1. Rounding Bottom Pattern Ki Pehchan

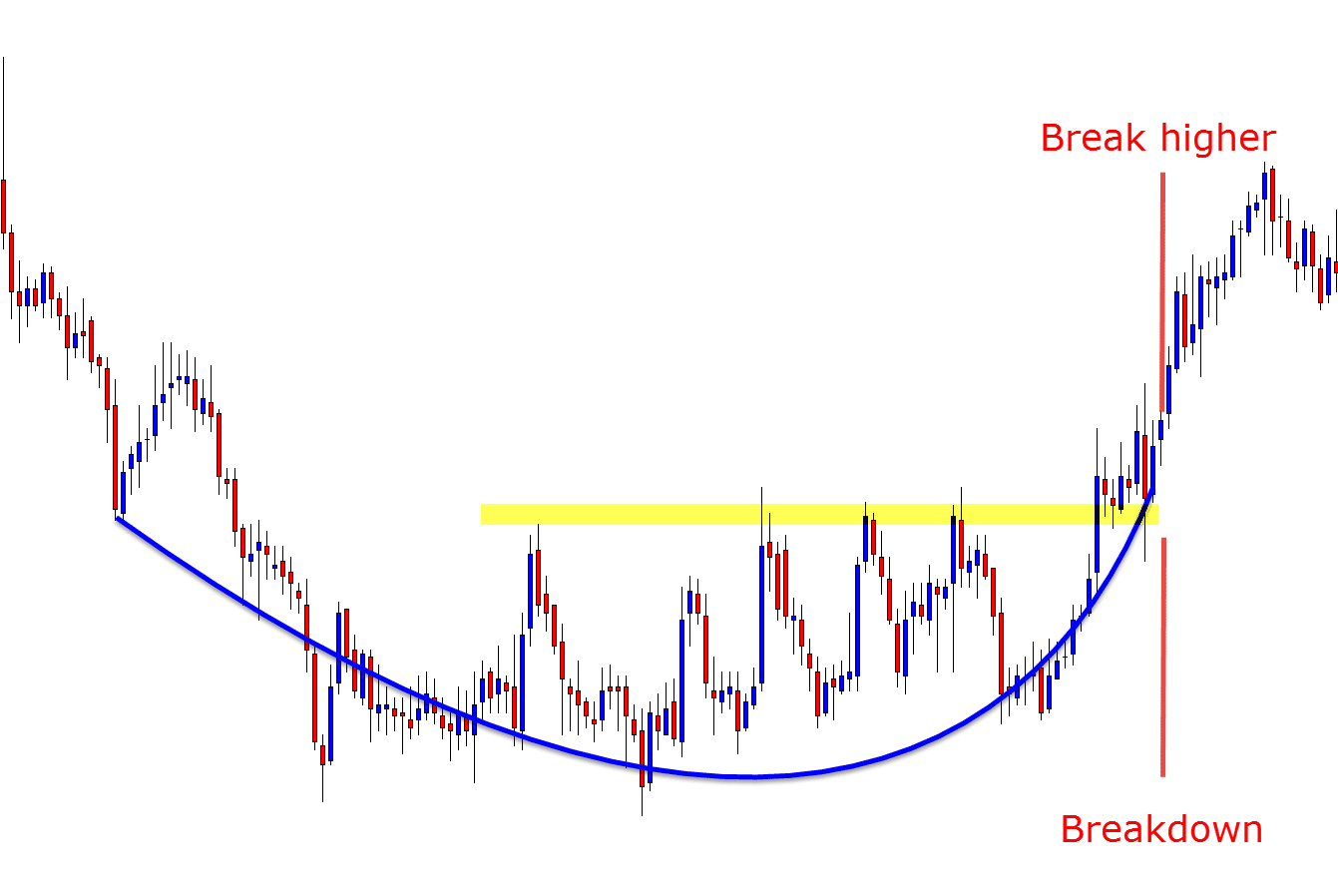

Rounding Bottom pattern ko identify karne ke liye, traders ko price chart par ek U-shaped curve dhundhna hota hai. Yeh curve typically downtrend ke baad dekha jata hai aur ek gradual recovery ko indicate karta hai. Is curve ka bottom point downtrend ke neeche hota hai aur phir gradual recovery ke baad price wapas upar ki taraf mudti hai. Traders ko dhyan dena chahiye ke is pattern mein curve ka shape smooth hona chahiye, agar curve mein kisi bhi jagah sharp angles ya abrupt changes hote hain toh woh actual Rounding Bottom pattern nahi ho sakta.

