What is Spike Candlestick Pattern

Spike Candlestick Pattern: Ek Technical Analysis Tijarat Ke Unwanat

I. Muqaddima (Introduction):

Tijarat mein maharat hasil karna aur behtareen faisle karne ke liye, technical analysis ek ahem tool hai. Ismein mukhtalif candlestick patterns shamil hote hain jo ke tijarat ke imkanat ko samajhne mein madadgar sabit hote hain. Aaj hum baat karenge "Spike Candlestick Pattern" ke bare mein, jo ke ek aham pattern hai jise tijarat mein istemal karna bohot zaroori hai.

II. Spike Candlestick Pattern Kya Hai?

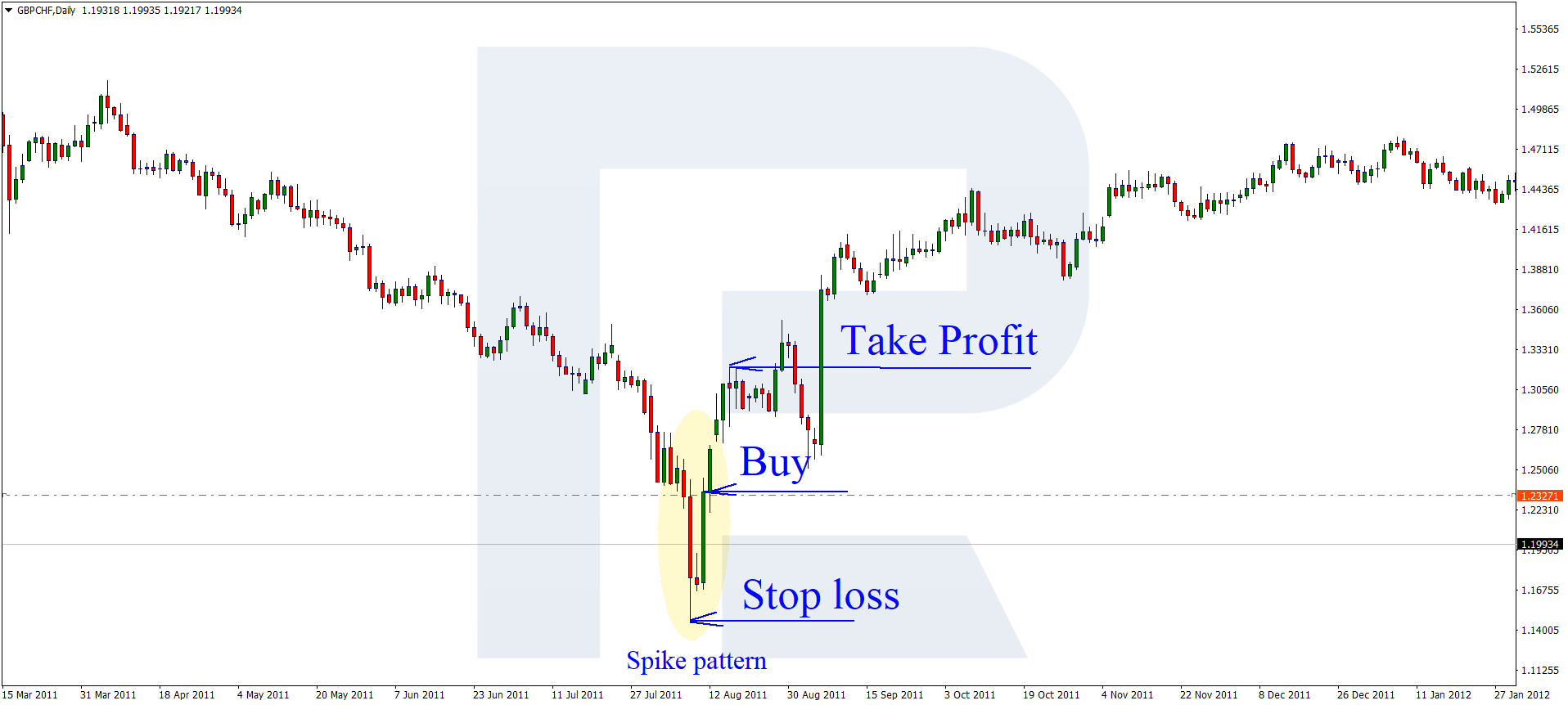

Spike candlestick pattern, tijarat mein aik khas tarah ka pattern hai jo market mein tezi se izafah ko darust karta hai. Is pattern mein aik ya zyada lambi wicks ya shadows hote hain, jo market mein sudden aur aggressive movement ko darust karte hain. Ye pattern traders ke liye ahem hota hai kyunki iske zariye market ke potential reversals ko pehchanne mein madad milti hai.

