What is Spike Candlestick Pattern:

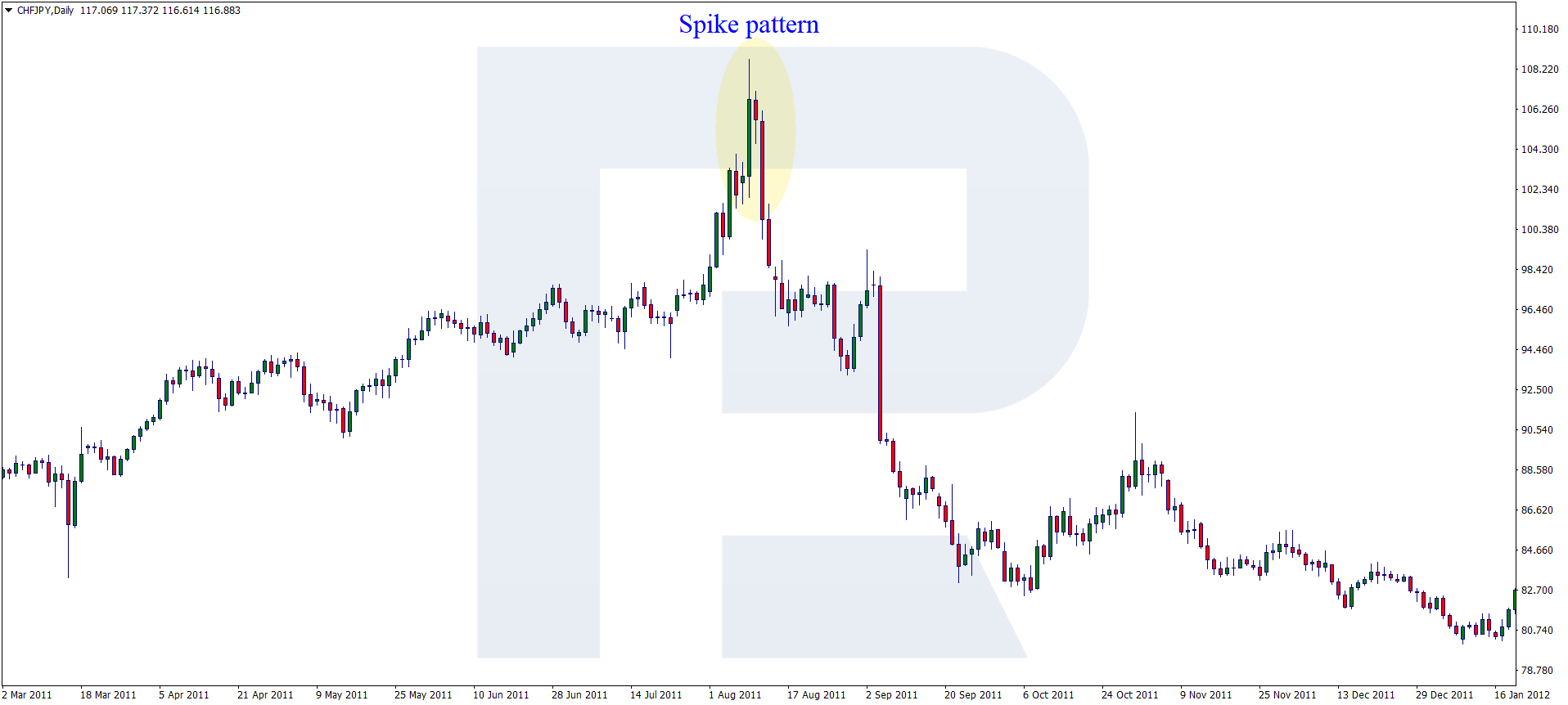

Spike candle stick patteren aik takneeki tajzia aala hai jo candle stick ke jism se istemaal hota hai. yeh ya to aik lamba oopri saya ya aik taweel nichala saya ho sakta hai.

Tajir bazaar ke jazbaat ki baseerat ko faida pohanchanay aur kharidari aur farokht ke bakhabar intikhab karne ke liye baqaidagi se mom btyon ke andaaz ka istemaal karte hain. اSpike candle stick ka namona khaas tor par ahem hai kyunkay yeh market ki harkiyaat mein herat angaiz tabdeeli ka ishara karta hai. yeh kaleedi madad ya muzahmat ki sthon par ho sakta hai, jo charge harkat ke andar aik barray mourr ko nishaan zad karta hai.

