong trend ke baad form hota hai, jaise ke ek strong upward ya downward move (flagpole).

Consolidation: Pennant ek symmetrical triangle shape mein form hota hai jahan price ek narrow range mein move karti hai.

Volume: Flagpole ke dauran volume zyada hota hai aur pennant ke consolidation phase mein volume kam ho jata hai.

Breakout Confirmation

Pennant ke breakout ke baad, volume phir se increase hota hai jo continuation ka signal deta hai.

Pennant Pattern ka Use

Bullish Pennant:

Jab price upward movekar rahi ho (flagpole) aur phir symmetrical triangle-shaped consolidation phase create kare (pennant), aur phir breakout upward ho.

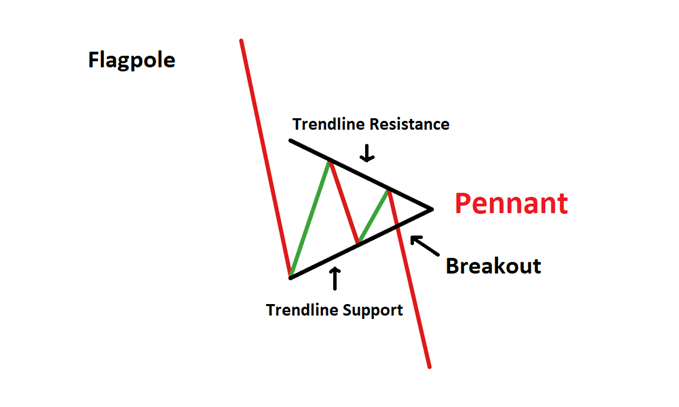

Bearish Pennant: Jab price downward move kar rahi ho (flagpole) aur phir symmetrical triangle-shaped consolidation phase create kare (pennant), aur phir breakout downward ho.

Pennant chart pattern bhi ek technical analysis pattern hai jo trading mein istemal hota hai taake potential continuation signals ko pehchana ja sakein. Yeh pattern, flag pattern ki tarah, ek strong price movement ke baad aata hai, lekin pennant pattern mein consolidation phase ek symmetrical triangle shape mein hoti hai. Pennant chart pattern ko continuation pattern mana jata hai aur yeh bullish aur bearish dono trends mein mil sakta hai.

Pennant Pattern ke Ajza

Flagpole: Ek strong aur sharp price movement jo ya to upward ya downward hoti hai.

Pennant

Ek symmetrical triangle-shaped consolidation phase jo flagpole ke baad aati hai. Yeh generally horizontal hoti hai.

Breakout: Woh nuqta jahan price pennant se nikal kar ek nayi movement shuru karti hai, jo pehle wale trend ke continuation ko indicate karti hai.

Pennant Pattern ko Pehchanne ke Tips

Trend Direction

Pennant pattern ek strong trend ke baad form hota hai, jaise ke ek strong upward ya downward move (flagpole).

Consolidation: Pennant ek symmetrical triangle shape mein form hota hai jahan price ek narrow range mein move karti hai.

Volume: Flagpole ke dauran volume zyada hota hai aur pennant ke consolidation phase mein volume kam ho jata hai.

Breakout Confirmation

Pennant ke breakout ke baad, volume phir se increase hota hai jo continuation ka signal deta hai.

Pennant Pattern ka Use

Bullish Pennant:

Jab price upward movekar rahi ho (flagpole) aur phir symmetrical triangle-shaped consolidation phase create kare (pennant), aur phir breakout upward ho.

Bearish Pennant: Jab price downward move kar rahi ho (flagpole) aur phir symmetrical triangle-shaped consolidation phase create kare (pennant), aur phir breakout downward ho.

تبصرہ

Расширенный режим Обычный режим