2. Rounding Bottom Ka Maqsad

Rounding Bottom pattern ka maqsad hota hai indicate karna ke asset ka price downtrend se recovery shuru kar chuka hai aur ab upar ki taraf jaane ka mood hai. Yeh pattern market mein ek reversal ko signal karta hai aur traders ko bullish trend ke possibility ke baare mein sochne par majboor karta hai. Is pattern ko identify karne se pehle traders ko confirmatory signals aur indicators ka bhi dhyaan dena chahiye taake wo sahi maayno mein pattern ko identify kar sakein aur false signals se bach sakein.

3. Rounding Bottom Ka Tareeqa-e-Amal

Is pattern ko identify karne ke liye, traders ko price movements ko closely observe karna hota hai. Is pattern mein ek U-shaped curve ki shape hoti hai jisme price initially downtrend mein hoti hai, phir gradual recovery ke baad ek saath jhuk kar wapas upar ki taraf mudti hai. Traders ko ye bhi dhyan mein rakhna chahiye ke Rounding Bottom pattern ka bottom point pehle downtrend ke neeche hota hai aur phir gradual recovery ke baad price wapas upar ki taraf jaati hai, isliye is pattern ko identify karne ke liye patience aur observation ki zaroorat hoti hai.

4. Rounding Bottom Aur Market Psychology

Rounding Bottom pattern ki interpretation mein market psychology ka bhi ek important role hota hai. Is pattern ko dekh kar traders samajhte hain ke market mein bearish sentiment khatam ho chuki hai aur bullish sentiment shuru ho rahi hai. Yeh indicate karta hai ke investors ke beech optimism badh rahi hai. Lekin traders ko dhyan mein rakhna chahiye ke Rounding Bottom pattern sirf ek indicator hai, aur doosri factors jaise fundamental analysis aur overall market conditions ko bhi consider karna important hai pattern ko confirm karne ke liye.

5. Rounding Bottom Ki Importance

Rounding Bottom pattern traders ke liye ek important tool hai kyun ke isse future price movements ka idea milta hai. Jab traders is pattern ko identify karte hain, toh unhe ek potential trend reversal ka indication milta hai, jisse wo apne trading strategies ko adjust kar sakte hain. Is pattern ko identify karne ke liye traders ko market ke overall trend ko analyze karna hota hai saath hi saath doosre technical indicators aur confirmatory signals ka bhi istemal karna hota hai taake wo accurate predictions kar sakein.

6. Rounding Bottom Ka Time Frame

Rounding Bottom pattern ka time frame kisi bhi timeframe par ho sakta hai, jaise kuch weeks ya phir months ke liye. Is pattern ko identify karne mein time frame ka dhyaan rakhna zaroori hai taake sahi prediction ki ja sake. Chhoti time frames par Rounding Bottom pattern ki identification karna thoda mushkil ho sakta hai kyunki volatility ke wajah se false signals bhi generate ho sakte hain. Isliye traders ko time frame ko choose karte waqt volatility aur overall market conditions ka bhi dhyaan dena chahiye.

7. Rounding Bottom Ka Confirmation

Rounding Bottom pattern ko confirm karne ke liye traders doosri indicators aur tools ka bhi istemal karte hain jaise volume, moving averages, aur price action. Jab ye confirmatory indicators bhi Rounding Bottom pattern ko support karte hain, toh traders confident hote hain apne trading decisions mein. Is pattern ko confirm karne ke liye traders ko doosre technical indicators ka bhi analysis karna hota hai taake wo false signals se bach sakein aur sahi trading decisions le sakein.

8. Rounding Bottom Vs. Double Bottom

Rounding Bottom pattern ko kabhi kabhi Double Bottom pattern ke saath compare kiya jata hai, lekin dono mein difference hota hai shape aur structure mein. Double Bottom pattern mein typically do bottoms hote hain jo ek dusre se alag hote hain, jabki Rounding Bottom mein ek gradual curve hoti hai. Traders ko dhyan mein rakhna chahiye ke dono patterns ka interpretation alag hota hai aur sahi identification ke liye traders ko price movements aur pattern ka structure closely analyze karna chahiye.