Types of Spike Candlestick Pattern:

Spike candle stick ke numaya andaaz hain : blush Spike aur bearish Spike. aik taizi se barhti hui mom batii ki chhari byorokrisi ka namona hai jab aik taweel neechay ka saya aur aik chhota sa haqeeqi jism hota hai, jo is baat ki nishandahi karta hai ke kharidaron ne dilron ko kuchal diya hai aur qeemat ko barha diya hai. doosri taraf, aik bearish Spike candle stick ka namona hota hai jab ke is mein aik tosiay oopri saya aur aik chhota haqeeqi frame hota hai, jo is baat ki nishandahi karta hai ke dilron ne hukmarani ki hai aur charge ko kam kardiya hai.

Mukhtalif qisam ke Spike candle stick ke namonon ko samjhna zaroori hai kyunkay woh market ke jazbaat aur salahiyat ki sharah ke ulat palat ke baray mein qeemti adaad o shumaar faraham karte hain. tajir tijarat mein jane ya bahar niklny ke liye un style ko tasdeeqi intabahat ke tor par istemaal kar satke hain.

Facters Considers when Analysing Spike Candlestick Pattern:

Spike candle stick ke namonon ka mutalea karte waqt, mutadid awamil par ghhor karna zaroori hai. sab se pehlay, Spike ki muddat ahem hai. aik izafi tosee shuda Spike market ki harkiyaat mein aik barri barri tabdeeli ki tajweez karta hai aur aik ziyada taaqatwar ulat ya tasalsul ke isharay ka mahswara day sakta hai.

Dosra, Spike candle stick patteren se mutaliq miqdaar ahem hai. Spike ki tashkeel ke kisi waqt ziyada hajam market mein izafi shirkat aur jaaiz signal ke behtar imkaan ki nishandahi karta hai. is ke bar aks, kam miqdaar bazaar mein kam shirkat aur kamzor alamat ki bhi nishandahi kar sakti hai.

Trading With Spike Candlestick Pattern:

Tajir Spike candle stick style ke istemaal se khareed o farokht ke mutadid tareeqay muqarrar kar satke hain. aik aam tareeqa yeh hai ke kaleedi support ki satah par blush Spike candle stick ka namona talaash kya jaye. yeh namona is baat ki nishandahi karta hai ke gahkon ne farokht knndgan ko shikast di hai aur fees ki karwai mein ulat par dastakhat kar satke hain. tajir khatray se nimatnay ke liye support level se neechay stop las order ke sath lambi position mein bhi daakhil ho satke hain.

Is ke bar aks, muzahmat ke aik ahem marhalay par aik bearish Spike candle stick patteren se pata chalta hai ke dilron ne control sambhaal liya hai, jo shayad qeemat ke ulat jane ka baais hai. tajir izafi tor par muzahmat ki satah se oopar stop las order ke sath aik mukhtasir function mein daakhil hona yaad kar satke hain.

Limitations of Spike Candlestick Pattern:

Agarchay takneeki tajziye mein Spike candle stick ke namoonay qeemti samaan hain, lekin un mein rakawaten hain jin se kharidaron ko waaqif hona chahiye. sab se pehlay, Spike candle stick ke andaaz ghalat isharay peda kar satke hain, khaas tor par bazaar ke utaar charhao walay halaat mein. taajiron ko kamyabi ke imkanaat ko badhaane ke liye deegar takneeki isharay ya chart style ke sath un ishaaron ki tasdeeq karni chahiye.

Dosra, akailey Spike candle stick patteren munfarid rasai ya bahar niklny ke maqamat paish nahi karte hain. taajiron ko aik jame tijarti nuqta nazar ko wasee karne ke liye takneeki tajzia ke deegar alaat ke sath un ka istemaal karna parta hai.

Spike candle stick patteren aik takneeki tajzia aala hai jo candle stick ke jism se istemaal hota hai. yeh ya to aik lamba oopri saya ya aik taweel nichala saya ho sakta hai.

