# Commodity Channel Index (CCI) Indicator

Commodity Channel Index (CCI) ek popular technical analysis tool hai jo traders aur investors ko market ki overbought ya oversold conditions ka andaza lagane mein madad karta hai. Iska istemal stock, commodities, aur currencies ki price movements ko samajhne ke liye kiya jata hai.

CCI indicator ko 1980s mein Donald Lambert ne introduce kiya tha. Ye indicator price ki current level ko uski average price se compare karta hai, jisse ye pata chalta hai ke koi asset apne historical range mein kis position par hai. CCI ka range -100 se +100 tak hota hai, aur ye 0 ke aas-paas fluctuates karta hai.

### CCI Ka Istemal

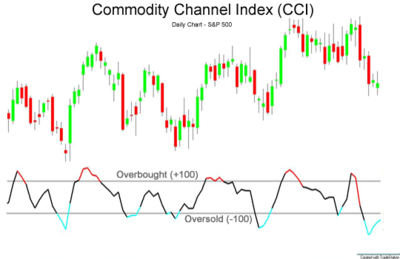

1. **Overbought aur Oversold Conditions**: Jab CCI +100 ke upar hota hai, to iska matlab hota hai ke market overbought hai, aur jab ye -100 ke neeche hota hai, to market oversold hai. Ye signals traders ko buy ya sell karne ka decision lene mein madad dete hain.

2. **Divergence**: CCI ka istemal divergence ko identify karne ke liye bhi hota hai. Agar price higher high banata hai lekin CCI lower high, to ye bearish divergence hai, jo ke price ke girne ki nishani ho sakti hai. Is tarah ka analysis trends ki reversal ya continuation ko samajhne mein madadgar hota hai.

3. **Entry aur Exit Points**: Traders CCI ki signals ka istemal entry aur exit points tay karne ke liye karte hain. Jab CCI +100 ke upar cross karta hai, to ye sell signal hota hai, jabke -100 ke neeche cross karne par buy signal milta hai.

### CCI Ka Calculation

CCI ko calculate karne ka formula kuch is tarah hai:

\[ CCI = \frac{(Current Price - Average Price)}{(0.015 \times Mean Deviation)} \]

Is formula mein, average price typically 20 ya 14 periods ka hota hai. Ye formula market ki volatility aur trends ko samajhne mein madad karta hai.

### Conclusion

CCI indicator ek powerful tool hai jo market ki sentiment ko samajhne aur trading decisions lene mein madadgar hai. Lekin, hamesha yaad rakhein ke kisi bhi indicator ko sirf ek tool ke taur par istemal karein aur market conditions aur dusre factors ko bhi madde nazar rakhein. Trading mein risk management aur analysis ka bahut zyada ahmiyat hota hai. Isliye, CCI ka istemal karte waqt apne research aur analysis par dhyan dena zaroori hai.

`

X

-

### Commodity Channel Index (CCI) Indicator

Commodity Channel Index (CCI) ek popular technical indicator hai jo market ke overbought aur oversold conditions ko identify karne ke liye use kiya jata hai. CCI ko first time Donald Lambert ne 1980s mai introduce kiya tha aur iski primary focus market ke cyclical trends aur price movements par hoti hai. Aaj hum CCI indicator ka detailed jaiza lenge aur dekhenge ke yeh forex aur stock trading mein kis tarah madadgar ho sakta hai.

**CCI Indicator Kya Hai?**

Commodity Channel Index (CCI) ek momentum-based indicator hai jo price deviation aur trend strength ko measure karta hai. Yeh indicator price aur average price ke beech ke deviation ko calculate karta hai aur ek numerical value generate karta hai jo traders ko market conditions ko assess karne mai madad karta hai. CCI typically -100 se +100 ke range mein oscillates, lekin extreme values se market ke overbought ya oversold conditions ka pata chalta hai.

