What is Price Action Indicator:

Price action Indicator aik takneeki tshkhisi tool hai jo mukammal tor par Price ki harkat par markooz hai aur dosray awamil ko nazar andaaz karta hai jis mein had ya waqt shaamil hai. yeh is khayaal par mabni hai ke tamam maloomat ko kharidari aur farokht ke intikhab karne ki zaroorat hoti hai jo fees mein hi mil sakti hai. Price action ke isharay is tasawwur par inhisaar karte hain ke qadeem charge ke iqdamaat mustaqbil ki fees ki simt ki paish goi mein madad kar satke hain. tajir jo Price action ke isharay istemaal karte hain woh tareekhi Price ke andaaz ka mushahida karte hain aur un ke andaaz ki bunyaad par salahiyat ke mustaqbil ke charge ke iqdamaat se aagah honay ki koshish karte hain.

Types of Price Action indicators:

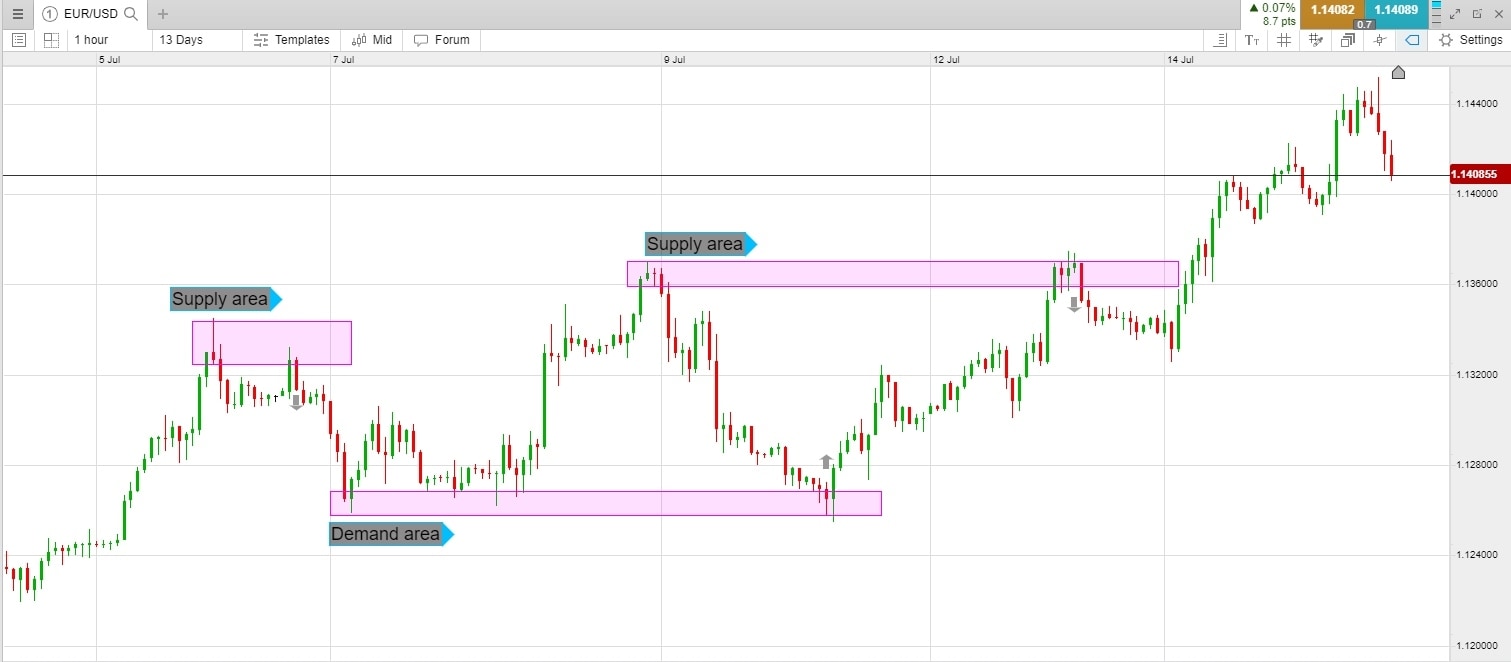

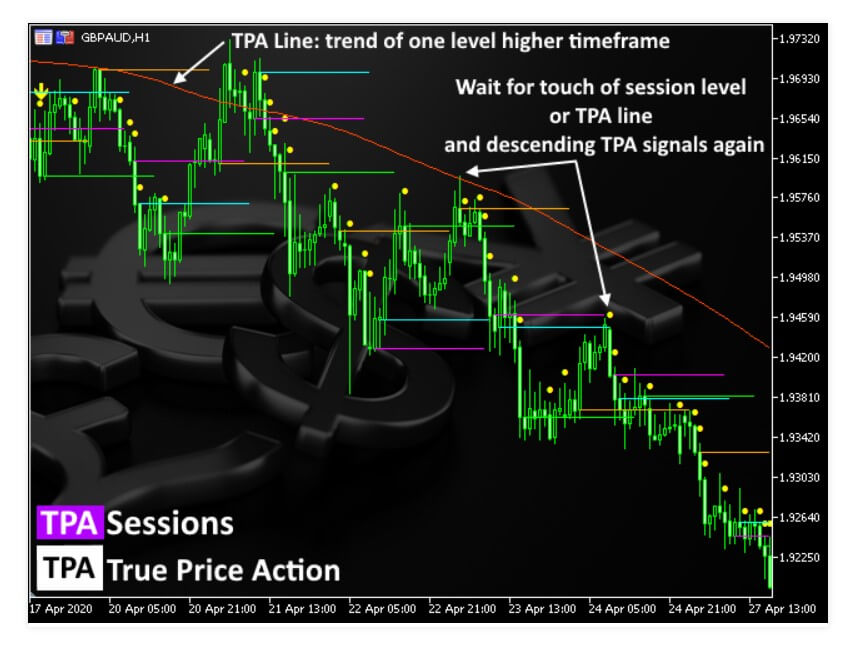

Price action ke nishanaat ki kayi kasmain hain jo sarmaya car zar e mubadla ki tijarat mein istemaal karte hain. kuch aam Price action alamaat mein support aur muzahmat ki hudood, candle stick style, chart patteren aur trained lines shaamil hain. support aur muzahmat ke darjay sharah ke kaleedi darjay hain jin mein aik ghair mulki currency ke jore ne pehlay ulta rasta ikhtiyar kya hai, aur taajiron ka khayaal hai ke yeh hudood mustaqbil mein bhi barqarar reh sakti hain. mom batii ki chhari ke andaaz, doji, hathora, aur ghairay hue andaaz ke sath, bazaar ke jazbaat aur mumkina ulat palat ke baray mein basri isharay paish karte hain. chart ke namoonay jaisay sir aur kandhay, masalas, aur jhanday woh taskeel hain jin ka istemaal sarmaya car fees ke aamaal ki paish goi ke liye karte hain. rujhanaat, jo chart par soyng highs ya lovs ko jor kar tayyar kiye jatay hain, taajiron ko fashion ke course se aagah karne mein madad karte hain.

How to use Price Action indicator:

