Explained.

Candlestick patterns ek important tool hain jin ka use forex market mein kiya jata hai. Double Doji candlestick pattern ek aisa pattern hai jis ko traders apne trading strategies mein istemal karte hain. Is article mein hum Double Doji candlestick pattern ke bare mein roman urdu mein baat karenge.

Doji candlestick pattern ek aisa pattern hai jismein candle ke open aur close price same hote hain. Is pattern ko dekh kar traders ko pata chalta hai ke market mein koi bhi trend nahi hai aur price range bound hai.

Double Doji Candlestick Pattern Make.

Double Doji candlestick pattern mein do consecutive doji candles hote hain. Matlab ke do candlesticks ke open aur close price same hote hain.

Is pattern ko dekh kar traders ko pata chalta hai ke market mein koi bhi trend nahi hai aur price range bound hai.

Double Doji Candlestick Pattern Use.

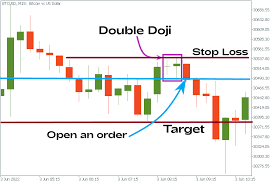

Double Doji candlestick pattern ko istemal karne ke liye traders ko price action aur support/resistance levels ke bare mein pata hona chahiye. Agar market kisi support/resistance level ke paas hai aur do consecutive doji candles form ho rahe hain toh yeh ek strong signal hai ke price range bound hai aur market directionless hai.

Traders aise situations mein range bound strategies istemal karte hain jaise ke range trading, breakouts aur reversals. Double Doji candlestick pattern ko confirm karne ke liye traders ko volume aur other technical indicators ka bhi istemal karna hota hai.

Trading Strategy.

Double Doji candlestick pattern ek useful tool hai jo traders ko market direction ke bare mein jankari deta hai. Is pattern ko istemal karne se traders ko market ki range bound movement ko samajhne mein madad milti hai aur woh apne trading strategies ko improve kar sakte hain.

Candlestick patterns ek important tool hain jin ka use forex market mein kiya jata hai. Double Doji candlestick pattern ek aisa pattern hai jis ko traders apne trading strategies mein istemal karte hain. Is article mein hum Double Doji candlestick pattern ke bare mein roman urdu mein baat karenge.

Doji candlestick pattern ek aisa pattern hai jismein candle ke open aur close price same hote hain. Is pattern ko dekh kar traders ko pata chalta hai ke market mein koi bhi trend nahi hai aur price range bound hai.

Double Doji Candlestick Pattern Make.

Double Doji candlestick pattern mein do consecutive doji candles hote hain. Matlab ke do candlesticks ke open aur close price same hote hain.

Is pattern ko dekh kar traders ko pata chalta hai ke market mein koi bhi trend nahi hai aur price range bound hai.

Double Doji Candlestick Pattern Use.

Double Doji candlestick pattern ko istemal karne ke liye traders ko price action aur support/resistance levels ke bare mein pata hona chahiye. Agar market kisi support/resistance level ke paas hai aur do consecutive doji candles form ho rahe hain toh yeh ek strong signal hai ke price range bound hai aur market directionless hai.

Traders aise situations mein range bound strategies istemal karte hain jaise ke range trading, breakouts aur reversals. Double Doji candlestick pattern ko confirm karne ke liye traders ko volume aur other technical indicators ka bhi istemal karna hota hai.

Trading Strategy.

Double Doji candlestick pattern ek useful tool hai jo traders ko market direction ke bare mein jankari deta hai. Is pattern ko istemal karne se traders ko market ki range bound movement ko samajhne mein madad milti hai aur woh apne trading strategies ko improve kar sakte hain.

تبصرہ

Расширенный режим Обычный режим