Harmonic price chart patterns, trading mein aik aham technical analysis tool hain jo traders istemal karte hain taake wo financial markets mein potential reversal points ko pehchaan sakein. Ye patterns Fibonacci retracement levels aur geometric price formations par mabni hoti hain. Traders ka khayal hai ke harmonic patterns market trends ke bare mein qeemati insights faraham kar sakti hain aur unhein zyada behtar trading decisions lene mein madad kar sakti hain.

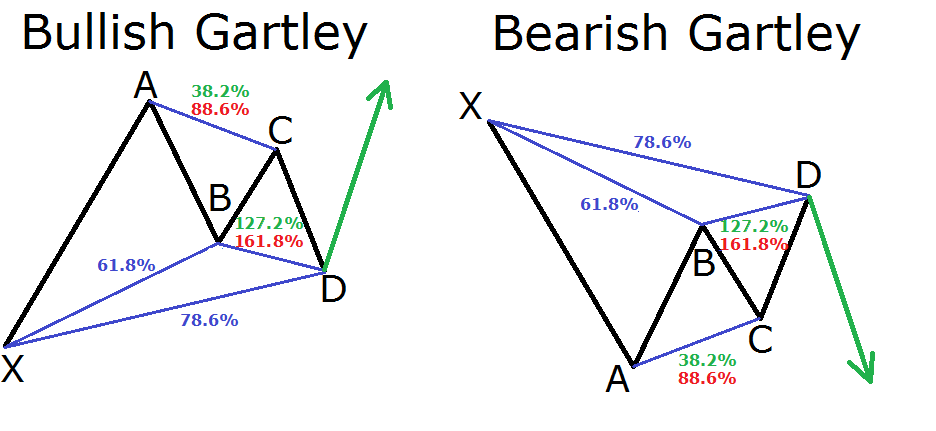

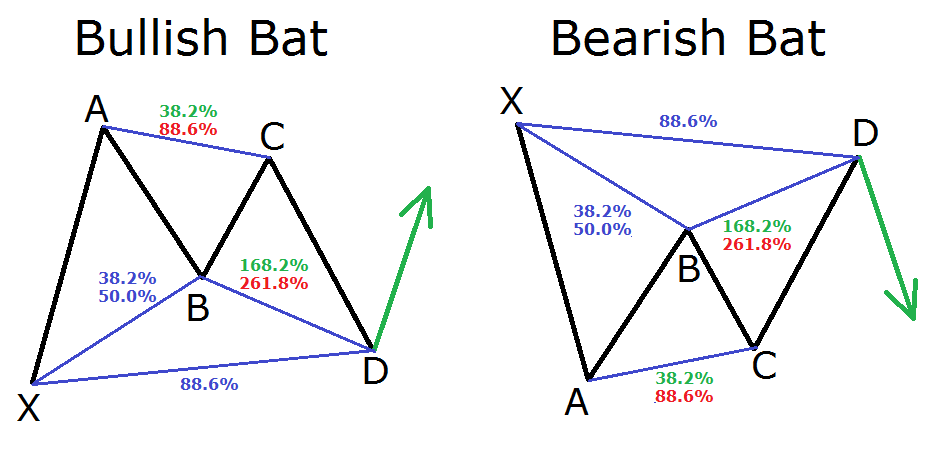

Gartley Pattern

Ek mashhoor harmonic pattern Gartley pattern hai. Ye pattern char price swings se bana hota hai, jo chart par M ya W shape banata hai. Gartley pattern ko pehchaan ne ke liye istemal hone wale key Fibonacci retracement levels 0.618 aur 0.382 hote hain. Traders specific ratios ko check karte hain in levels ke darmiyan taake pattern ki sahiyat ko confirm kar sakein.

