Introduction.

Momentum trading strategy ek aisi trading strategy hai jo forex market mein istemal ki jati hai. Is strategy mein traders ko market ki trend aur momentum par focus karna hota hai. Is Post main hum momentum trading strategy ke results ke bare mein baat karenge.

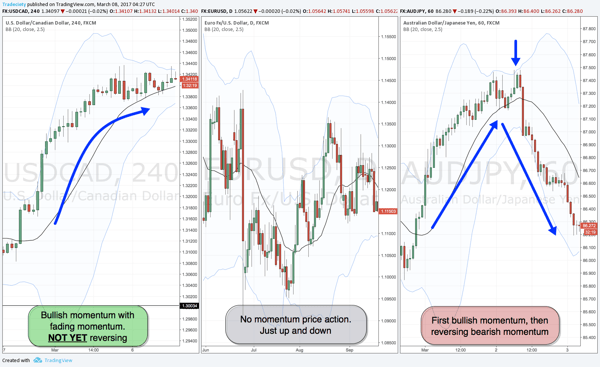

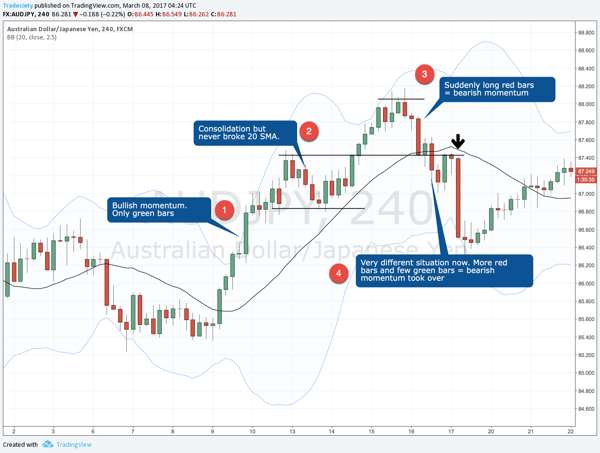

Trend and Momentum.

Forex market mein trading karne ke liye trend aur momentum ka bohat zyada importance hota hai. Agar aap market ki trend aur momentum ko samajh lenge to aap market mein successful trading kar sakte hain.Her terha ki strategies ka use kerty howy trading ko continue krna boht hota hay is say success k chances zeyada ho jaty hain earn kerna easy ho jata hay.

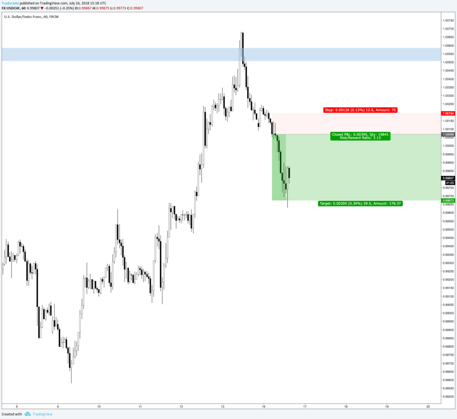

Momentum Trading Strategy.

Momentum trading strategy mein traders ko market ki momentum aur trend ko follow karna hota hai. Yeh strategy short-term trading ke liye bohat zyada effective hai. Is strategy mein traders ko market ki strength aur weakness ke baray mein pata hona chahiye.

Momentum Trading Strategy Results.

Momentum trading strategy ke results bohat zyada positive hote hain. Is strategy ke zariye traders short-term trading mein bohat zyada profit earn kar sakte hain. Is strategy ko follow karne ke liye traders ko market ki trend aur momentum ko constantly monitor karna hota hai.

Basic Concept.

Momentum trading strategy forex mein bohat zyada popular hai aur is strategy ke results bohat zyada positive hote hain. Traders ko market ki trend aur momentum ko samajhne ke liye bohat zyada research aur analysis karna hota hai. Agar aap momentum trading strategy ko follow karte hain to aap short-term trading mein bohat zyada profit earn kar sakte hain.

Momentum trading strategy ek aisi trading strategy hai jo forex market mein istemal ki jati hai. Is strategy mein traders ko market ki trend aur momentum par focus karna hota hai. Is Post main hum momentum trading strategy ke results ke bare mein baat karenge.

Trend and Momentum.

Forex market mein trading karne ke liye trend aur momentum ka bohat zyada importance hota hai. Agar aap market ki trend aur momentum ko samajh lenge to aap market mein successful trading kar sakte hain.Her terha ki strategies ka use kerty howy trading ko continue krna boht hota hay is say success k chances zeyada ho jaty hain earn kerna easy ho jata hay.

Momentum Trading Strategy.

Momentum trading strategy mein traders ko market ki momentum aur trend ko follow karna hota hai. Yeh strategy short-term trading ke liye bohat zyada effective hai. Is strategy mein traders ko market ki strength aur weakness ke baray mein pata hona chahiye.

Momentum Trading Strategy Results.

Momentum trading strategy ke results bohat zyada positive hote hain. Is strategy ke zariye traders short-term trading mein bohat zyada profit earn kar sakte hain. Is strategy ko follow karne ke liye traders ko market ki trend aur momentum ko constantly monitor karna hota hai.

Basic Concept.

Momentum trading strategy forex mein bohat zyada popular hai aur is strategy ke results bohat zyada positive hote hain. Traders ko market ki trend aur momentum ko samajhne ke liye bohat zyada research aur analysis karna hota hai. Agar aap momentum trading strategy ko follow karte hain to aap short-term trading mein bohat zyada profit earn kar sakte hain.

تبصرہ

Расширенный режим Обычный режим