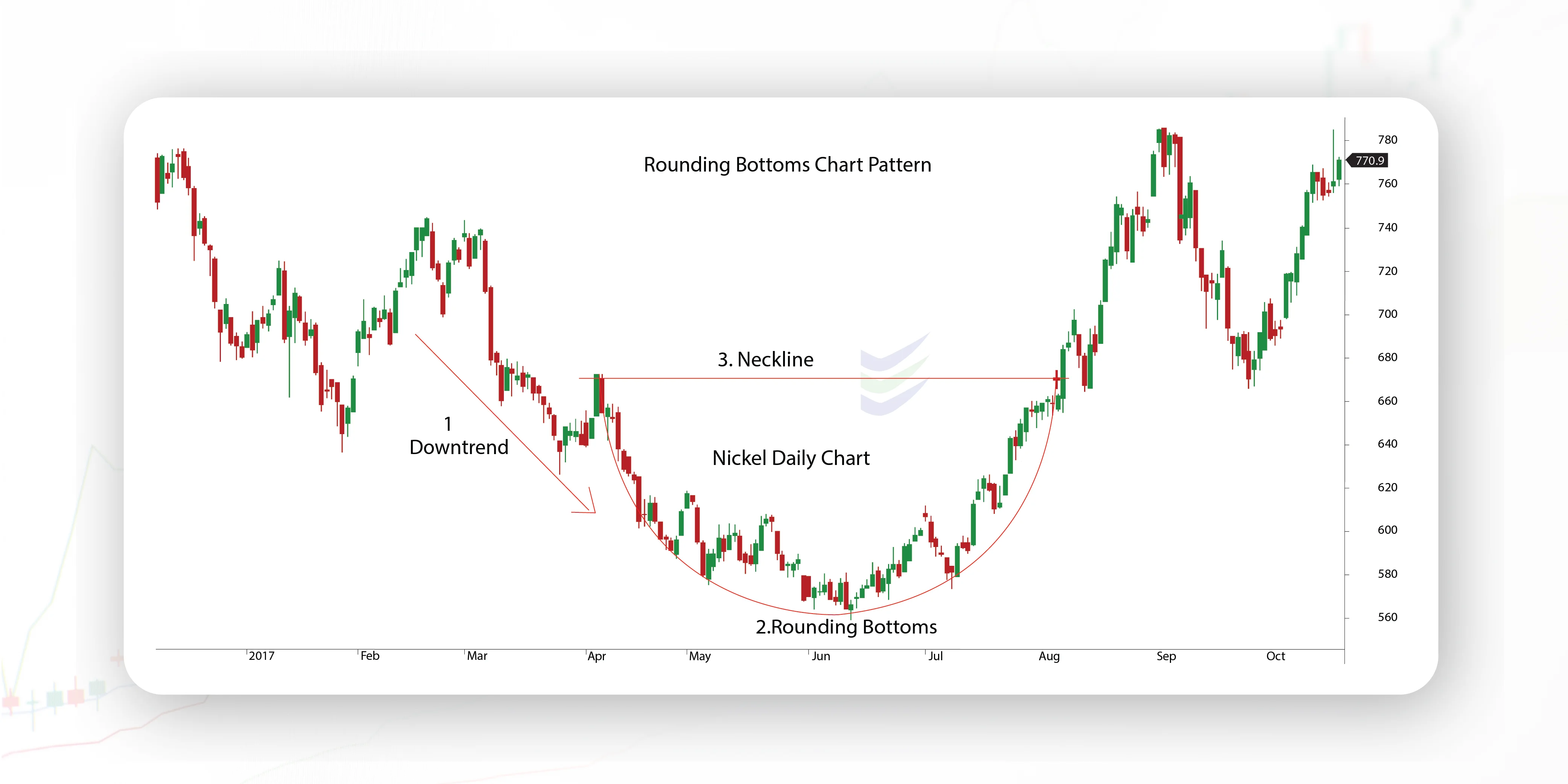

Rounding Bottom Rounding Bottom Candlestick Pattern ek technical analysis ka hissa hai jo stock market mein istemal hota hai. Ye pattern market mein trend reversal ko darust karnay mein madadgar hota hai. Is pattern ka pehchan karna asaan hota hai jab chart par ek U-shaped curve ban jati hai, jo market ke downtrend ko indicate karti hai.