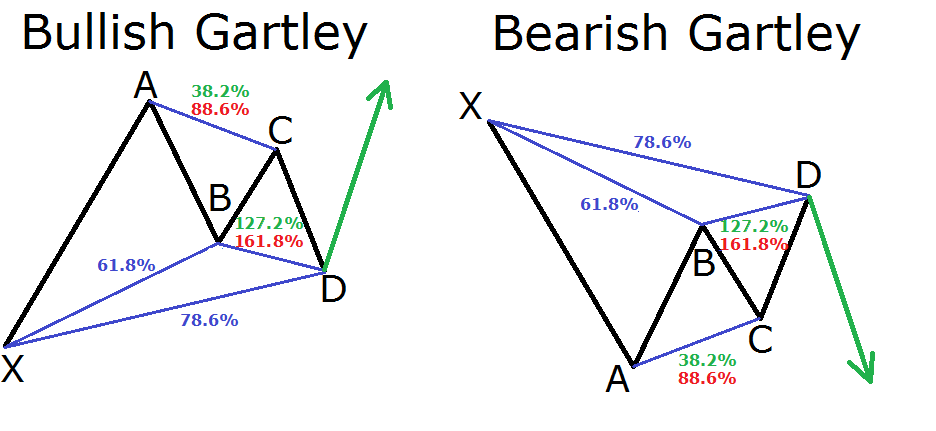

Ek aur common harmonic pattern Butterfly pattern hai. Ye pattern ek butterfly ke wings jaise hota hai aur paanch price swings se bana hota hai. Butterfly pattern ke liye key Fibonacci levels 0.786 aur 1.272 hote hain. Traders in ratios ko istemal karte hain ek valid Butterfly pattern ko doosri price movements se pehchaan ne ke liye.

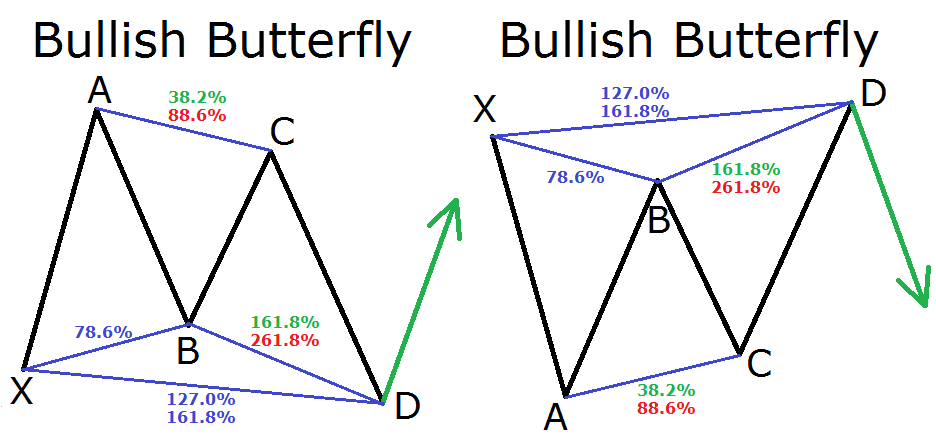

Bat Pattern

Bat pattern bhi ek aham harmonic pattern hai jo traders aksar dhoondhte hain. Ye pattern Gartley pattern ki tarah hota hai lekin alag Fibonacci ratios ke saath. Bat pattern ke liye key levels 0.886 aur 0.786 hote hain. Traders in levels ke aas paas price action ko analyze karte hain taake Bat pattern ki mojoodgi ko confirm kar sakein.

Harmonic patterns ka aik faida ye hai ke ye clear entry aur exit points faraham kar sakti hain trades ke liye. Traders ek harmonic pattern ka completion as a signal istemal kar sakte hain ek trade mein enter hone ke liye expected reversal ke direction mein. Wo pattern ki structure ke basis par stop-loss orders set kar sakte hain risk ko effectively manage karne ke liye.

Magar yaad rahe ke harmonic patterns foolproof nahi hoti aur inhein doosre technical analysis tools aur risk management strategies ke saath istemal karna chahiye. Market conditions jaldi badal sakti hain aur patterns hamesha expected tarah se kaam nahi kar sakte. Traders ko hamesha ehtiyaat aur thorough analysis ka amal karna chahiye trading decisions lene se pehle harmonic patterns par buniyadi research karte hue.

Shark Pattern

Gartley, Butterfly, aur Bat patterns ke ilawa bhi kai aur harmonic patterns hote hain jo traders ko milte hain. Ye patterns include karte hain Crab pattern, Shark pattern, aur Cypher pattern, har pattern apni set of Fibonacci ratios aur price characteristics ke saath. Traders jo harmonic pattern trading mein specialize karte hain wo in patterns ko extensively study karte hain takay unki trading accuracy improve ho sake.

