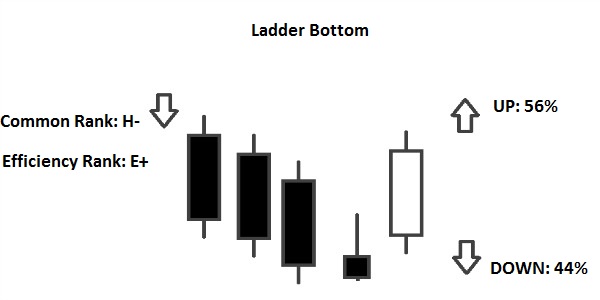

LADDER BOTTOM PATTERN EXPLAINED IN FOREX

LADDER BOTTOM PATTERN DESCRIPTION

Ladder bottom pattern ek candlestick chart pattern hai jo market mein trend reversal ko darust karti hai. Yeh pattern uptrend ke baad ata hai aur downward trend ki starting point hoti hai.Ladder bottom pattern forex mein ek candlestick chart pattern hai jo trend reversal ko darust karta hai. Is pattern ko uptrend ke baad dekha jata hai, jab market mein kuch downtrend candles aati hain, phir ek long bullish candle aati hai jo previous candles ki low levels se neeche nahi jaati. Yeh pattern uptrend ki shuruaat ko darust karta hai aur traders isay trend reversal ka indication samajhte hain.

UPTREND CONFIRMATION

Is pattern ko confirm karne ke liye, traders dusre technical indicators ka bhi istemal karte hain. Ladder bottom pattern ko pehchanne ke liye, aapko pehle ek uptrend dekhna hai, phir market mein kuch downtrend candles aati hain aur phir ek long bullish candle aati hai jo previous candles ki low levels se neeche nahi jaati. Is pattern ki tashkhis karne ke liye, aapko dekhna hota hai ke kya previous downtrend candles ke baad ek long bullish candle aati hai jo aik naye uptrend ki shuruaat darust karti hai.

TRADING STRATEGY

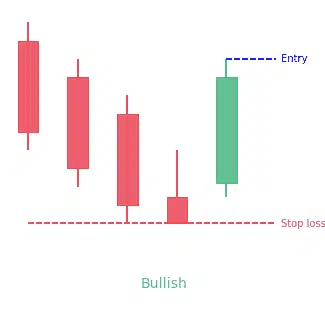

Ladder bottom pattern ki trading strategy mein, traders usually buy positions lete hain jab yeh pattern confirm hota hai, aur stop-loss orders previous low ke neeche lagate hain.

Ladder bottom pattern ek powerful trend reversal indicator hai jo traders ko market ke direction change ka pata lagane mein madad karta hai, lekin isay confirm karne ke liye dusre technical indicators ka bhi istemal kiya jata hai.

LADDER BOTTOM PATTERN DESCRIPTION

Ladder bottom pattern ek candlestick chart pattern hai jo market mein trend reversal ko darust karti hai. Yeh pattern uptrend ke baad ata hai aur downward trend ki starting point hoti hai.Ladder bottom pattern forex mein ek candlestick chart pattern hai jo trend reversal ko darust karta hai. Is pattern ko uptrend ke baad dekha jata hai, jab market mein kuch downtrend candles aati hain, phir ek long bullish candle aati hai jo previous candles ki low levels se neeche nahi jaati. Yeh pattern uptrend ki shuruaat ko darust karta hai aur traders isay trend reversal ka indication samajhte hain.

UPTREND CONFIRMATION

Is pattern ko confirm karne ke liye, traders dusre technical indicators ka bhi istemal karte hain. Ladder bottom pattern ko pehchanne ke liye, aapko pehle ek uptrend dekhna hai, phir market mein kuch downtrend candles aati hain aur phir ek long bullish candle aati hai jo previous candles ki low levels se neeche nahi jaati. Is pattern ki tashkhis karne ke liye, aapko dekhna hota hai ke kya previous downtrend candles ke baad ek long bullish candle aati hai jo aik naye uptrend ki shuruaat darust karti hai.

TRADING STRATEGY

Ladder bottom pattern ki trading strategy mein, traders usually buy positions lete hain jab yeh pattern confirm hota hai, aur stop-loss orders previous low ke neeche lagate hain.

Ladder bottom pattern ek powerful trend reversal indicator hai jo traders ko market ke direction change ka pata lagane mein madad karta hai, lekin isay confirm karne ke liye dusre technical indicators ka bhi istemal kiya jata hai.

تبصرہ

Расширенный режим Обычный режим