Forex Mein Harmonic Price Chart Patterns+=+=+

Forex mein harmonic price chart patterns trading mein ek important tool hote hain. Ye patterns traders ko market ke direction aur potential reversals ke baray mein signals dete hain. Ye patterns Fibonacci retracement aur extension levels ke based hote hain.

Harmonic Price Chart Patterns ka use primarily price reversals aur trend changes ko identify karne mein hota hai. Ye patterns market mein geometry aur Fibonacci ratios ko follow karte hain, jinhe traders aur investors Fibonacci retracement aur extension levels ke through calculate karte hain.

Forex Mein Harmonic Price Chart Ke Common Patterns +=+=+

Kuch common harmonic price chart patterns hain:

In patterns ko samajh kar aur unki confirmation ke liye technical analysis tools ka istemal karke traders market mein entry aur exit points ka faisla karte hain. Harmonic price chart patterns ki sahi tarah se samajh aur istemal karne se traders ko trading mein faida hota hai.

Forex mein harmonic price chart patterns trading mein ek important tool hote hain. Ye patterns traders ko market ke direction aur potential reversals ke baray mein signals dete hain. Ye patterns Fibonacci retracement aur extension levels ke based hote hain.

Harmonic Price Chart Patterns ka use primarily price reversals aur trend changes ko identify karne mein hota hai. Ye patterns market mein geometry aur Fibonacci ratios ko follow karte hain, jinhe traders aur investors Fibonacci retracement aur extension levels ke through calculate karte hain.

Forex Mein Harmonic Price Chart Ke Common Patterns +=+=+

Kuch common harmonic price chart patterns hain:

- ABCD Pattern: Ye pattern market mein trend change hone ka signal deta hai. Isme four legs hote hain: AB, BC, CD. CD leg usually AB leg ke opposite direction mein move karta hai.

- Gartley Pattern: Ye pattern bhi trend reversal ka signal deta hai. Isme four legs hote hain: XA, AB, BC, CD. Gartley pattern Fibonacci levels ko follow karta hai.

- Butterfly Pattern: Ye pattern bhi trend reversal ko indicate karta hai. Isme five legs hote hain: XA, AB, BC, CD, XD. Butterfly pattern mein BC leg AB leg ki extension hoti hai aur CD leg AB leg ki retracement hoti hai.

- Bat Pattern: Ye pattern bhi Fibonacci levels par based hota hai. Isme four legs hote hain: XA, AB, BC, CD. Bat pattern mein CD leg usually AB leg ki retracement hoti hai.

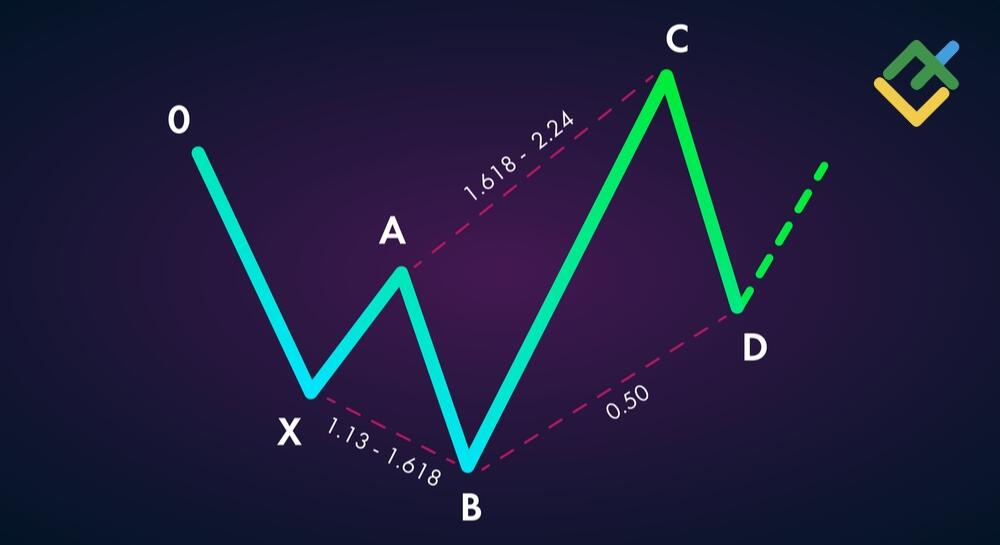

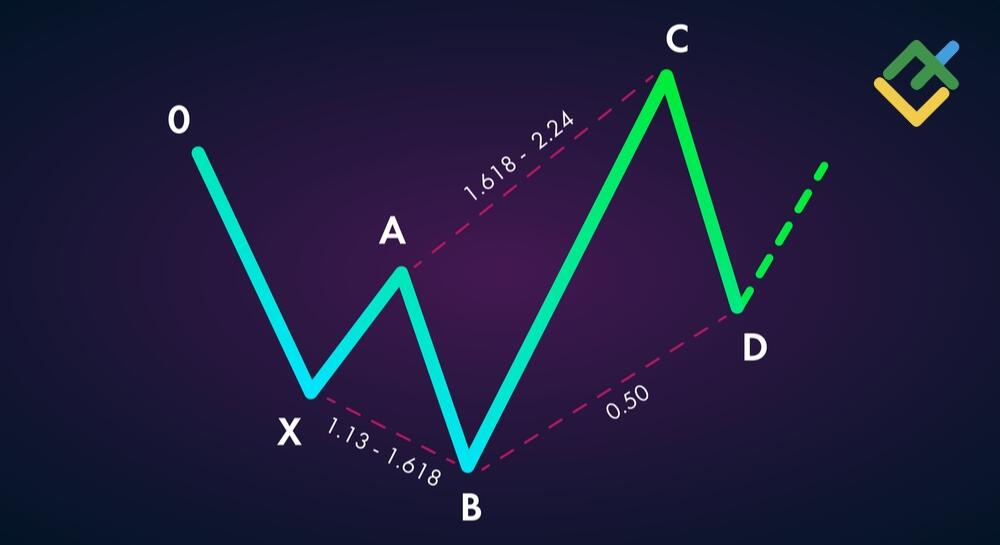

- Cypher Pattern: Ye pattern bhi Fibonacci levels ko follow karta hai. Isme five legs hote hain: XA, AB, BC, CD, XD. Cypher pattern mein CD leg usually XA leg ke 0.786 level tak move karta hai.

In patterns ko samajh kar aur unki confirmation ke liye technical analysis tools ka istemal karke traders market mein entry aur exit points ka faisla karte hain. Harmonic price chart patterns ki sahi tarah se samajh aur istemal karne se traders ko trading mein faida hota hai.

تبصرہ

Расширенный режим Обычный режим