**Calculation:**

CCI calculate karne ke liye, pehle aapko following steps follow karne hote hain:

1. **Calculate the Typical Price (TP):** TP = (High + Low + Close) / 3

2. **Calculate the Moving Average (MA):** N-period ka simple moving average TP ke values ka calculate karen.

3. **Calculate the Mean Deviation (MD):** TP values aur MA ke beech ke absolute differences ka average calculate karen.

4. **Calculate CCI:** CCI = (TP - MA) / (0.015 × MD)

Yahan, 0.015 ek constant hai jo CCI ko scale par rakhta hai.

**CCI Patterns Aur Signals:**

1. **Overbought Conditions:** Jab CCI +100 se upar hota hai, toh yeh market ke overbought conditions ko indicate karta hai. Iska matlab hota hai ke price excessive level par hai aur trend reversal ya correction ka potential ho sakta hai.

2. **Oversold Conditions:** Jab CCI -100 se niche hota hai, toh yeh market ke oversold conditions ko indicate karta hai. Iska matlab hota hai ke price excessively low hai aur reversal ya rebound ka potential ho sakta hai.

3. **Divergence:** CCI aur price ke beech divergence bhi trading signals provide karta hai. Agar price higher high banati hai lekin CCI lower high banata hai, toh yeh bearish divergence ko indicate karta hai aur potential reversal ka signal hota hai.

**Trading Strategy:**

1. **Entry Points:** CCI ke extreme levels par trade entries consider ki jati hain. Overbought aur oversold conditions ke signals par buy ya sell positions open ki jati hain.

2. **Stop Loss:** Stop loss ko recent price swings ke levels ke paas set karna chahiye taa ke risk ko manage kiya ja sake.

3. **Take Profit:** Take profit levels ko CCI ke extreme values ya recent support aur resistance levels ke mutabiq set karen.

**Benefits of CCI Indicator:**

1. **Trend Reversal Identification:** CCI market ke overbought aur oversold conditions ko identify karta hai, jo trend reversal points ko highlight karte hain.

2. **Momentum Measurement:** Yeh indicator market ke momentum aur trend strength ko measure karta hai, jo traders ko informed decisions lene mai madad karta hai.

3. **Versatility:** CCI indicator ko various timeframes aur markets mai use kiya ja sakta hai, jo iski versatility ko highlight karta hai.

**Limitations:**

1. **False Signals:** CCI kabhi kabhi false signals bhi generate kar sakta hai, isliye confirmation signals aur additional indicators ke sath combine karke use karna chahiye.

2. **Lagging Indicator:** Yeh indicator trend changes ko thoda late signal kar sakta hai, isliye timely trading decisions lene ke liye other tools ke sath use karna zaroori hai.

**Nateeja:**

Commodity Channel Index (CCI) forex aur stock trading mai ek valuable tool hai jo market ke overbought aur oversold conditions ko identify karne aur trend reversal points ko predict karne mai madad karta hai. Iski accurate calculation aur effective use se traders apne trading strategies ko enhance kar sakte hain. CCI indicator ko apne trading toolkit mai shamil karna aur uski signals ko samajhna trading success ke liye bohot zaroori hai.

Leave a comment:

-

Forex trading aur doosre financial markets mein traders ke liye ek bohot ahem zariya hai technical analysis. Technical analysis ke zariye traders market ki activity aur trends ko samajhte hain aur apne trading decisions ko tez o taiz bana sakte hain. Commodity Channel Index (CCI) ek aise popular technical indicator hai jo ke traders apne analysis mein istemal karte hain.

CCI Indicator Kya Hai?

CCI ek momentum-based indicator hai jo ke market volatility ko measure karta hai. Donald Lambert ne 1980s mein CCI indicator ko develop kiya tha. Is indicator ka maqsad market mein overbought ya oversold conditions ko detect karna hai. CCI usually -100 to +100 ke darmiyan oscillate karta hai. Positive values indicate ke market overbought hai aur negative values indicate ke market oversold hai.

