Dark Cloud Cover Pattern Kya Hai?

Dark Cloud Cover Pattern ek technical analysis ka concept hai jo ke stock market mein istemal hota hai. Yeh ek bearish reversal pattern hai jo indicate karta hai ke stock ke bullish trend ka khatra hai aur ab prices mein neeche ki taraf move expected hai.

Dark Cloud Cover Pattern Ka Tareeqa Amal

Dark Cloud Cover Pattern ko identify karne ke liye do candlesticks ki zaroorat hoti hai. Pehla candlestick ek long green candle hota hai jo bullish trend ko represent karta hai aur doosra candlestick ek long red candle hota hai jo pehle candlestick ke upper half mein open hota hai aur neeche ki taraf close hota hai. Yeh red candle previous green candle ke kuch hisse ko cover karta hai, isliye isse "dark cloud" kaha jata hai.

Dark Cloud Cover Pattern Ki Tashkhis

Dark Cloud Cover Pattern ko tashkhis karne ke liye kuch factors ka khayal rakha jata hai:

Dark Cloud Cover Pattern Ka Istemal

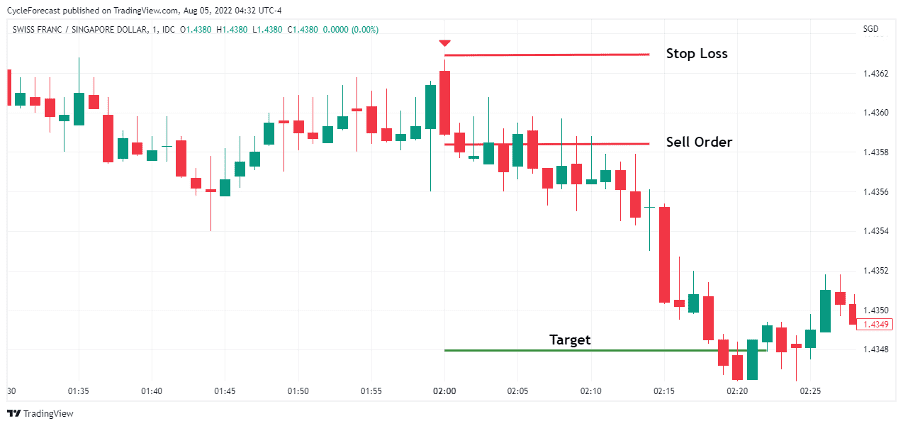

Dark Cloud Cover Pattern ka istemal bearish reversal ko anticipate karne ke liye kiya jata hai. Agar yeh pattern sahi taur par identify kiya jata hai aur confirm hota hai, toh traders neeche ki taraf move karne ki umeed rakhte hain aur iske mutabiq apne trades ko adjust karte hain.

Dark Cloud Cover Pattern Ki Limitations

Dark Cloud Cover Pattern ke istemal mein kuch limitations bhi hain:

Dark Cloud Cover Pattern: A Conclusion

Dark Cloud Cover Pattern ek useful tool hai bearish reversal ko anticipate karne ke liye, lekin iska istemal karte waqt traders ko cautious rehna chahiye aur dusre technical indicators aur market context ko bhi consider karna chahiye. Is pattern ka istemal karne se pehle thorough research aur analysis ki zaroorat hoti hai.

Dark Cloud Cover Pattern ek technical analysis ka concept hai jo ke stock market mein istemal hota hai. Yeh ek bearish reversal pattern hai jo indicate karta hai ke stock ke bullish trend ka khatra hai aur ab prices mein neeche ki taraf move expected hai.

Dark Cloud Cover Pattern Ka Tareeqa Amal

Dark Cloud Cover Pattern ko identify karne ke liye do candlesticks ki zaroorat hoti hai. Pehla candlestick ek long green candle hota hai jo bullish trend ko represent karta hai aur doosra candlestick ek long red candle hota hai jo pehle candlestick ke upper half mein open hota hai aur neeche ki taraf close hota hai. Yeh red candle previous green candle ke kuch hisse ko cover karta hai, isliye isse "dark cloud" kaha jata hai.

Dark Cloud Cover Pattern Ki Tashkhis

Dark Cloud Cover Pattern ko tashkhis karne ke liye kuch factors ka khayal rakha jata hai:

- Size: Pehli candle ka size zyada hona chahiye aur doosri candle ka size pehli candle ke upper half mein open hona chahiye.

- Volume: Volume ki taraqqi doosri candle ke sath honi chahiye, yani ki trading activity zyada honi chahiye.

- Confirmation: Dark Cloud Cover Pattern ko confirm karne ke liye traders doosri candle ke neeche ki ek breakdown ka wait karte hain. Agar price doosri candle ke neeche move karta hai, toh yeh bearish signal ko confirm karta hai.

Dark Cloud Cover Pattern Ka Istemal

Dark Cloud Cover Pattern ka istemal bearish reversal ko anticipate karne ke liye kiya jata hai. Agar yeh pattern sahi taur par identify kiya jata hai aur confirm hota hai, toh traders neeche ki taraf move karne ki umeed rakhte hain aur iske mutabiq apne trades ko adjust karte hain.

Dark Cloud Cover Pattern Ki Limitations

Dark Cloud Cover Pattern ke istemal mein kuch limitations bhi hain:

- False Signals: Kabhi-kabhi yeh pattern false signals bhi generate kar sakta hai, jiski wajah se traders galat trades execute kar sakte hain.

- Confirmation: Is pattern ko confirm karne ke liye price ke neeche ki breakdown ki zaroorat hoti hai, jo kabhi-kabhi missing ho sakti hai ya late ho sakti hai.

- Market Context: Dark Cloud Cover Pattern ko sirf market ke specific context mein hi consider kiya ja sakta hai. Agar overall market bullish hai toh yeh pattern kam effective ho sakta hai.

Dark Cloud Cover Pattern: A Conclusion

Dark Cloud Cover Pattern ek useful tool hai bearish reversal ko anticipate karne ke liye, lekin iska istemal karte waqt traders ko cautious rehna chahiye aur dusre technical indicators aur market context ko bhi consider karna chahiye. Is pattern ka istemal karne se pehle thorough research aur analysis ki zaroorat hoti hai.

تبصرہ

Расширенный режим Обычный режим