Jab market mein bearish trend hota hai aur prices neeche ja rahi hain, to Rounding Bottom pattern ka ubhar hota hai. Is pattern mein, prices mein gradual recovery hoti hai aur ek curve ban jati hai jiska neeche ka hissa bearish trend ko represent karta hai. Jab ye curve complete ho jati hai, aur prices ise breakout karte hain, to yeh ek bullish reversal signal provide karta hai.

Is pattern ko samajhne ke liye, traders ko candlestick charts par focus rakhna hota hai. Har candlestick ek specific time period ko represent karta hai, jisme opening price, closing price, high aur low prices darust hoti hain. Jab Rounding Bottom pattern form hota hai, to candles gradual recovery ko darust karte hain.

Jab ye pattern ban raha hota hai, traders ko dhyan rakhna chahiye ke volume bhi badhna shuru ho jata hai, jo ki bullish reversal ko confirm karta hai. Agar volume ke saath saath prices bhi badh rahi hain, to ye ek strong indication hai ke market mein trend reversal hone wala hai.

Rounding Bottom pattern ke breakout ke baad, traders ko entry point ka dhyan rakhna chahiye. Entry point ka chayan candlestick patterns aur technical indicators ke madhyam se kiya ja sakta hai. Stop-loss orders ka sahi taur par placement bhi crucial hai taaki unforeseen market movements se bacha ja sake.

Is pattern ki mukamal samajh ke liye, traders ko market ke fundamental factors ko bhi analyze karna chahiye jaise economic indicators, company performance, aur global events. Rounding Bottom pattern ek tool hai, lekin ise standalone indicator nahi samajhna chahiye. Sahi analysis ke liye, multiple indicators ka istemal kiya jana chahiye.

In conclusion, Rounding Bottom Candlestick Pattern ek powerful tool hai jo market trends ko predict karne mein madad karta hai. Lekin, iska istemal karne se pehle thorough research aur analysis ki zarurat hoti hai taaki traders accurate decisions le sakein

Jab market mein bearish trend hota hai aur prices neeche ja rahi hain, to Rounding Bottom pattern ka ubhar hota hai. Is pattern mein, prices mein gradual recovery hoti hai aur ek curve ban jati hai jiska neeche ka hissa bearish trend ko represent karta hai. Jab ye curve complete ho jati hai, aur prices ise breakout karte hain, to yeh ek bullish reversal signal provide karta hai.

Is pattern ko samajhne ke liye, traders ko candlestick charts par focus rakhna hota hai. Har candlestick ek specific time period ko represent karta hai, jisme opening price, closing price, high aur low prices darust hoti hain. Jab Rounding Bottom pattern form hota hai, to candles gradual recovery ko darust karte hain.

Jab ye pattern ban raha hota hai, traders ko dhyan rakhna chahiye ke volume bhi badhna shuru ho jata hai, jo ki bullish reversal ko confirm karta hai. Agar volume ke saath saath prices bhi badh rahi hain, to ye ek strong indication hai ke market mein trend reversal hone wala hai.

Rounding Bottom pattern ke breakout ke baad, traders ko entry point ka dhyan rakhna chahiye. Entry point ka chayan candlestick patterns aur technical indicators ke madhyam se kiya ja sakta hai. Stop-loss orders ka sahi taur par placement bhi crucial hai taaki unforeseen market movements se bacha ja sake.

Is pattern ki mukamal samajh ke liye, traders ko market ke fundamental factors ko bhi analyze karna chahiye jaise economic indicators, company performance, aur global events. Rounding Bottom pattern ek tool hai, lekin ise standalone indicator nahi samajhna chahiye. Sahi analysis ke liye, multiple indicators ka istemal kiya jana chahiye.

In conclusion, Rounding Bottom Candlestick Pattern ek powerful tool hai jo market trends ko predict karne mein madad karta hai. Lekin, iska istemal karne se pehle thorough research aur analysis ki zarurat hoti hai taaki traders accurate decisions le sakein

تبصرہ

Расширенный режим Обычный режим