Kuch traders automated tools aur software programs ka istemal karte hain harmonic patterns ko scan karne ke liye price charts par. Ye tools potential opportunities ko zyada efficiently identify karne mein madadgar ho sakti hain aur manual analysis par zyada time na lagayein. Magar zaroori hai ke traders harmonic patterns ke principles ko samajhne ke liye aur automated signals par pura bharosa na karein.

Harmonic price chart patterns traders ke liye aik aisa qeemati tool hain jo unhein financial markets mein potential reversal points ko pehchaanne mein madad faraham kar sakti hain. Ye patterns Fibonacci retracement levels aur geometric price formations par mabni hote hain, clear entry aur exit points faraham kar ke trades ke liye. Halan ke harmonic patterns trading strategies ko enhance kar sakti hain, lekin inhein doosri analysis techniques aur risk management strategies ke saath istemal karna chahiye behtareen nataij ke liye.

Gartley Pattern

Ek mashhoor harmonic pattern Gartley pattern hai. Ye pattern char price swings se bana hota hai, jo chart par M ya W shape banata hai. Gartley pattern ko pehchaan ne ke liye istemal hone wale key Fibonacci retracement levels 0.618 aur 0.382 hote hain. Traders specific ratios ko check karte hain in levels ke darmiyan taake pattern ki sahiyat ko confirm kar sakein.

Ek aur common harmonic pattern Butterfly pattern hai. Ye pattern ek butterfly ke wings jaise hota hai aur paanch price swings se bana hota hai. Butterfly pattern ke liye key Fibonacci levels 0.786 aur 1.272 hote hain. Traders in ratios ko istemal karte hain ek valid Butterfly pattern ko doosri price movements se pehchaan ne ke liye.

Bat Pattern

Bat pattern bhi ek aham harmonic pattern hai jo traders aksar dhoondhte hain. Ye pattern Gartley pattern ki tarah hota hai lekin alag Fibonacci ratios ke saath. Bat pattern ke liye key levels 0.886 aur 0.786 hote hain. Traders in levels ke aas paas price action ko analyze karte hain taake Bat pattern ki mojoodgi ko confirm kar sakein.

Harmonic patterns ka aik faida ye hai ke ye clear entry aur exit points faraham kar sakti hain trades ke liye. Traders ek harmonic pattern ka completion as a signal istemal kar sakte hain ek trade mein enter hone ke liye expected reversal ke direction mein. Wo pattern ki structure ke basis par stop-loss orders set kar sakte hain risk ko effectively manage karne ke liye.

Magar yaad rahe ke harmonic patterns foolproof nahi hoti aur inhein doosre technical analysis tools aur risk management strategies ke saath istemal karna chahiye. Market conditions jaldi badal sakti hain aur patterns hamesha expected tarah se kaam nahi kar sakte. Traders ko hamesha ehtiyaat aur thorough analysis ka amal karna chahiye trading decisions lene se pehle harmonic patterns par buniyadi research karte hue.

Shark Pattern

Gartley, Butterfly, aur Bat patterns ke ilawa bhi kai aur harmonic patterns hote hain jo traders ko milte hain. Ye patterns include karte hain Crab pattern, Shark pattern, aur Cypher pattern, har pattern apni set of Fibonacci ratios aur price characteristics ke saath. Traders jo harmonic pattern trading mein specialize karte hain wo in patterns ko extensively study karte hain takay unki trading accuracy improve ho sake.

Kuch traders automated tools aur software programs ka istemal karte hain harmonic patterns ko scan karne ke liye price charts par. Ye tools potential opportunities ko zyada efficiently identify karne mein madadgar ho sakti hain aur manual analysis par zyada time na lagayein. Magar zaroori hai ke traders harmonic patterns ke principles ko samajhne ke liye aur automated signals par pura bharosa na karein.

Harmonic price chart patterns traders ke liye aik aisa qeemati tool hain jo unhein financial markets mein potential reversal points ko pehchaanne mein madad faraham kar sakti hain. Ye patterns Fibonacci retracement levels aur geometric price formations par mabni hote hain, clear entry aur exit points faraham kar ke trades ke liye. Halan ke harmonic patterns trading strategies ko enhance kar sakti hain, lekin inhein doosri analysis techniques aur risk management strategies ke saath istemal karna chahiye behtareen nataij ke liye.

تبصرہ

Расширенный режим Обычный режим