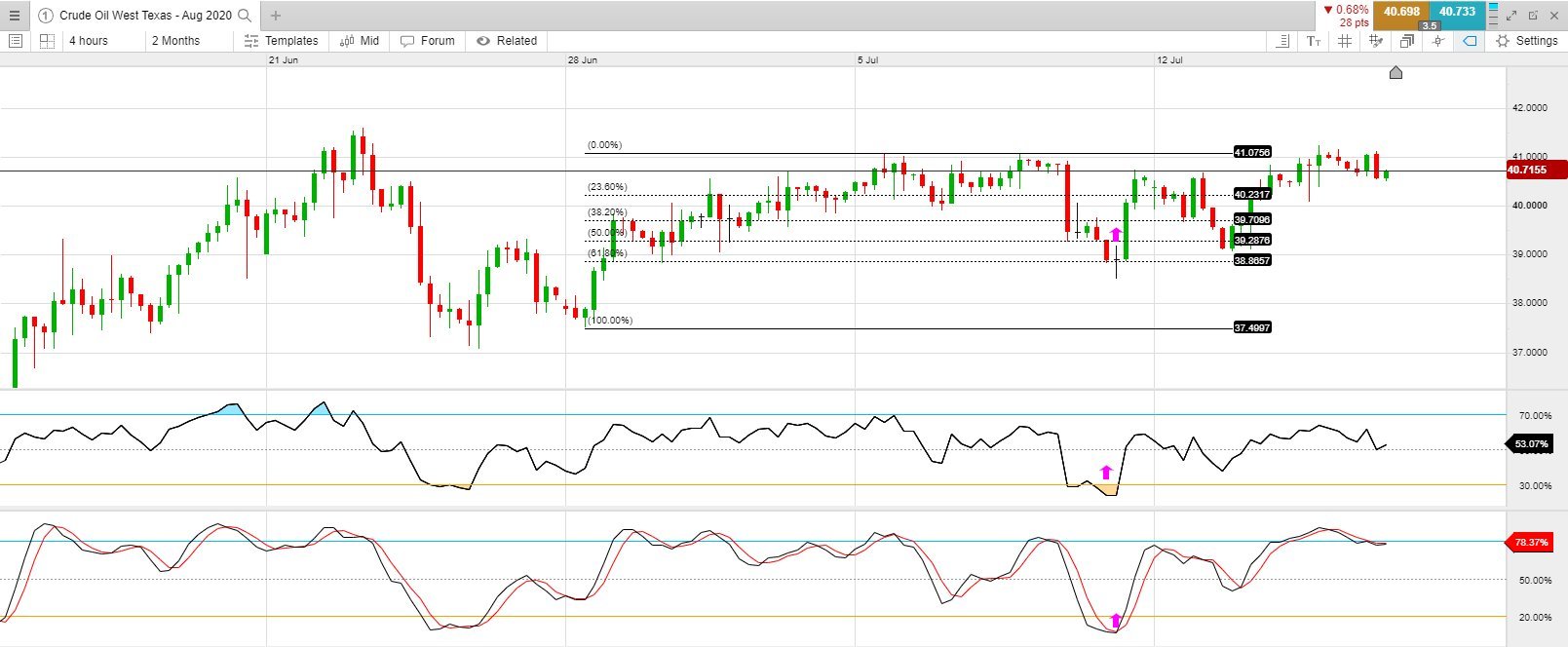

Price action ke nishanaat ko ghair mulki currency ke taajiron ke zariye tijarti faislay karne ke liye istemaal kya jata hai jo ke peechay reh jane walay isharay ya bunyadi tajzia par inhisaar karne ke bajaye charge chalon ki bunyaad par hotay hain. tajir jo Price action Indicator istemaal karte hain woh charge chart par makhsoos namonon ya formation ki talaash karte hain jo salahiyat ki kharidari ya farokht ke mawaqay par dastakhat karte hain. misaal ke tor par, agar koi currency jori byorokrisi aik kaleedi imdadi marhalay par double bottom namona hai, to sarmaya car is ki tashreeh kharidari ki alamat ke tor par bhi kar satke hain. isi terhan, agar koi ghair mulki currency ka jora trained line ke tehat toot jata hai aur kam had tak barh jata hai, to tajir usay farogh dainay ke liye aik mandi ki alamat ke tor par bhi dekh satke hain. tijarti intabahat ki tasdeeq ke liye mukhtalif takneeki tajzia alaat ke sath mil kar Price action andikitrz ka istemaal kya ja sakta hai.

