Slow Stochastic Trading introduction,

Slow Stochastic, ek technical analysis indicator hai jo trading mein istemal hota hai. Ye indicator market ke momentum aur overbought/oversold conditions ko samajhne mein madad karta hai. Isay trading strategies mein shamil karke traders apne faislay mein sahayak hone ke liye istemal karte hain.Stochastic indicator, Dr. George Lane ke tajaweez par mabni hai. Isay 0 se 100 tak ke range mein darust karnay ka maqsad hota hai. Yeh do lines se munsalik hota hai: %K line aur %D line.Slow Stochastic, trading mein ek aham tool hai jo market trends aur momentum ko samajhne mein madad karta hai.

Components of Slow Stochastic indicator,

%K Line:

Slow Stochastic, market ke momentum aur overbought/oversold conditions ko samajhne mein madad karta hai. Yeh traders ko ye batata hai ke market kitna strong hai aur kya woh extreme levels par hai.

Overbought and Oversold Conditions,

Slow Stochastic ko trading strategies mein istemal karne ke liye kuch muddat par amal karna zaroori hai.

Additional Note,

Iska istemal karke traders apne faislay mein mazbooti aur asani hasil kar sakte hain. Lekin, har ek trading indicator ki tarah, Slow Stochastic ka istemal bhi mushkil market conditions mein hosla afzai aur doosre confirmatory indicators ke sath karna zaroori hai.

Slow Stochastic, ek technical analysis indicator hai jo trading mein istemal hota hai. Ye indicator market ke momentum aur overbought/oversold conditions ko samajhne mein madad karta hai. Isay trading strategies mein shamil karke traders apne faislay mein sahayak hone ke liye istemal karte hain.Stochastic indicator, Dr. George Lane ke tajaweez par mabni hai. Isay 0 se 100 tak ke range mein darust karnay ka maqsad hota hai. Yeh do lines se munsalik hota hai: %K line aur %D line.Slow Stochastic, trading mein ek aham tool hai jo market trends aur momentum ko samajhne mein madad karta hai.

Components of Slow Stochastic indicator,

%K Line:

- %K line, current closing price ko past ki range mein set kiye gaye high aur low prices ke darmiyan adjust karta hai.

- Iski formula ye hai: %K = [(Current Close - Lowest Low) / (Highest High - Lowest Low)] * 100

- %K line, market ke momentum ko represent karta hai.

- %D line, %K line ki simple moving average hoti hai aur smoothing ke liye istemal hoti hai.

- Iski formula ye hai: %D = 3-day simple moving average of %K line

- %D line, %K ki volatility ko kam karti hai aur trends ko samajhne mein madad karti hai.

Slow Stochastic, market ke momentum aur overbought/oversold conditions ko samajhne mein madad karta hai. Yeh traders ko ye batata hai ke market kitna strong hai aur kya woh extreme levels par hai.

Overbought and Oversold Conditions,

- %K aur %D lines 0 se 100 ke darmiyan ghoomte hain. Traditionally, 80 ke upar %K ko overbought aur 20 ke niche ko oversold mana jata hai.

- Overbought condition, market mein zyada khareedari ko darust karti hai aur oversold condition, zyada farokht ko darust karti hai.

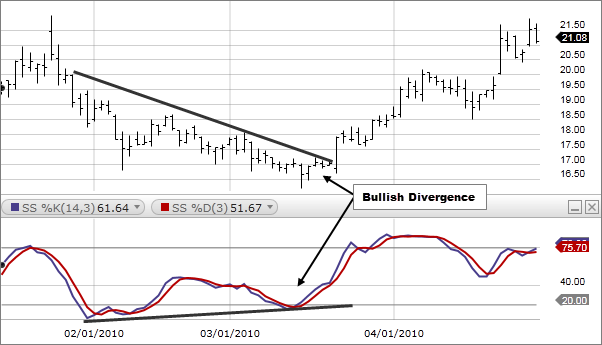

- %K line, %D line ko cross karti hai, jo traders ko signals provide karta hai.

- Agar %K line %D line ko neeche se upar cross karti hai, to ye ek buying signal hai. Wahi agar %K line %D line ko upar se neeche cross karti hai, to ye ek selling signal hai.

Slow Stochastic ko trading strategies mein istemal karne ke liye kuch muddat par amal karna zaroori hai.

- Slow Stochastic, existing trend ko confirm karne mein madad karta hai. Agar market uptrend mein hai aur %K line %D line ko upar se cross karti hai, to ye ek aur confirmatory signal hai.

- Divergence, jab market ki movement aur stochastic lines mein farq hota hai, ko darust karta hai.

- Convergence, jab market aur stochastic lines ek dusre ke kareeb hote hain, ko indicate karta hai.

- Overbought aur oversold conditions, support aur resistance levels ko identify karne mein madad karte hain. Agar market overbought hai aur %K line 80 ko cross karta hai, to yeh ek potential resistance point hai.

- Slow Stochastic ka istemal karte waqt, kuch zaroori tadabeer aur tahqiqati asoolon ka bhi khayal rakhna zaroori hai.

- Slow Stochastic ko dusre indicators ke sath istemal karke confirmation hasil ki ja sakti hai. Yeh strategy ko aur bhi mazboot bana sakta hai.Har trading strategy mein risk management ka ehmiyat hota hai. Stop-loss orders ka istemal karke traders apne nuksan ko control mein rakh sakte hain.

- Different timeframes par Slow Stochastic ka istemal karke traders market ki mukhtalif layers ko samajh sakte hain.

Additional Note,

Iska istemal karke traders apne faislay mein mazbooti aur asani hasil kar sakte hain. Lekin, har ek trading indicator ki tarah, Slow Stochastic ka istemal bhi mushkil market conditions mein hosla afzai aur doosre confirmatory indicators ke sath karna zaroori hai.

:max_bytes(150000):strip_icc()/dotdash_INV-final-Stochastic-Oscillator-Jun-2021-01-0580390daa1c44ffaac8c7ffcbb96f6a.jpg)

تبصرہ

Расширенный режим Обычный режим