9. Rounding Bottom Aur Trading Strategies

Traders Rounding Bottom pattern ko dekh kar apni trading strategies ko modify karte hain. Jab ye pattern identify hota hai, toh traders long positions lena shuru karte hain ya phir existing positions ko hold karte hain taake unhe potential profits mil sakein. Lekin traders ko dhyan mein rakhna chahiye ke pattern sirf ek indicator hai aur doosre factors jaise overall market conditions aur fundamental analysis bhi consider karna important hai trading decisions lene ke liye.

10. Rounding Bottom Aur Risk Management

Is pattern ki understanding traders ko better risk management karne mein madad karta hai. Jab traders is pattern ko samajhte hain, toh wo apne stop loss levels ko set kar sakte hain aur apne positions ko effectively manage kar sakte hain. Traders ko apne trading positions ko enter karte waqt risk reward ratio ka bhi dhyaan dena chahiye taake wo apne losses ko minimize kar sakein aur potential profits maximize kar sakein.

11. Rounding Bottom Aur Entry Points

Traders is pattern ko dekh kar apne entry aur exit points ko bhi decide karte hain. Jab ye pattern confirm ho jata hai, toh traders apne entry points ko identify karke apni positions ko enter karte hain taake wo potential profits kamayein. Lekin traders ko entry points ko choose karte waqt overall market conditions aur pattern ka confirmation bhi consider karna important hai taake wo sahi trading decisions le sakein.

12. Rounding Bottom Aur Stop Loss

Stop loss levels ko set karne mein bhi Rounding Bottom pattern ki importance hoti hai. Traders apne stop loss levels ko set karke apne positions ko protect karte hain aur apne losses ko minimize karne ka tareeqa follow karte hain. Stop loss levels ko set karte waqt traders ko volatility aur overall market conditions ka bhi dhyaan dena chahiye taake wo apne positions ko effectively manage kar sakein.

13. Rounding Bottom Aur Price Targets

Is pattern ke pehchan karne ke baad traders price targets ko bhi set karte hain. Jab ye pattern confirm hota hai, toh traders apne price targets ko identify karte hain jisse wo apne trades ka potential profit calculate kar sakein. Lekin traders ko price targets ko set karte waqt overall market conditions aur pattern ka confirmation bhi consider karna important hai taake wo realistic price targets ko set kar sakein.

14. Rounding Bottom Aur False Signals

Traders ko dhyan mein rakhna chahiye ke kabhi kabhi Rounding Bottom pattern false signals bhi de sakta hai. Isliye dusri confirmatory indicators ka bhi istemal karna zaroori hai taake sahi trading decisions li ja sakein. False signals ko identify karne ke liye traders ko doosre technical indicators ka bhi analysis karna hota hai taake wo accurate predictions kar sakein aur sahi trading decisions le sakein.

15. Rounding Bottom Ka Example

Ek example ke roop mein, agar ek stock ka price downtrend mein tha aur phir gradual recovery ke baad U-shaped curve banata hai, toh ye ek potential Rounding Bottom pattern ho sakta hai. Traders is pattern ko identify karke apne trading decisions le sakte hain. Lekin traders ko dhyan mein rakhna chahiye ke pattern sirf ek indicator hai aur sahi identification ke liye traders ko overall market conditions aur doosre technical indicators ka bhi analysis karna hota hai.

16. Rounding Bottom Ka Istemal

Rounding Bottom pattern ko analyze karke traders apne investment decisions ko support karte hain. Is pattern ko dekh kar traders market trends ko better understand karke apne trading strategies ko improve kar sakte hain. Lekin traders ko dhyan mein rakhna chahiye ke pattern sirf ek indicator hai aur sahi trading decisions lene ke liye traders ko doosre factors jaise fundamental analysis aur overall market conditions ka bhi dhyaan dena chahiye.

