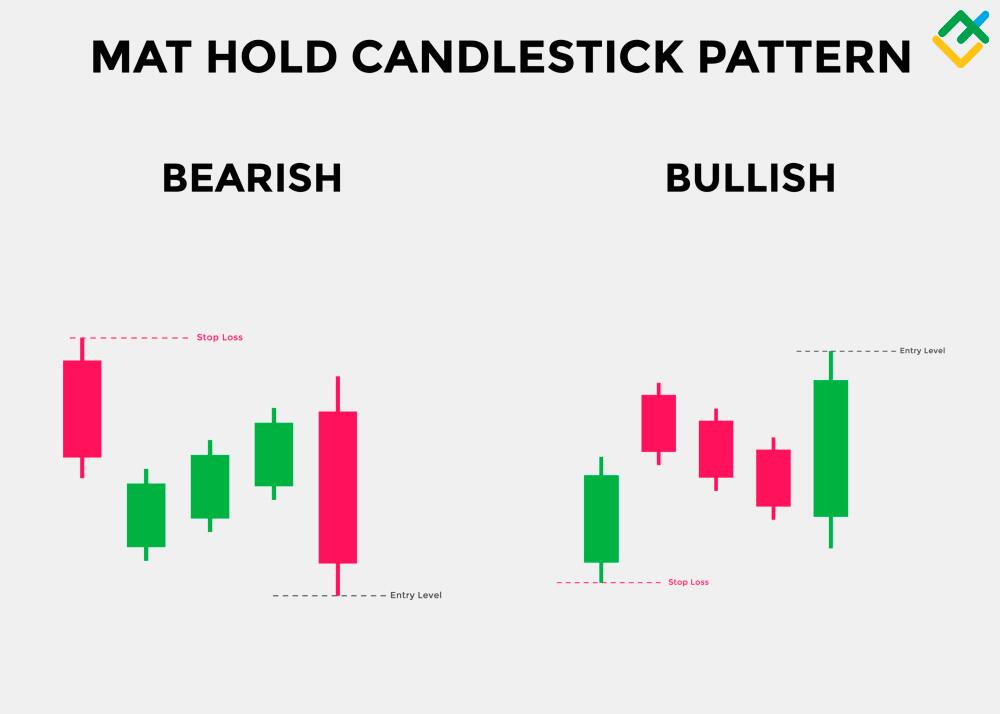

Mat hold candlestick pattern main centre wali teen candles ko follow kerty huey reverse direction main trade open karni chahiye ky humein is tarah trade kerny per bara loss ho sakta hai jabky agar ham previous trend ky mutabiq trade continue karte hain tou hamein bahut achi earning hasil ho sakti hai.Mat hold candlestick pattern ka matlab hai ky jab market main aesa pattern creat ho jata hai toh uske baad market reverse direction main trend start nahi karti balky apny previous trend ko follow kerty huey hi market apni movement continue kerti hai isliye hamain mat hold candlestick pattern create hony per previous trend ko follow kerty huey trade continue karni chahiye

TYPES OF MAT HOLD CANDLESTICK PATTERN

Agar market continuously bullish trend main movement kerty huey aik bari candle create kerny ky bahd three candle bearish main create kerny ky bahd again bullish main candle create kerti hai tou same pattern bullish mat hold candlestick pattern hota hai jis ko follow kerty huey hamain buy ki trade enter karte hain ky market mat hold pattern create hony per previous trend ko continue rakhne ki confirmation deti hai jis ko follow kerty huey trade continue karni chahiye.Mat hold candlestick pattern ki bhi two types hoti hai bullish mat hold pattern aur bearish mat hold pattern jab market continuously downtrend main movement kerty huey aik bari candle creat kerti hai aur uske baad three candle bullish create kerny ky bahd again aik candle bearish create kerti hai tou easy main bearish mat hold candlestick pattern create hota hai jis per sell ki trade enter karna hota hai jabki

BULLISH MAT HOLD PATTERN

Mat hold candlestick pattern middle wali 3 small candlestick hoti hai wo small hoti hai sari previous yani first candle k nechy close hoti hai. Jo last candle hoti hai wo pattern k high point ko manage karny ma kamyab ho jati hai. is pattern ma pehle candlestick bullish or large body ki hoti hai or es k bad wali 3 candlesticks small hoti hai or bearish trend ma hoti hain jb k last candlestick phr sy bullish or large body ki hoti hai.

BEARISH MAT HOLD PATTERN

Pehle candlestick pattern ma market over sold ho jati hai phr baki 3 candle market ko stable or correct karto hai or last candle ko strength provide karti hai k market phr mazeed down dip kar jati hai.Ye pattern bullish mat hold pattern k opposite banta hai es ma pehle candle bearish hoti hai or market ko down move karwany ma kamyabi ho jati hai.darmiyan wali 3 candle bullish hoti hain jo market ko stable kar deti hai or ye three candles pehle candle k high point sy up move kar jato hai but phr last candle bearish or tall banti hai or market ko ik bar phir sy down move karwany ma kamyab ho jati hai.

TYPES OF MAT HOLD CANDLESTICK PATTERN

Agar market continuously bullish trend main movement kerty huey aik bari candle create kerny ky bahd three candle bearish main create kerny ky bahd again bullish main candle create kerti hai tou same pattern bullish mat hold candlestick pattern hota hai jis ko follow kerty huey hamain buy ki trade enter karte hain ky market mat hold pattern create hony per previous trend ko continue rakhne ki confirmation deti hai jis ko follow kerty huey trade continue karni chahiye.Mat hold candlestick pattern ki bhi two types hoti hai bullish mat hold pattern aur bearish mat hold pattern jab market continuously downtrend main movement kerty huey aik bari candle creat kerti hai aur uske baad three candle bullish create kerny ky bahd again aik candle bearish create kerti hai tou easy main bearish mat hold candlestick pattern create hota hai jis per sell ki trade enter karna hota hai jabki

BULLISH MAT HOLD PATTERN

Mat hold candlestick pattern middle wali 3 small candlestick hoti hai wo small hoti hai sari previous yani first candle k nechy close hoti hai. Jo last candle hoti hai wo pattern k high point ko manage karny ma kamyab ho jati hai. is pattern ma pehle candlestick bullish or large body ki hoti hai or es k bad wali 3 candlesticks small hoti hai or bearish trend ma hoti hain jb k last candlestick phr sy bullish or large body ki hoti hai.

BEARISH MAT HOLD PATTERN

Pehle candlestick pattern ma market over sold ho jati hai phr baki 3 candle market ko stable or correct karto hai or last candle ko strength provide karti hai k market phr mazeed down dip kar jati hai.Ye pattern bullish mat hold pattern k opposite banta hai es ma pehle candle bearish hoti hai or market ko down move karwany ma kamyabi ho jati hai.darmiyan wali 3 candle bullish hoti hain jo market ko stable kar deti hai or ye three candles pehle candle k high point sy up move kar jato hai but phr last candle bearish or tall banti hai or market ko ik bar phir sy down move karwany ma kamyab ho jati hai.

تبصرہ

Расширенный режим Обычный режим