III. Spike Candlestick Pattern Ki Pechan Kaise Hoti Hai?

Spike candlestick pattern ko pehchanne ke liye kuch ahem points hain:

IV. Spike Candlestick Pattern Ke Types:

V. Spike Candlestick Pattern Aur Trading Strategies:

Spike candlestick pattern ko samajh kar traders apni trading strategies banate hain. Kuch common strategies hain:

VI. Spike Candlestick Pattern Ke Faide Aur Nuksan:

VII. Akhri Alfaz (Conclusion):

Spike candlestick pattern tijarat mein ek ahem aur mufeed tool hai jo traders ko market ke potential reversals ko samajhne mein madad karta hai. Is pattern ki sahi pehchan aur samajh se traders apne faisle behtareen tareeqe se le sakte hain. Hamesha yaad rahe ke har ek trading decision ko sabr aur tajaweez ke sath lena zaroori hai, aur spike candlestick pattern sirf ek piece of the puzzle hai jo traders ko market analysis mein madad karta hai.

Spike Candlestick Pattern: Ek Technical Analysis Tijarat Ke Unwanat

I. Muqaddima (Introduction):

Tijarat mein maharat hasil karna aur behtareen faisle karne ke liye, technical analysis ek ahem tool hai. Ismein mukhtalif candlestick patterns shamil hote hain jo ke tijarat ke imkanat ko samajhne mein madadgar sabit hote hain. Aaj hum baat karenge "Spike Candlestick Pattern" ke bare mein, jo ke ek aham pattern hai jise tijarat mein istemal karna bohot zaroori hai.

II. Spike Candlestick Pattern Kya Hai?

Spike candlestick pattern, tijarat mein aik khas tarah ka pattern hai jo market mein tezi se izafah ko darust karta hai. Is pattern mein aik ya zyada lambi wicks ya shadows hote hain, jo market mein sudden aur aggressive movement ko darust karte hain. Ye pattern traders ke liye ahem hota hai kyunki iske zariye market ke potential reversals ko pehchanne mein madad milti hai.

III. Spike Candlestick Pattern Ki Pechan Kaise Hoti Hai?

Spike candlestick pattern ko pehchanne ke liye kuch ahem points hain:

- Lambi Wicks/Shafts: Spike pattern mein lambi wicks ya shafts ka hona zaroori hai. Ye wicks market mein tezi se izafah ko darust karte hain.

- Aggressive Movement: Is pattern ki pehchan ke liye market mein ek zabardast aur tizi movement dekhi jaati hai. Agar market mein sudden aur tezi se izafah hota hai, to yeh ek potential spike candlestick pattern ki nishani hai.

- Volume Ki Izafat: Jab spike candlestick pattern banta hai, to volume mein bhi izafah hota hai. Isse ye samajhna asaan ho jata hai ke yeh movement market mein asal izafah ki taraf ishara kar raha hai ya sirf temporary hai.

IV. Spike Candlestick Pattern Ke Types:

- Bullish Spike Candlestick Pattern: Jab market mein tezi se izafah hota hai aur candlestick ka body bhi bada hota hai, to ise bullish spike candlestick pattern kehte hain. Is pattern ki alamat hai ke buyers control mein hain aur market mein bullish trend hone ke chances hain.

- Bearish Spike Candlestick Pattern: Is pattern mein bhi lambi wicks aur aggressive movement hoti hai, lekin candlestick ka body bearish hota hai. Ye pattern market mein potential reversal ko darust karta hai aur indicate karta hai ke sellers control mein hain.

V. Spike Candlestick Pattern Aur Trading Strategies:

Spike candlestick pattern ko samajh kar traders apni trading strategies banate hain. Kuch common strategies hain:

- Reversal Trading: Agar bullish spike pattern nazar aata hai to traders long position le sakte hain, jabke bearish spike pattern par short position lena ek acha tareeqa ho sakta hai.

- Confirmation Indicators: Spike pattern ko confirm karne ke liye traders doosre technical indicators ka bhi istemal karte hain jaise ke RSI (Relative Strength Index) aur MACD (Moving Average Convergence Divergence).

VI. Spike Candlestick Pattern Ke Faide Aur Nuksan:

- Faide:

- Spike pattern market ke potential reversals ko early stage mein identify karne mein madad karta hai.

- Traders ko market sentiment ko samajhne mein asani hoti hai.

- Is pattern ke istemal se risk management improve ho sakta hai.

- Nuksan:

- Kuch baray spike candlestick patterns false signals bhi de sakte hain, is liye confirmation ke liye doosre indicators ka istemal zaroori hai.

- Agar traders is pattern ko samajhne mein na-kamiyaab hote hain, to nuksan ho sakta hai.

VII. Akhri Alfaz (Conclusion):

Spike candlestick pattern tijarat mein ek ahem aur mufeed tool hai jo traders ko market ke potential reversals ko samajhne mein madad karta hai. Is pattern ki sahi pehchan aur samajh se traders apne faisle behtareen tareeqe se le sakte hain. Hamesha yaad rahe ke har ek trading decision ko sabr aur tajaweez ke sath lena zaroori hai, aur spike candlestick pattern sirf ek piece of the puzzle hai jo traders ko market analysis mein madad karta hai.

Faida:

Faida:

تبصرہ

Расширенный режим Обычный режим