ABCD Pattern Technical Analysis Intro.

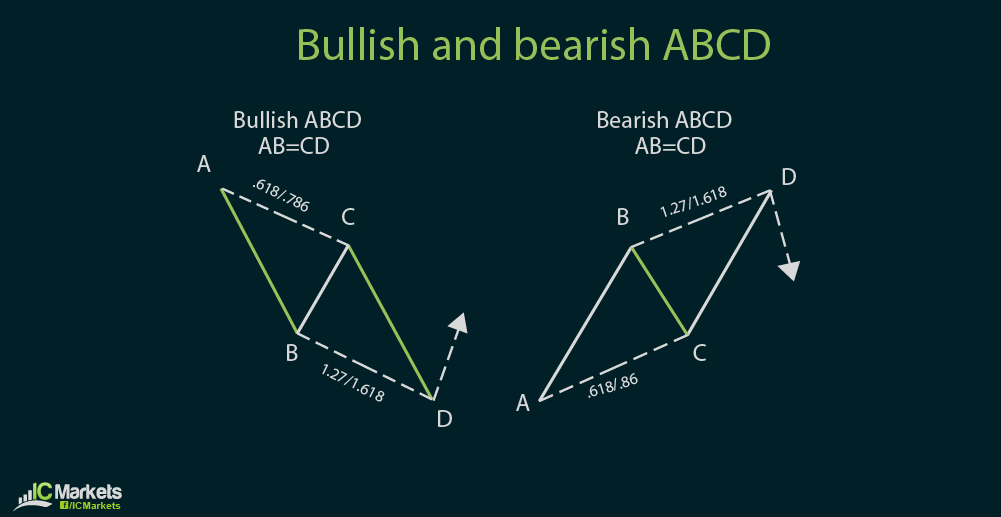

ABCD Pattern ek technical analysis pattern hai jo stocks, commodities, currencies, ya anya financial instruments ke price movements ko analyze karne ke liye istemal hota hai. Ye pattern traders ko price trends ko samajhne aur future price movements ka anuman lagane mein madad karta hai.ABCD pattern ek powerful technical analysis tool hai jo traders ko price movements ko samajhne aur trading ke decisions lene mein madad karta hai. Lekin, is pattern ko samajhna aur istemal karna experience aur practice ka kaam hai. Traders ko apne risk ko manage karte hue pattern ko sahi tareeke se istemal karna chahiye.ABCD pattern, price action ka ek prakar hai jo typically chaar mukhya stages ya points ko shamil karta hai: A, B, C, aur D. Ye points market mein reversals ya trend changes ko darust karte hain. Har point ko specific price levels ya swings se represent kiya jata hai.

ABCD Pattern Ke Tareeqay.

ABCD pattern ka istemal karna trading mein kamyabi ke liye kai challenges ke sath ata hai. Kuch pechidaayiyan is tarah hain.

ABCD Pattern Ke Fayde.

ABCD pattern ke istemal se traders ko kuch fawaid bhi hote hain.

ABCD pattern ko samajhne aur istemal karne ke liye traders ko kuch steps follow karne chahiye.

ABCD Pattern ek technical analysis pattern hai jo stocks, commodities, currencies, ya anya financial instruments ke price movements ko analyze karne ke liye istemal hota hai. Ye pattern traders ko price trends ko samajhne aur future price movements ka anuman lagane mein madad karta hai.ABCD pattern ek powerful technical analysis tool hai jo traders ko price movements ko samajhne aur trading ke decisions lene mein madad karta hai. Lekin, is pattern ko samajhna aur istemal karna experience aur practice ka kaam hai. Traders ko apne risk ko manage karte hue pattern ko sahi tareeke se istemal karna chahiye.ABCD pattern, price action ka ek prakar hai jo typically chaar mukhya stages ya points ko shamil karta hai: A, B, C, aur D. Ye points market mein reversals ya trend changes ko darust karte hain. Har point ko specific price levels ya swings se represent kiya jata hai.

ABCD Pattern Ke Tareeqay.

- Point A: Yeh pehla point hota hai jahan price trend shuru hota hai. Ye typically ek trend reversal ke baad ya phir ek existing trend ke extension ke doran paya jata hai.

- Point B: Point B ek retracement ya correction point hota hai jahan price trend mein ek temporary reversal hota hai. Yeh point usually Point A se kuch had tak opposite direction mein hota hai.

- Point C: Point C bhi ek retracement point hota hai jahan price trend mein doosri muddat ka reversal hota hai. Yeh typically Point B ke pasandaaz mein hota hai.

- Point D: Point D, pattern ka ant, ya toh ek reversal ke liye ya phir ek trend extension ke liye hota hai. Yeh typically ek Fibonacci extension level ke nazdeek paya jata hai.

ABCD pattern ka istemal karna trading mein kamyabi ke liye kai challenges ke sath ata hai. Kuch pechidaayiyan is tarah hain.

- Subjectivity: Pattern ko identify karna ek tajziati mizaaj hai. Traders ko price movements ko analyze karne mein mahir hona chahiye taake woh sahi tareeke se pattern ko pehchan sakein.

- False Signals: Kabhi kabhi ABCD pattern false signals ya fakeouts bhi generate kar sakta hai. Yeh hota hai jab price trend pattern ke mutabiq nahi chalta aur traders ko galat samjha jaata hai.

- Risk Management: Trading mein risk management ka ahem kirdaar hota hai. ABCD pattern ko follow karte hue, traders ko apne positions ko control karna aur stop loss orders ka istemal karna zaroori hota hai.

- Experience Required: ABCD pattern ko samajhna aur istemal karna traders ke liye experience aur practice ki zaroorat hai. Naye traders ko pattern ko sahi tareeke se pehchanna aur us par trade karna seekhne mein waqt lag sakta hai.

ABCD Pattern Ke Fayde.

ABCD pattern ke istemal se traders ko kuch fawaid bhi hote hain.

- Price Analysis: Pattern ko samajh kar traders price movements ko better analyze kar sakte hain aur potential trading opportunities ko pehchan sakte hain.

- Entry Points: ABCD pattern entry points provide karta hai jahan traders apne positions ko enter kar sakte hain.

- Risk Reward Ratio: Pattern traders ko risk reward ratio ko manage karne mein madad karta hai. Sahi entry aur exit points ko chun kar, traders apne risk ko kam kar sakte hain aur potential rewards ko maximize kar sakte hain.

- Pattern Recognition: ABCD pattern ke istemal se traders apne technical analysis skills ko improve kar sakte hain aur future price movements ko predict karne mein maharat hasil kar sakte hain.

ABCD pattern ko samajhne aur istemal karne ke liye traders ko kuch steps follow karne chahiye.

- Chart Analysis: Pehle toh traders ko price charts analyze karna chahiye aur potential ABCD patterns ko pehchan na chahiye.

- Confirmation: Pattern ko confirm karne ke liye, traders ko aur technical indicators ya price action signals ka istemal karke verify karna chahiye.

- Entry aur Exit Points: Traders ko entry aur exit points ko tay karna chahiye jahan wo positions enter karenge aur exit karenge.

- Risk Management: Har trade ke liye risk management plan banana zaroori hai. Traders ko apne positions ko monitor karna aur stop loss orders ka istemal karna chahiye.

- Practice: ABCD pattern ko samajhne aur us par trade karne ke liye practice aur experience ka hona zaroori hai. Traders ko demo accounts ya small positions par trading karke pattern ko samajhna chahiye.

تبصرہ

Расширенный режим Обычный режим