17. Rounding Bottom Aur Trend Reversal

Is pattern ka sabse bada maqsad hota hai trend reversal ko indicate karna. Jab ye pattern confirm hota hai, toh traders ek potential trend reversal ka indication samajhte hain aur apne trading strategies ko uss direction mein adjust karte hain. Lekin traders ko dhyan mein rakhna chahiye ke pattern sirf ek indicator hai aur sahi identification ke liye traders ko overall market conditions aur doosre technical indicators ka bhi analysis karna hota hai.

18. Rounding Bottom Ka Observation

Traders ko price movements ko closely observe karna hota hai Rounding Bottom pattern ko identify karne ke liye. Jab ye pattern observe hota hai, toh traders uss direction mein apne trading decisions lete hain jisse wo potential profits earn kar sakein. Lekin traders ko dhyan mein rakhna chahiye ke pattern sirf ek indicator hai aur sahi identification ke liye traders ko overall market conditions aur doosre technical indicators ka bhi analysis karna hota hai.

19. Rounding Bottom Aur Volatility

Is pattern ke identification mein volatility ka bhi ek important role hota hai. Rounding Bottom pattern ek gradual recovery ko indicate karta hai jisse traders volatility ko bhi dhyan mein rakhte hain apne trading decisions ke liye. Lekin traders ko dhyan mein rakhna chahiye ke volatility ke wajah se false signals bhi generate ho sakte hain, isliye sahi identification ke liye traders ko overall market conditions aur doosre technical indicators ka bhi analysis karna hota hai.

20. Rounding Bottom Aur Long-Term Investing

Rounding Bottom pattern ko long-term investing ke liye bhi istemal kiya ja sakta hai. Jab ye pattern confirm hota hai, toh investors apne long-term investment decisions ko support karte hain aur future price trends ko anticipate karke apne investments ko manage karte hain. Lekin investors ko dhyan mein rakhna chahiye ke pattern sirf ek indicator hai aur sahi identification ke liye investors ko fundamental analysis aur overall market conditions ka bhi dhyaan dena chahiye.

Rounding Bottom pattern ko identify karne ke liye, traders ko price chart par ek U-shaped curve dhundhna hota hai. Yeh curve typically downtrend ke baad dekha jata hai aur ek gradual recovery ko indicate karta hai. Is curve ka bottom point downtrend ke neeche hota hai aur phir gradual recovery ke baad price wapas upar ki taraf mudti hai. Traders ko dhyan dena chahiye ke is pattern mein curve ka shape smooth hona chahiye, agar curve mein kisi bhi jagah sharp angles ya abrupt changes hote hain toh woh actual Rounding Bottom pattern nahi ho sakta.

2. Rounding Bottom Ka Maqsad

Rounding Bottom pattern ka maqsad hota hai indicate karna ke asset ka price downtrend se recovery shuru kar chuka hai aur ab upar ki taraf jaane ka mood hai. Yeh pattern market mein ek reversal ko signal karta hai aur traders ko bullish trend ke possibility ke baare mein sochne par majboor karta hai. Is pattern ko identify karne se pehle traders ko confirmatory signals aur indicators ka bhi dhyaan dena chahiye taake wo sahi maayno mein pattern ko identify kar sakein aur false signals se bach sakein.

3. Rounding Bottom Ka Tareeqa-e-Amal

Is pattern ko identify karne ke liye, traders ko price movements ko closely observe karna hota hai. Is pattern mein ek U-shaped curve ki shape hoti hai jisme price initially downtrend mein hoti hai, phir gradual recovery ke baad ek saath jhuk kar wapas upar ki taraf mudti hai. Traders ko ye bhi dhyan mein rakhna chahiye ke Rounding Bottom pattern ka bottom point pehle downtrend ke neeche hota hai aur phir gradual recovery ke baad price wapas upar ki taraf jaati hai, isliye is pattern ko identify karne ke liye patience aur observation ki zaroorat hoti hai.

4. Rounding Bottom Aur Market Psychology

Rounding Bottom pattern ki interpretation mein market psychology ka bhi ek important role hota hai. Is pattern ko dekh kar traders samajhte hain ke market mein bearish sentiment khatam ho chuki hai aur bullish sentiment shuru ho rahi hai. Yeh indicate karta hai ke investors ke beech optimism badh rahi hai. Lekin traders ko dhyan mein rakhna chahiye ke Rounding Bottom pattern sirf ek indicator hai, aur doosri factors jaise fundamental analysis aur overall market conditions ko bhi consider karna important hai pattern ko confirm karne ke liye.

