Introduction to Commodity Channel Index (CCI)

Commodity Channel Index (CCI) ek popular technical analysis indicator hai jo traders ke liye istemal hota hai taake wo potential changes in price direction, overbought or oversold conditions, aur trend ki strength ko identify kar sakein. Donald Lambert ne late 1970s mein isko develop kiya tha aur CCI ne various financial markets mein, jaise ke stocks, commodities, currencies, aur cryptocurrencies, mein widespread use hasil ki hai. Iski versatility aur simplicity se yeh novice aur experienced traders dono ke liye ek valuable tool hai.

Commodity Channel Index (CCI) ek popular technical analysis indicator hai jo traders ke liye istemal hota hai taake wo potential changes in price direction, overbought or oversold conditions, aur trend ki strength ko identify kar sakein. Donald Lambert ne late 1970s mein isko develop kiya tha aur CCI ne various financial markets mein, jaise ke stocks, commodities, currencies, aur cryptocurrencies, mein widespread use hasil ki hai. Iski versatility aur simplicity se yeh novice aur experienced traders dono ke liye ek valuable tool hai.

Calculation Formula and Core Concept

Commodity Channel Index ka core concept hai ke yeh asset ka current price, uska moving average, aur uska standard deviation measure karta hai. CCI ko calculate karne ka formula kuch steps ko involve karta hai. Sabse pehle, typical price (TP) calculate kiya jata hai, jo ke asset ka high, low, aur close prices ka average hota hai ek specific period ke dauran, jisme commonly 20 periods istemal hoti hai. Next, typical prices ka simple moving average (SMA) bhi same period ke liye calculate kiya jata hai. Phir, mean absolute deviation (MAD) ko calculate kiya jata hai taake typical prices ka moving average se variability measure ho sake. CCI ko phir derive kiya jata hai typical price aur moving average ke beech ka difference ko mean absolute deviation ka multiple divide karke.

Interpretation of CCI Values

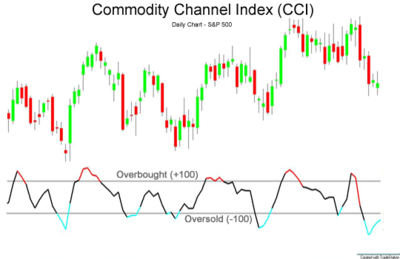

Resulting CCI values central line ke ird gird fluctuate karte hain, jo ke commonly zero par set ki jati hai, aur indicate karte hain ke asset apni average price ke upar ya niche trade kar raha hai. Positive CCI values suggest karte hain ke asset ka price apni average ke upar hai, jo ke potential overbought conditions ko indicate karte hain, jabke negative values yeh show karte hain ke price apni average ke niche hai, jo ke oversold conditions ko suggest karte hain. Traders often extreme CCI readings, jaise ke values above +100 ya below -100, ko potential signals ke tor par dekhte hain jo overextended price moves ko signal kar sakte hain jo ek reversal ke pehle indicator ho sakte hain.

Customization and Adaptability of CCI

CCI ka ek key feature yeh hai ke yeh different market conditions ke according adapt ho sakta hai apne calculations mein time frame ko adjust karke. Traders CCI ka lookback period customize kar sakte hain apne trading style aur asset ke specific characteristics ke hisab se. Shorter lookback periods, jaise ke 14 ya 20 periods, often intraday trading ke liye use hoti hain ya short-term price swings ko identify karne ke liye, jabke longer periods, jaise ke 50 ya 100 periods, broader market trends ko capture karne ke liye preferred hote hain.

Overbought aur oversold conditions ko identify karne ke ilawa, Commodity Channel Index ko buy aur sell signals generate karne ke liye bhi use kiya ja sakta hai. Ek common approach yeh hai ke CCI aur asset ke price ke darmiyan divergences ko dekha jaye. Bullish divergence tab hoti hai jab price ek new low banata hai, lekin CCI ek higher low form karta hai, jo ke weakening selling pressure ko indicate karta hai aur ek potential reversal ko signal karta hai. Oppositely, bearish divergence tab hoti hai jab price ek new high banata hai, lekin CCI ek lower high form karta hai, jo ke waning buying momentum ko signal karta hai aur ek possible downturn ko indicate karta hai.

Trading Strategies with CCI

CCI se related ek aur popular trading strategy overbought aur oversold levels par based hai. Jab CCI +100 ke upar cross karta hai, yeh suggest karta hai ke asset overbought hai, aur traders selling ya profits lena consider kar sakte hain. Oppositely, jab CCI -100 ke niche cross karta hai, yeh oversold conditions indicate karta hai, aur traders buying opportunities ya potential reversals ko upside ki taraf dekh sakte hain. Kuch traders additional confirmation signals ka istemal karte hain, jaise ke price patterns ya aur technical indicators, CCI-based trading signals ki reliability ko increase karne ke liye.

Limitations and Considerations of CCI

Despite its effectiveness, Commodity Channel Index ki limitations hain aur yeh false signals ya whipsaws se immune nahi hai, especially choppy ya range-bound markets mein. Jaise ke koi bhi technical indicator, CCI tab best kaam karta hai jab ise dusre tools aur analysis techniques ke saath use kiya jaye ek comprehensive trading strategy ke hisab se. Aur traders ko CCI ka inherent lagging nature ka bhi dhyan rakhna chahiye, jo ke yeh indicate karta hai ke signals price move start hone ke baad rather than uske pehle ho sakte hain.

Commodity Channel Index ek valuable tool hai technical analysis aur trading decision-making ke liye. Iski ability overbought aur oversold conditions ko identify karne mein, trend ki strength ko detect karne mein, aur buy aur sell signals generate karne mein yeh ek versatile indicator hai traders ke liye alag alag financial markets mein.

تبصرہ

Расширенный режим Обычный режим