Island Reversal Candlestick Pattern Introduction.

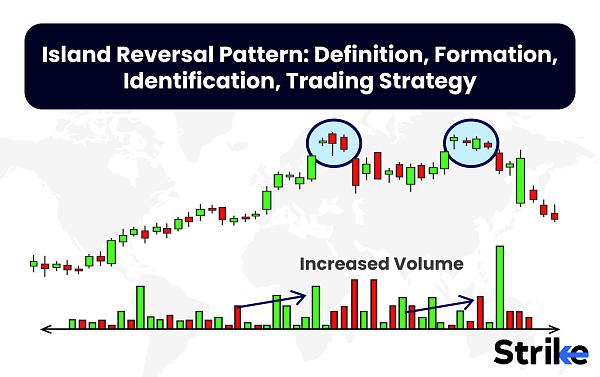

Island reversal candlestick pattern ek aham technical analysis tool hai jo traders ko market ke trend changes ka andaza dene mein madad karta hai. Island reversal pattern mein, ek chhota sa 'island' of price action nazar aata hai jo ki surrounding candles se isolated hota hai. Ye 'island' typically ek uptrend ya downtrend ke darmiyan aata hai aur uski formation ka matlab hota hai ke trend change hone ka imkan hai.

Pattern Ki Pehchan.

Island reversal pattern ko pehchanna mushkil nahi hota. Ye typically ek chhota sa cluster hota hai jo market mein alag dikhayi deta hai. Agar trend reversal hone ke chances hote hain, to is cluster ke baad price action mein clear change hota hai.

Bullish Island Reversal Pattern.

Agar bullish island reversal pattern dekha jaye, to ye indicate karta hai ke bearish trend khatam hone ke bad ek bullish trend ka shuru ho sakta hai. Ye pattern typically ek downtrend ke baad dekha jata hai, jab ek chhota sa 'island' of bullish price action surrounding candles se isolated hota hai.

Bearish Island Reversal Pattern.

Bearish island reversal pattern mein, ek chhota sa 'island' of bearish price action surrounding candles se isolated hota hai, jo ki bullish trend ke darmiyan nazar aata hai. Ye pattern bullish trend ke khatam hone ke baad dekha jata hai aur indicate karta hai ke bearish trend shuru hone ke chances hain.

Trading Strategies with Island Reversal Pattern.

Island reversal pattern ke saath trading karte waqt, traders ko kuch strategies follow karni chahiye. Ye include karte hain:

Island reversal pattern ko confirm karne ke liye, traders ko typically next few candles ka wait karna chahiye, jisse ke pattern ki validity ko confirm kiya ja sake.Jab ek trader ek island reversal pattern identify karta hai, to wo stop loss ka istemal karta hai taake in case agar reversal hone ki jagah trend phir se usi direction mein chalne lagta hai, to nuksan se bacha ja sake.Island reversal pattern ki pehchan karne ke baad, traders ko target set karna chahiye ke wo kis direction mein trade kar rahe hain, aur unki exit strategy kya hogi agar trend reversal ho jaye.

Additional information.

Island reversal candlestick pattern ek mufeed tool hai jo traders ko trend changes ka andaza dene mein madad karta hai. Iski sahi pehchan aur samajh traders ko market mein successful trading karne mein madad karti hai. Lekin, ye pattern sirf ek indicator hai aur traders ko dusre technical analysis tools ke saath combine karke istemal karna chahiye, taki unka trading decision sahi ho sake.

Island reversal candlestick pattern ek aham technical analysis tool hai jo traders ko market ke trend changes ka andaza dene mein madad karta hai. Island reversal pattern mein, ek chhota sa 'island' of price action nazar aata hai jo ki surrounding candles se isolated hota hai. Ye 'island' typically ek uptrend ya downtrend ke darmiyan aata hai aur uski formation ka matlab hota hai ke trend change hone ka imkan hai.

Pattern Ki Pehchan.

Island reversal pattern ko pehchanna mushkil nahi hota. Ye typically ek chhota sa cluster hota hai jo market mein alag dikhayi deta hai. Agar trend reversal hone ke chances hote hain, to is cluster ke baad price action mein clear change hota hai.

Bullish Island Reversal Pattern.

Agar bullish island reversal pattern dekha jaye, to ye indicate karta hai ke bearish trend khatam hone ke bad ek bullish trend ka shuru ho sakta hai. Ye pattern typically ek downtrend ke baad dekha jata hai, jab ek chhota sa 'island' of bullish price action surrounding candles se isolated hota hai.

Bearish Island Reversal Pattern.

Bearish island reversal pattern mein, ek chhota sa 'island' of bearish price action surrounding candles se isolated hota hai, jo ki bullish trend ke darmiyan nazar aata hai. Ye pattern bullish trend ke khatam hone ke baad dekha jata hai aur indicate karta hai ke bearish trend shuru hone ke chances hain.

Trading Strategies with Island Reversal Pattern.

Island reversal pattern ke saath trading karte waqt, traders ko kuch strategies follow karni chahiye. Ye include karte hain:

Island reversal pattern ko confirm karne ke liye, traders ko typically next few candles ka wait karna chahiye, jisse ke pattern ki validity ko confirm kiya ja sake.Jab ek trader ek island reversal pattern identify karta hai, to wo stop loss ka istemal karta hai taake in case agar reversal hone ki jagah trend phir se usi direction mein chalne lagta hai, to nuksan se bacha ja sake.Island reversal pattern ki pehchan karne ke baad, traders ko target set karna chahiye ke wo kis direction mein trade kar rahe hain, aur unki exit strategy kya hogi agar trend reversal ho jaye.

Additional information.

Island reversal candlestick pattern ek mufeed tool hai jo traders ko trend changes ka andaza dene mein madad karta hai. Iski sahi pehchan aur samajh traders ko market mein successful trading karne mein madad karti hai. Lekin, ye pattern sirf ek indicator hai aur traders ko dusre technical analysis tools ke saath combine karke istemal karna chahiye, taki unka trading decision sahi ho sake.

تبصرہ

Расширенный режим Обычный режим