5. Rounding Bottom Ki Importance

Rounding Bottom pattern traders ke liye ek important tool hai kyun ke isse future price movements ka idea milta hai. Jab traders is pattern ko identify karte hain, toh unhe ek potential trend reversal ka indication milta hai, jisse wo apne trading strategies ko adjust kar sakte hain. Is pattern ko identify karne ke liye traders ko market ke overall trend ko analyze karna hota hai saath hi saath doosre technical indicators aur confirmatory signals ka bhi istemal karna hota hai taake wo accurate predictions kar sakein.

6. Rounding Bottom Ka Time Frame

Rounding Bottom pattern ka time frame kisi bhi timeframe par ho sakta hai, jaise kuch weeks ya phir months ke liye. Is pattern ko identify karne mein time frame ka dhyaan rakhna zaroori hai taake sahi prediction ki ja sake. Chhoti time frames par Rounding Bottom pattern ki identification karna thoda mushkil ho sakta hai kyunki volatility ke wajah se false signals bhi generate ho sakte hain. Isliye traders ko time frame ko choose karte waqt volatility aur overall market conditions ka bhi dhyaan dena chahiye.

7. Rounding Bottom Ka Confirmation

Rounding Bottom pattern ko confirm karne ke liye traders doosri indicators aur tools ka bhi istemal karte hain jaise volume, moving averages, aur price action. Jab ye confirmatory indicators bhi Rounding Bottom pattern ko support karte hain, toh traders confident hote hain apne trading decisions mein. Is pattern ko confirm karne ke liye traders ko doosre technical indicators ka bhi analysis karna hota hai taake wo false signals se bach sakein aur sahi trading decisions le sakein.

8. Rounding Bottom Vs. Double Bottom

Rounding Bottom pattern ko kabhi kabhi Double Bottom pattern ke saath compare kiya jata hai, lekin dono mein difference hota hai shape aur structure mein. Double Bottom pattern mein typically do bottoms hote hain jo ek dusre se alag hote hain, jabki Rounding Bottom mein ek gradual curve hoti hai. Traders ko dhyan mein rakhna chahiye ke dono patterns ka interpretation alag hota hai aur sahi identification ke liye traders ko price movements aur pattern ka structure closely analyze karna chahiye.

9. Rounding Bottom Aur Trading Strategies

Traders Rounding Bottom pattern ko dekh kar apni trading strategies ko modify karte hain. Jab ye pattern identify hota hai, toh traders long positions lena shuru karte hain ya phir existing positions ko hold karte hain taake unhe potential profits mil sakein. Lekin traders ko dhyan mein rakhna chahiye ke pattern sirf ek indicator hai aur doosre factors jaise overall market conditions aur fundamental analysis bhi consider karna important hai trading decisions lene ke liye.

10. Rounding Bottom Aur Risk Management

Is pattern ki understanding traders ko better risk management karne mein madad karta hai. Jab traders is pattern ko samajhte hain, toh wo apne stop loss levels ko set kar sakte hain aur apne positions ko effectively manage kar sakte hain. Traders ko apne trading positions ko enter karte waqt risk reward ratio ka bhi dhyaan dena chahiye taake wo apne losses ko minimize kar sakein aur potential profits maximize kar sakein.

11. Rounding Bottom Aur Entry Points

Traders is pattern ko dekh kar apne entry aur exit points ko bhi decide karte hain. Jab ye pattern confirm ho jata hai, toh traders apne entry points ko identify karke apni positions ko enter karte hain taake wo potential profits kamayein. Lekin traders ko entry points ko choose karte waqt overall market conditions aur pattern ka confirmation bhi consider karna important hai taake wo sahi trading decisions le sakein.

12. Rounding Bottom Aur Stop Loss

Stop loss levels ko set karne mein bhi Rounding Bottom pattern ki importance hoti hai. Traders apne stop loss levels ko set karke apne positions ko protect karte hain aur apne losses ko minimize karne ka tareeqa follow karte hain. Stop loss levels ko set karte waqt traders ko volatility aur overall market conditions ka bhi dhyaan dena chahiye taake wo apne positions ko effectively manage kar sakein.