Tajir bazaar ke jazbaat ki baseerat ko faida pohanchanay aur kharidari aur farokht ke bakhabar intikhab karne ke liye baqaidagi se mom btyon ke andaaz ka istemaal karte hain. اSpike candle stick ka namona khaas tor par ahem hai kyunkay yeh market ki harkiyaat mein herat angaiz tabdeeli ka ishara karta hai. yeh kaleedi madad ya muzahmat ki sthon par ho sakta hai, jo charge harkat ke andar aik barray mourr ko nishaan zad karta hai.

Types of Spike Candlestick Pattern:

Spike candle stick ke numaya andaaz hain : blush Spike aur bearish Spike. aik taizi se barhti hui mom batii ki chhari byorokrisi ka namona hai jab aik taweel neechay ka saya aur aik chhota sa haqeeqi jism hota hai, jo is baat ki nishandahi karta hai ke kharidaron ne dilron ko kuchal diya hai aur qeemat ko barha diya hai. doosri taraf, aik bearish Spike candle stick ka namona hota hai jab ke is mein aik tosiay oopri saya aur aik chhota haqeeqi frame hota hai, jo is baat ki nishandahi karta hai ke dilron ne hukmarani ki hai aur charge ko kam kardiya hai.

Mukhtalif qisam ke Spike candle stick ke namonon ko samjhna zaroori hai kyunkay woh market ke jazbaat aur salahiyat ki sharah ke ulat palat ke baray mein qeemti adaad o shumaar faraham karte hain. tajir tijarat mein jane ya bahar niklny ke liye un style ko tasdeeqi intabahat ke tor par istemaal kar satke hain.

Facters Considers when Analysing Spike Candlestick Pattern:

Spike candle stick ke namonon ka mutalea karte waqt, mutadid awamil par ghhor karna zaroori hai. sab se pehlay, Spike ki muddat ahem hai. aik izafi tosee shuda Spike market ki harkiyaat mein aik barri barri tabdeeli ki tajweez karta hai aur aik ziyada taaqatwar ulat ya tasalsul ke isharay ka mahswara day sakta hai.

Dosra, Spike candle stick patteren se mutaliq miqdaar ahem hai. Spike ki tashkeel ke kisi waqt ziyada hajam market mein izafi shirkat aur jaaiz signal ke behtar imkaan ki nishandahi karta hai. is ke bar aks, kam miqdaar bazaar mein kam shirkat aur kamzor alamat ki bhi nishandahi kar sakti hai.

Trading With Spike Candlestick Pattern:

Tajir Spike candle stick style ke istemaal se khareed o farokht ke mutadid tareeqay muqarrar kar satke hain. aik aam tareeqa yeh hai ke kaleedi support ki satah par blush Spike candle stick ka namona talaash kya jaye. yeh namona is baat ki nishandahi karta hai ke gahkon ne farokht knndgan ko shikast di hai aur fees ki karwai mein ulat par dastakhat kar satke hain. tajir khatray se nimatnay ke liye support level se neechay stop las order ke sath lambi position mein bhi daakhil ho satke hain.

Is ke bar aks, muzahmat ke aik ahem marhalay par aik bearish Spike candle stick patteren se pata chalta hai ke dilron ne control sambhaal liya hai, jo shayad qeemat ke ulat jane ka baais hai. tajir izafi tor par muzahmat ki satah se oopar stop las order ke sath aik mukhtasir function mein daakhil hona yaad kar satke hain.

Limitations of Spike Candlestick Pattern:

Agarchay takneeki tajziye mein Spike candle stick ke namoonay qeemti samaan hain, lekin un mein rakawaten hain jin se kharidaron ko waaqif hona chahiye. sab se pehlay, Spike candle stick ke andaaz ghalat isharay peda kar satke hain, khaas tor par bazaar ke utaar charhao walay halaat mein. taajiron ko kamyabi ke imkanaat ko badhaane ke liye deegar takneeki isharay ya chart style ke sath un ishaaron ki tasdeeq karni chahiye.

Dosra, akailey Spike candle stick patteren munfarid rasai ya bahar niklny ke maqamat paish nahi karte hain. taajiron ko aik jame tijarti nuqta nazar ko wasee karne ke liye takneeki tajzia ke deegar alaat ke sath un ka istemaal karna parta hai.

تبصرہ

Расширенный режим Обычный режим