Advantages of Price Action indicators:

Price action andikitrz ke ahem fawaid mein se aik yeh hai ke woh paicheeda mathematics tashkeel ya isharay par inhisaar kiye baghair sharah ki harkato ki tehqeeq ka aik aasaan aur aasaan tareeqa paish karte hain. Price action ke isharay bazaar ke jazbaat ki wazeh numaindagi faraham karte hain aur sarmaya karon ko bazaar ke bdalty hue halaat par fori radd amal zahir karne ki ijazat dete hain. Price action ke isharay sarmaya karon ko market ki harkiyaat aur Price ke ravayye ke baray mein gehri maloomat ko wasee karne mein bhi madad karte hain, jo faisla saazi ki salahiyaton aur khareed o farokht ki mustaqil mizaji ko barha satke hain. mazeed bar-aan, Price action ke isharay lachak dar hotay hain aur un ka itlaq kisi bhi time frame ya market place par kya ja sakta hai, jis se woh tamam sthon ke sarmaya karon ke liye mozoon ho jatay hain.

Limitations of Price Action indicators:

Agarchay Price action ke isharay bohat se fawaid faraham karte hain, lekin un ki hudood bhi hoti hain jin se sarmaya karon ko waaqif hona chahiye. Price action ke isharay qadeem Price ke record par munhasir hotay hain, aur is baat ki koi zamanat nahi ho sakti hai ke mustaqbil mein charge se bahar ke andaaz duhraey jayen ge. bazaar ke halaat jald baazi mein tabdeel ho satke hain, bunyadi tor par jaali intabahat ya achanak sharah ki naqal o harkat. Price action ke isharay bhi section ho satke hain, kyunkay ghair mamooli sarmaya car masawi Price ke namoonay ki tashreeh bhi kar satke hain. taajiron ko Price action ke ishaaron par ziyada ginti karne se mohtaat rehna chahiye aur inhen tajzia ki deegar shaklon ke sath mil kar qabil feham tijarti faislay karne ke liye istemaal karna chahiye. mazeed bar-aan, Price action ke isharay ko samajhney ke liye mashq aur tafreeh ki zaroorat hoti hai, lehaza nowarid sarmaya car sahih taleem ke baghair un ka sahih istemaal karne ke liye bhi jung kar satke hain.

Price action Indicator aik takneeki tshkhisi tool hai jo mukammal tor par Price ki harkat par markooz hai aur dosray awamil ko nazar andaaz karta hai jis mein had ya waqt shaamil hai. yeh is khayaal par mabni hai ke tamam maloomat ko kharidari aur farokht ke intikhab karne ki zaroorat hoti hai jo fees mein hi mil sakti hai. Price action ke isharay is tasawwur par inhisaar karte hain ke qadeem charge ke iqdamaat mustaqbil ki fees ki simt ki paish goi mein madad kar satke hain. tajir jo Price action ke isharay istemaal karte hain woh tareekhi Price ke andaaz ka mushahida karte hain aur un ke andaaz ki bunyaad par salahiyat ke mustaqbil ke charge ke iqdamaat se aagah honay ki koshish karte hain.

Types of Price Action indicators:

Price action ke nishanaat ki kayi kasmain hain jo sarmaya car zar e mubadla ki tijarat mein istemaal karte hain. kuch aam Price action alamaat mein support aur muzahmat ki hudood, candle stick style, chart patteren aur trained lines shaamil hain. support aur muzahmat ke darjay sharah ke kaleedi darjay hain jin mein aik ghair mulki currency ke jore ne pehlay ulta rasta ikhtiyar kya hai, aur taajiron ka khayaal hai ke yeh hudood mustaqbil mein bhi barqarar reh sakti hain. mom batii ki chhari ke andaaz, doji, hathora, aur ghairay hue andaaz ke sath, bazaar ke jazbaat aur mumkina ulat palat ke baray mein basri isharay paish karte hain. chart ke namoonay jaisay sir aur kandhay, masalas, aur jhanday woh taskeel hain jin ka istemaal sarmaya car fees ke aamaal ki paish goi ke liye karte hain. rujhanaat, jo chart par soyng highs ya lovs ko jor kar tayyar kiye jatay hain, taajiron ko fashion ke course se aagah karne mein madad karte hain.