CCI Indicator Ka Istemal:

CCI indicator ke istemal se traders market trends aur reversals ko identify kar sakte hain. Jab CCI positive territory mein hota hai, yani +100 se zyada, to yeh indicate karta hai ke market ka trend strong hai aur traders ko long positions consider karne chahiye. Jab CCI negative territory mein hota hai, yani -100 se kam, to yeh indicate karta hai ke market weak hai aur traders ko short positions consider karne chahiye.

CCI Indicator Ka Istemal Ka Tareeqa:CCI indicator ka istemal karne ke liye, traders ko iski signals ko samajhna aur interpret karna zaroori hai. Agar CCI positive territory mein hai aur phir se negative territory mein ja raha hai, to yeh ek potential sell signal ho sakta hai. Aur agar CCI negative territory mein hai aur phir se positive territory mein ja raha hai, to yeh ek potential buy signal ho sakta hai. Lekin, traders ko always confirmatory signals aur doosre technical indicators ka bhi istemal karna chahiye taake unki trading decisions ko validate kiya ja sake.

Conclusion:

CCI indicator forex trading aur doosre financial markets mein ek zaroori tool hai jo ke traders ko market ki momentum aur volatility ka andaza lagane mein madad karta hai. Lekin, yeh important hai ke traders is indicator ke signals ko samajhne aur interpret karne mein maharat hasil karein. Aur hamesha yaad rahe ke ek indicator ke istemal ke saath doosre confirmatory signals aur risk management techniques ka bhi istemal zaroori hai. Is tarah se, CCI indicator ke sahi istemal se traders apne trading strategies ko mazeed behtar bana sakte hain aur market mein kamiyabi hasil kar sakte hain.

- CL

- Mentions 0

-

سا0 like

Leave a comment:

-

Commodity Channel Index (CCI) Indicator:

1. Introduction: Commodity Channel Index (CCI) ek popular technical indicator hai jo market volatility aur price trends ko measure karne ke liye istemal hota hai. Is article mein hum CCI indicator ke tareeqe aur uske faiday bayan karenge.

2. Tareef: CCI indicator price ke current level ko ek moving average se compare karta hai. Iske zariye ye determine karta hai ke market overbought ya oversold hai aur potential trend reversals ko detect karta hai.

3. Kaise Kaam Karta Hai: CCI indicator ka calculation price ke current level ko uska moving average se minus karke hota hai aur fir isko ek constant multiplier se divide kiya jata hai. Isse ek oscillator value hasil hoti hai jo typically +100 aur -100 ke darmiyan hoti hai.

4. Trading Strategy: CCI indicator ke istemal se traders overbought aur oversold levels ko identify kar sakte hain. Jab CCI indicator +100 se oopar jata hai, toh ye indicate karta hai ke market overbought hai aur agar -100 se neeche jata hai, toh ye oversold condition ko indicate karta hai.

5. Entry aur Exit Points: Traders CCI indicator ka istemal karke entry aur exit points tay kar sakte hain. Jab CCI +100 se oopar jata hai, toh traders sell positions lete hain aur jab ye -100 se neeche jata hai, toh traders buy positions lete hain.

6. Fawaid: CCI indicator ke istemal se traders ko kuch fawaid milte hain:- Overbought/Oversold Levels: CCI indicator overbought aur oversold levels ko identify karne mein madad karta hai.

- Trend Reversals: Ye indicator potential trend reversals ko detect karne mein madad karta hai.

7. Nukhsanat: CCI indicator ke istemal mein kuch nukhsanat bhi hote hain:- False Signals: Kabhi kabhi CCI indicator false signals generate kar sakta hai.

- Lagging Nature: Ye indicator lagging nature ka hota hai, isliye sometimes late entries ya exits ho sakte hain.

CCI indicator forex aur stocks trading mein ek useful tool hai jo traders ko market trends aur volatility ke baray mein maloomat faraham karta hai. Lekin, iske istemal se pehle traders ko iska proper use aur interpretation samajhna zaroori hai.