13. Rounding Bottom Aur Price Targets

Is pattern ke pehchan karne ke baad traders price targets ko bhi set karte hain. Jab ye pattern confirm hota hai, toh traders apne price targets ko identify karte hain jisse wo apne trades ka potential profit calculate kar sakein. Lekin traders ko price targets ko set karte waqt overall market conditions aur pattern ka confirmation bhi consider karna important hai taake wo realistic price targets ko set kar sakein.

14. Rounding Bottom Aur False Signals

Traders ko dhyan mein rakhna chahiye ke kabhi kabhi Rounding Bottom pattern false signals bhi de sakta hai. Isliye dusri confirmatory indicators ka bhi istemal karna zaroori hai taake sahi trading decisions li ja sakein. False signals ko identify karne ke liye traders ko doosre technical indicators ka bhi analysis karna hota hai taake wo accurate predictions kar sakein aur sahi trading decisions le sakein.

15. Rounding Bottom Ka Example

Ek example ke roop mein, agar ek stock ka price downtrend mein tha aur phir gradual recovery ke baad U-shaped curve banata hai, toh ye ek potential Rounding Bottom pattern ho sakta hai. Traders is pattern ko identify karke apne trading decisions le sakte hain. Lekin traders ko dhyan mein rakhna chahiye ke pattern sirf ek indicator hai aur sahi identification ke liye traders ko overall market conditions aur doosre technical indicators ka bhi analysis karna hota hai.

16. Rounding Bottom Ka Istemal

Rounding Bottom pattern ko analyze karke traders apne investment decisions ko support karte hain. Is pattern ko dekh kar traders market trends ko better understand karke apne trading strategies ko improve kar sakte hain. Lekin traders ko dhyan mein rakhna chahiye ke pattern sirf ek indicator hai aur sahi trading decisions lene ke liye traders ko doosre factors jaise fundamental analysis aur overall market conditions ka bhi dhyaan dena chahiye.

17. Rounding Bottom Aur Trend Reversal

Is pattern ka sabse bada maqsad hota hai trend reversal ko indicate karna. Jab ye pattern confirm hota hai, toh traders ek potential trend reversal ka indication samajhte hain aur apne trading strategies ko uss direction mein adjust karte hain. Lekin traders ko dhyan mein rakhna chahiye ke pattern sirf ek indicator hai aur sahi identification ke liye traders ko overall market conditions aur doosre technical indicators ka bhi analysis karna hota hai.

18. Rounding Bottom Ka Observation

Traders ko price movements ko closely observe karna hota hai Rounding Bottom pattern ko identify karne ke liye. Jab ye pattern observe hota hai, toh traders uss direction mein apne trading decisions lete hain jisse wo potential profits earn kar sakein. Lekin traders ko dhyan mein rakhna chahiye ke pattern sirf ek indicator hai aur sahi identification ke liye traders ko overall market conditions aur doosre technical indicators ka bhi analysis karna hota hai.

19. Rounding Bottom Aur Volatility

Is pattern ke identification mein volatility ka bhi ek important role hota hai. Rounding Bottom pattern ek gradual recovery ko indicate karta hai jisse traders volatility ko bhi dhyan mein rakhte hain apne trading decisions ke liye. Lekin traders ko dhyan mein rakhna chahiye ke volatility ke wajah se false signals bhi generate ho sakte hain, isliye sahi identification ke liye traders ko overall market conditions aur doosre technical indicators ka bhi analysis karna hota hai.

20. Rounding Bottom Aur Long-Term Investing

Rounding Bottom pattern ko long-term investing ke liye bhi istemal kiya ja sakta hai. Jab ye pattern confirm hota hai, toh investors apne long-term investment decisions ko support karte hain aur future price trends ko anticipate karke apne investments ko manage karte hain. Lekin investors ko dhyan mein rakhna chahiye ke pattern sirf ek indicator hai aur sahi identification ke liye investors ko fundamental analysis aur overall market conditions ka bhi dhyaan dena chahiye.

تبصرہ

Расширенный режим Обычный режим