How to use Price Action indicator:

Price action ke nishanaat ko ghair mulki currency ke taajiron ke zariye tijarti faislay karne ke liye istemaal kya jata hai jo ke peechay reh jane walay isharay ya bunyadi tajzia par inhisaar karne ke bajaye charge chalon ki bunyaad par hotay hain. tajir jo Price action Indicator istemaal karte hain woh charge chart par makhsoos namonon ya formation ki talaash karte hain jo salahiyat ki kharidari ya farokht ke mawaqay par dastakhat karte hain. misaal ke tor par, agar koi currency jori byorokrisi aik kaleedi imdadi marhalay par double bottom namona hai, to sarmaya car is ki tashreeh kharidari ki alamat ke tor par bhi kar satke hain. isi terhan, agar koi ghair mulki currency ka jora trained line ke tehat toot jata hai aur kam had tak barh jata hai, to tajir usay farogh dainay ke liye aik mandi ki alamat ke tor par bhi dekh satke hain. tijarti intabahat ki tasdeeq ke liye mukhtalif takneeki tajzia alaat ke sath mil kar Price action andikitrz ka istemaal kya ja sakta hai.

Advantages of Price Action indicators:

Price action andikitrz ke ahem fawaid mein se aik yeh hai ke woh paicheeda mathematics tashkeel ya isharay par inhisaar kiye baghair sharah ki harkato ki tehqeeq ka aik aasaan aur aasaan tareeqa paish karte hain. Price action ke isharay bazaar ke jazbaat ki wazeh numaindagi faraham karte hain aur sarmaya karon ko bazaar ke bdalty hue halaat par fori radd amal zahir karne ki ijazat dete hain. Price action ke isharay sarmaya karon ko market ki harkiyaat aur Price ke ravayye ke baray mein gehri maloomat ko wasee karne mein bhi madad karte hain, jo faisla saazi ki salahiyaton aur khareed o farokht ki mustaqil mizaji ko barha satke hain. mazeed bar-aan, Price action ke isharay lachak dar hotay hain aur un ka itlaq kisi bhi time frame ya market place par kya ja sakta hai, jis se woh tamam sthon ke sarmaya karon ke liye mozoon ho jatay hain.

Limitations of Price Action indicators:

Agarchay Price action ke isharay bohat se fawaid faraham karte hain, lekin un ki hudood bhi hoti hain jin se sarmaya karon ko waaqif hona chahiye. Price action ke isharay qadeem Price ke record par munhasir hotay hain, aur is baat ki koi zamanat nahi ho sakti hai ke mustaqbil mein charge se bahar ke andaaz duhraey jayen ge. bazaar ke halaat jald baazi mein tabdeel ho satke hain, bunyadi tor par jaali intabahat ya achanak sharah ki naqal o harkat. Price action ke isharay bhi section ho satke hain, kyunkay ghair mamooli sarmaya car masawi Price ke namoonay ki tashreeh bhi kar satke hain. taajiron ko Price action ke ishaaron par ziyada ginti karne se mohtaat rehna chahiye aur inhen tajzia ki deegar shaklon ke sath mil kar qabil feham tijarti faislay karne ke liye istemaal karna chahiye. mazeed bar-aan, Price action ke isharay ko samajhney ke liye mashq aur tafreeh ki zaroorat hoti hai, lehaza nowarid sarmaya car sahih taleem ke baghair un ka sahih istemaal karne ke liye bhi jung kar satke hain.

تبصرہ

Расширенный режим Обычный режим