Leave a comment:

-

Forex trading ek dinamik aur complex duniya hai jahan traders ko market ke tabdeel hone wale patterns aur price movements ko samajhne ke liye mukhtalif tools aur indicators ka istemal karna parta hai. CCI (Commodity Channel Index) ek aham technical indicator hai jo market ki volatility aur price changes ko measure karta hai. Is article mein, hum CCI indicator ke bare mein gehraai se ghoor karenge aur samjhenge ke kis tarah se is ka istemal forex trading mein hota hai.

1. CCI Indicator Ki Tareef aur Tareekh

CCI indicator, Donald Lambert ne 1980 mein tashkeel diya tha. Is ka maqsad market trends aur price movements ko measure karna hai. CCI ek momentum-based indicator hai jo market volatility aur price changes ko quantify karta hai. Ye ek oscillating indicator hai jo market ke dynamics ko analyze karne mein madad deta hai.

2. CCI Indicator Ki Calculation

CCI indicator ki calculation mukhtalif steps par mabni hoti hai. Sab se pehle, ek mukhtalif waqt ke liye average price calculate kiya jata hai, jo typically 20 periods ke liye hota hai. Phir, is average price se current price ko subtract kiya jata hai. Uske baad, ek constant factor se is difference ko multiply kiya jata hai, jo volatility ko adjust karta hai. Final step mein, is result ka ek moving average calculate kiya jata hai. Is process ke natije mein CCI ka final value nikalta hai.

3. CCI Indicator Ke Key Features

CCI indicator ke kuch key features hain jo isay traders ke liye ahem banate hain:- Overbought aur oversold levels ko identify karna: CCI indicator +100 aur -100 levels ko overbought aur oversold levels ke liye use karta hai. Jab CCI +100 se upar jata hai, to ye overbought condition ko indicate karta hai, jabke jab ye -100 se neeche jata hai, to ye oversold condition ko indicate karta hai.

- Trend direction ko samajhna: CCI indicator ke positive aur negative values traders ko trend direction ka pata lagane mein madad karte hain. Positive values uptrend ko indicate karte hain jabke negative values downtrend ko indicate karte hain.

- Volatility ko measure karna: CCI indicator market ki volatility ko bhi measure karta hai. Agar CCI ki values ziada hain, to ye high volatility ko indicate karte hain aur agar values kam hain, to ye low volatility ko indicate karte hain.

4. CCI Indicator Ka Istemal Kaise Hota Hai

CCI indicator ko trading strategies mein istemal karne ke liye traders mukhtalif tareeqon par amal karte hain. Kuch common tareeqay hain:- Overbought aur oversold conditions ko identify karne ke liye: Jab CCI indicator extreme levels par pohanch jata hai, jaise ke +100 aur -100, to ye overbought aur oversold conditions ko point out karta hai. Traders is information ka istemal kar ke entry aur exit points tay karte hain.

- Divergence ke istemal: CCI indicator ke aur price movement ke darmiyan ki divergence ko dekh kar traders market reversals ko anticipate karte hain.

- Trend identification: CCI indicator ke trend lines ko analyze kar ke traders trend direction ko determine karte hain aur us ke mutabiq trading decisions lete hain.

5. CCI Indicator Ke Benefits

CCI indicator forex trading mein istemal karne ke kai faide hain:- Market trends aur price movements ko samajhne mein asani.

- Overbought aur oversold conditions ko identify karne ki sahulat.

- Volatility ko measure karne mein madad.

- Trading strategies ko optimize karne mein help.

6. CCI Indicator Ke Limitations

CCI indicator ke sath kuch limitations bhi hain jo traders ko dhyan mein rakhna chahiye:- False signals: Kabhi kabhi CCI indicator false signals generate kar sakta hai jo traders ko ghalat trading decisions par le ja sakta hai.

- Lagging indicator: CCI indicator thori der se market trends aur reversals ko identify karta hai, is liye traders ko sabr aur tahammul ki zaroorat hoti hai.

- Sirf ek tool: CCI indicator ek tool hai, isay isolated istemal kar ke trading decisions lena theek nahi hai. Isay doosre technical indicators aur market analysis ke sath combine karna zaroori hai.

