Momentum Trading Strategy Useful results in Forex.

Momentum Trading Strategy Useful results in Forex

Momentum Trading: Ek Agahi

Momentum trading forex ke liye ek popular tareeqa hai jisme traders naye trends ko pehchaan kar unme shamil ho jate hain. Yeh ek strategy hai jo tezi se market movement ko istemal karti hai aur traders ko faida dene ki koshish karti hai. Is strategy ka maqsad hota hai ke maazi ki tezi ko dekhte hue agle movement ko predict karna. Lekin, is tareeqay ka istemal karne se pehle, traders ko iske faide aur nuksan ka pata hona zaroori hai.

Kya Hai Momentum Trading?

Momentum trading ek aise tareeqa hai jisme traders current market trends ko analyze karte hain aur un trends ke hisaab se trading karte hain. Is tareeqay mein traders market ke momentum ko samajhte hain aur uss momentum ke saath trading karte hain. Yeh strategy tezi ya mandi ke dauran kaam karti hai aur traders ko tezi ke dauran zyada faida hota hai.

Momentum Trading ke Faide

Momentum trading ke kuch faide hain jo isay forex market mein ahem bana dete hain:

Momentum Trading ke Nuksan

Lekin, momentum trading ke kuch nuksan bhi hain jo traders ko yaad rakhna chahiye:

Momentum Trading ke Tareeqay

Momentum trading ke kuch ahem tareeqay hain jo traders istemal karte hain:

Nateeje

Momentum trading forex market mein ahem role ada karti hai aur agar sahi tareeqay se istemal ki jaye, toh yeh traders ko zyada munafa dene mein madad kar sakti hai. Lekin, isay istemal karne se pehle traders ko market ko acche se samajhna zaroori hai aur sahi tareeqay se analysis karna chahiye. Jaise hi yeh strategy sahi tareeqay se istemal ki jaye, traders ko behtar results mil sakte hain.

Momentum Trading Strategy Useful results in Forex

Momentum Trading: Ek Agahi

Momentum trading forex ke liye ek popular tareeqa hai jisme traders naye trends ko pehchaan kar unme shamil ho jate hain. Yeh ek strategy hai jo tezi se market movement ko istemal karti hai aur traders ko faida dene ki koshish karti hai. Is strategy ka maqsad hota hai ke maazi ki tezi ko dekhte hue agle movement ko predict karna. Lekin, is tareeqay ka istemal karne se pehle, traders ko iske faide aur nuksan ka pata hona zaroori hai.

Kya Hai Momentum Trading?

Momentum trading ek aise tareeqa hai jisme traders current market trends ko analyze karte hain aur un trends ke hisaab se trading karte hain. Is tareeqay mein traders market ke momentum ko samajhte hain aur uss momentum ke saath trading karte hain. Yeh strategy tezi ya mandi ke dauran kaam karti hai aur traders ko tezi ke dauran zyada faida hota hai.

Momentum Trading ke Faide

Momentum trading ke kuch faide hain jo isay forex market mein ahem bana dete hain:

- Tezi Ke Dauran Zyada Munafa: Momentum trading tezi ke dauran zyada munafa dene ka dawa karti hai kyunki isme traders tezi ke movement ka faida uthate hain.

- Asani Se Samajhne Ki Salahiyat: Yeh trading strategy asani se samajhne aur istemal karne ki salahiyat rakhti hai, jo naye traders ke liye bhi faida mand hai.

- Chhote Samay Mein Munafa: Momentum trading ke zariye traders chhote samay mein bhi munafa kama sakte hain agar unhone sahi trend ko pehchana aur uss par trading ki.

Momentum Trading ke Nuksan

Lekin, momentum trading ke kuch nuksan bhi hain jo traders ko yaad rakhna chahiye:

- Jokhim: Tezi ke dauran trading karna jokhim bhara ho sakta hai kyunki tezi kabhi bhi gir sakti hai aur traders ko nuksan ho sakta hai.

- Zyada Tahqiqat Ki Zaroorat: Is tareeqay ko istemal karne se pehle zyada tahqiqat aur market analysis ki zaroorat hoti hai taake traders sahi faisla kar sakein.

- Emotional Trading: Tezi ke dauran traders ki emotions un par asar andaaz ho sakti hain aur woh ghalat faislay kar sakte hain.

Momentum Trading ke Tareeqay

Momentum trading ke kuch ahem tareeqay hain jo traders istemal karte hain:

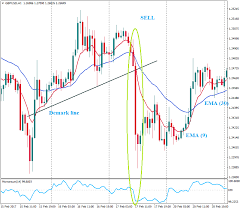

- Moving Average Crossover: Is tareeqay mein traders moving averages ka istemal karte hain taake unhein market ke momentum ka andaza ho sake.

- RSI (Relative Strength Index): RSI ka istemal bhi momentum trading mein hota hai jisme traders market ke overbought ya oversold conditions ko pehchante hain.

- MACD (Moving Average Convergence Divergence): MACD bhi ek popular indicator hai jo momentum trading mein istemal hota hai aur traders ko market ke direction ka pata lagata hai.

Nateeje

Momentum trading forex market mein ahem role ada karti hai aur agar sahi tareeqay se istemal ki jaye, toh yeh traders ko zyada munafa dene mein madad kar sakti hai. Lekin, isay istemal karne se pehle traders ko market ko acche se samajhna zaroori hai aur sahi tareeqay se analysis karna chahiye. Jaise hi yeh strategy sahi tareeqay se istemal ki jaye, traders ko behtar results mil sakte hain.

تبصرہ

Расширенный режим Обычный режим