Inverse Head and Shoulders

"Inverse Head and Shoulders" forex trading mein ek bullish reversal pattern hai. Ye pattern typically downtrend ke baad dikhta hai aur bullish reversal ke indication ke taur par consider kiya jata hai.

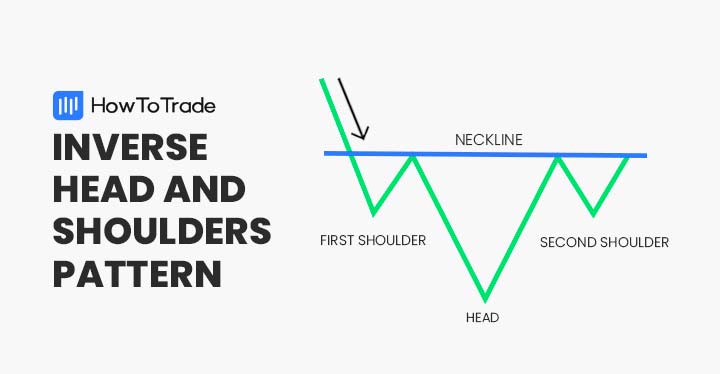

"Inverse Head and Shoulders" pattern ek specific shape ko represent karta hai, jismein teen key components hote hain:

Head: Downtrend ke doran, market mein ek "head" formation hoti hai, jise ek temporary bottom ke roop mein dekha jata hai. Head typically lows ka level hota hai.

Shoulders: Head ke do sides mein "shoulders" formation hoti hai. Ye shoulders bhi lows ko represent karte hain, lekin head se kam intense hoti hain. Left shoulder ka formation head se pehle hota hai aur right shoulder ka formation head ke baad hota hai.

Neckline: Head ke lows aur shoulders ke lows ko connect karne wali ek trendline ko "neckline" kaha jata hai. Neckline typically horizontally sloping hoti hai aur neckline ko breakout key moment consider kiya jata hai.

Inverse Head and Shoulders pattern ka appearance market mein ek potential bullish reversal point ko indicate karta hai. Jab market neckline ko breakout karta hai (typically right shoulder ke highs ke upar), toh ye bullish reversal ka signal hota hai aur uptrend shuru ho sakta hai.

Is pattern ko confirm karne ke liye, traders usually breakout ke baad higher volume aur price action ka wait karte hain. Agar volume increase hota hai aur price upward direction mein move karta hai, toh ye Inverse Head and Shoulders pattern ki validity confirm hoti hai.

Inverse Head and Shoulders pattern ka istemal traders bearish trend ke reversal ko identify karne ke liye karte hain. Agar ye pattern downtrend ke baad dikhai deta hai, toh ye ek potential bullish reversal signal ho sakta hai.

Is pattern ke saath saath, traders ko market conditions aur additional technical indicators ka bhi analysis karna chahiye. Ye pattern sirf ek indicator hai aur iski accuracy aur reliability ko confirm karne ke liye additional research aur analysis ki zarurat hoti hai.

"Inverse Head and Shoulders" forex trading mein ek bullish reversal pattern hai. Ye pattern typically downtrend ke baad dikhta hai aur bullish reversal ke indication ke taur par consider kiya jata hai.

"Inverse Head and Shoulders" pattern ek specific shape ko represent karta hai, jismein teen key components hote hain:

Head: Downtrend ke doran, market mein ek "head" formation hoti hai, jise ek temporary bottom ke roop mein dekha jata hai. Head typically lows ka level hota hai.

Shoulders: Head ke do sides mein "shoulders" formation hoti hai. Ye shoulders bhi lows ko represent karte hain, lekin head se kam intense hoti hain. Left shoulder ka formation head se pehle hota hai aur right shoulder ka formation head ke baad hota hai.

Neckline: Head ke lows aur shoulders ke lows ko connect karne wali ek trendline ko "neckline" kaha jata hai. Neckline typically horizontally sloping hoti hai aur neckline ko breakout key moment consider kiya jata hai.

Inverse Head and Shoulders pattern ka appearance market mein ek potential bullish reversal point ko indicate karta hai. Jab market neckline ko breakout karta hai (typically right shoulder ke highs ke upar), toh ye bullish reversal ka signal hota hai aur uptrend shuru ho sakta hai.

Is pattern ko confirm karne ke liye, traders usually breakout ke baad higher volume aur price action ka wait karte hain. Agar volume increase hota hai aur price upward direction mein move karta hai, toh ye Inverse Head and Shoulders pattern ki validity confirm hoti hai.

Inverse Head and Shoulders pattern ka istemal traders bearish trend ke reversal ko identify karne ke liye karte hain. Agar ye pattern downtrend ke baad dikhai deta hai, toh ye ek potential bullish reversal signal ho sakta hai.

Is pattern ke saath saath, traders ko market conditions aur additional technical indicators ka bhi analysis karna chahiye. Ye pattern sirf ek indicator hai aur iski accuracy aur reliability ko confirm karne ke liye additional research aur analysis ki zarurat hoti hai.

تبصرہ

Расширенный режим Обычный режим