7. CCI Indicator Aur Trading Strategies

CCI indicator ko mukhtalif trading strategies ke sath combine kiya ja sakta hai jaise ke:- Trend following strategies: CCI indicator ke trend lines ko analyze kar ke traders trend direction ke mutabiq positions lete hain.

- Range-bound trading strategies: Jab market range-bound hota hai, CCI indicator overbought aur oversold levels ko identify kar ke trading opportunities faraham karta hai.

- Divergence strategies: CCI indicator ke aur price movement ke darmiyan ki divergence ko dekh kar traders market reversals ko anticipate karte hain.

8. CCI Indicator Ka Demo

CCI indicator ka demo dekhne ke liye, ek imaginary scenario consider karte hain:- Agar CCI indicator +100 se upar jata hai, to ye overbought condition ko indicate karta hai aur traders sell positions enter karte hain.

- Agar CCI indicator -100 se neeche jata hai, to ye oversold condition ko indicate karta hai aur traders buy positions enter karte hain.

9. CCI Indicator Ki Best Practices

CCI indicator ko behtareen tareeqay se istemal karne ke liye kuch best practices hain:- Dusre technical indicators ke sath combine karen.

- Sirf ek tool ke bharose par na chalen.

- Trading plan banaye aur us par amal karen.

- Risk management ko prioritize karen.

10. CCI Indicator Aur Risk Management

CCI indicator ke istemal ke doran, risk management ko prioritize karna zaroori hai. Risk management ke strategies include stop-loss orders, position sizing, aur risk-reward ratios. Ye sabhi techniques traders ko loss se bachane mein madadgar hoti hain.

11. CCI Indicator Ka Istemal Sikhnay Ke Liye Resources

CCI indicator ka istemal sikhnay ke liye mukhtalif resources mojood hain jaise ke online tutorials, books, aur webinars. Traders ko in resources ka istemal kar ke CCI indicator ke istemal aur trading strategies ko samajhna chahiye.

12. CCI Indicator Ka Istemal Karne Ka Conclusion

CCI indicator ek powerful aur versatile tool hai jo traders ko market trends aur price movements ke baray mein maloomat faraham karta hai. Is ka istemal kar ke traders apni trading strategies ko optimize kar sakte hain aur behtar trading decisions le sakte hain. Lekin, traders ko CCI indicator ke limitations ko bhi samajhna zaroori hai aur doosre technical indicators ke sath combine karna chahiye.

13. Aakhri Alfaaz

CCI indicator forex trading mein ek ahem aur useful tool hai jo traders ko market conditions ko samajhne aur trading decisions lenay mein madad deta hai. Lekin, isay istemal karne se pehle traders ko iske tareeqay aur limitations ko samajhna zaroori hai. Sahi istemal aur proper risk management ke sath, CCI indicator traders ke liye faida mand sabit ho sakta hai.

Leave a comment:

-

Commodity Channel Index (CCI) Indicator

Introduction to Commodity Channel Index (CCI)

Commodity Channel Index (CCI) ek popular technical analysis indicator hai jo traders ke liye istemal hota hai taake wo potential changes in price direction, overbought or oversold conditions, aur trend ki strength ko identify kar sakein. Donald Lambert ne late 1970s mein isko develop kiya tha aur CCI ne various financial markets mein, jaise ke stocks, commodities, currencies, aur cryptocurrencies, mein widespread use hasil ki hai. Iski versatility aur simplicity se yeh novice aur experienced traders dono ke liye ek valuable tool hai.

Calculation Formula and Core Concept

Commodity Channel Index ka core concept hai ke yeh asset ka current price, uska moving average, aur uska standard deviation measure karta hai. CCI ko calculate karne ka formula kuch steps ko involve karta hai. Sabse pehle, typical price (TP) calculate kiya jata hai, jo ke asset ka high, low, aur close prices ka average hota hai ek specific period ke dauran, jisme commonly 20 periods istemal hoti hai. Next, typical prices ka simple moving average (SMA) bhi same period ke liye calculate kiya jata hai. Phir, mean absolute deviation (MAD) ko calculate kiya jata hai taake typical prices ka moving average se variability measure ho sake. CCI ko phir derive kiya jata hai typical price aur moving average ke beech ka difference ko mean absolute deviation ka multiple divide karke.

Interpretation of CCI Values

Resulting CCI values central line ke ird gird fluctuate karte hain, jo ke commonly zero par set ki jati hai, aur indicate karte hain ke asset apni average price ke upar ya niche trade kar raha hai. Positive CCI values suggest karte hain ke asset ka price apni average ke upar hai, jo ke potential overbought conditions ko indicate karte hain, jabke negative values yeh show karte hain ke price apni average ke niche hai, jo ke oversold conditions ko suggest karte hain. Traders often extreme CCI readings, jaise ke values above +100 ya below -100, ko potential signals ke tor par dekhte hain jo overextended price moves ko signal kar sakte hain jo ek reversal ke pehle indicator ho sakte hain.

Customization and Adaptability of CCI

CCI ka ek key feature yeh hai ke yeh different market conditions ke according adapt ho sakta hai apne calculations mein time frame ko adjust karke. Traders CCI ka lookback period customize kar sakte hain apne trading style aur asset ke specific characteristics ke hisab se. Shorter lookback periods, jaise ke 14 ya 20 periods, often intraday trading ke liye use hoti hain ya short-term price swings ko identify karne ke liye, jabke longer periods, jaise ke 50 ya 100 periods, broader market trends ko capture karne ke liye preferred hote hain.

Overbought aur oversold conditions ko identify karne ke ilawa, Commodity Channel Index ko buy aur sell signals generate karne ke liye bhi use kiya ja sakta hai. Ek common approach yeh hai ke CCI aur asset ke price ke darmiyan divergences ko dekha jaye. Bullish divergence tab hoti hai jab price ek new low banata hai, lekin CCI ek higher low form karta hai, jo ke weakening selling pressure ko indicate karta hai aur ek potential reversal ko signal karta hai. Oppositely, bearish divergence tab hoti hai jab price ek new high banata hai, lekin CCI ek lower high form karta hai, jo ke waning buying momentum ko signal karta hai aur ek possible downturn ko indicate karta hai.

Trading Strategies with CCI

CCI se related ek aur popular trading strategy overbought aur oversold levels par based hai. Jab CCI +100 ke upar cross karta hai, yeh suggest karta hai ke asset overbought hai, aur traders selling ya profits lena consider kar sakte hain. Oppositely, jab CCI -100 ke niche cross karta hai, yeh oversold conditions indicate karta hai, aur traders buying opportunities ya potential reversals ko upside ki taraf dekh sakte hain. Kuch traders additional confirmation signals ka istemal karte hain, jaise ke price patterns ya aur technical indicators, CCI-based trading signals ki reliability ko increase karne ke liye.

Limitations and Considerations of CCI

Despite its effectiveness, Commodity Channel Index ki limitations hain aur yeh false signals ya whipsaws se immune nahi hai, especially choppy ya range-bound markets mein. Jaise ke koi bhi technical indicator, CCI tab best kaam karta hai jab ise dusre tools aur analysis techniques ke saath use kiya jaye ek comprehensive trading strategy ke hisab se. Aur traders ko CCI ka inherent lagging nature ka bhi dhyan rakhna chahiye, jo ke yeh indicate karta hai ke signals price move start hone ke baad rather than uske pehle ho sakte hain.

Commodity Channel Index ek valuable tool hai technical analysis aur trading decision-making ke liye. Iski ability overbought aur oversold conditions ko identify karne mein, trend ki strength ko detect karne mein, aur buy aur sell signals generate karne mein yeh ek versatile indicator hai traders ke liye alag alag financial markets mein.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:23 AM (GMT+5)۔

Working...

X

Leave a comment: