The Bullish Pin Bar candlestick pattern is a significant indicator in technical analysis, often signaling potential reversals or shifts in market sentiment. Let's rationalize the pattern

Definition

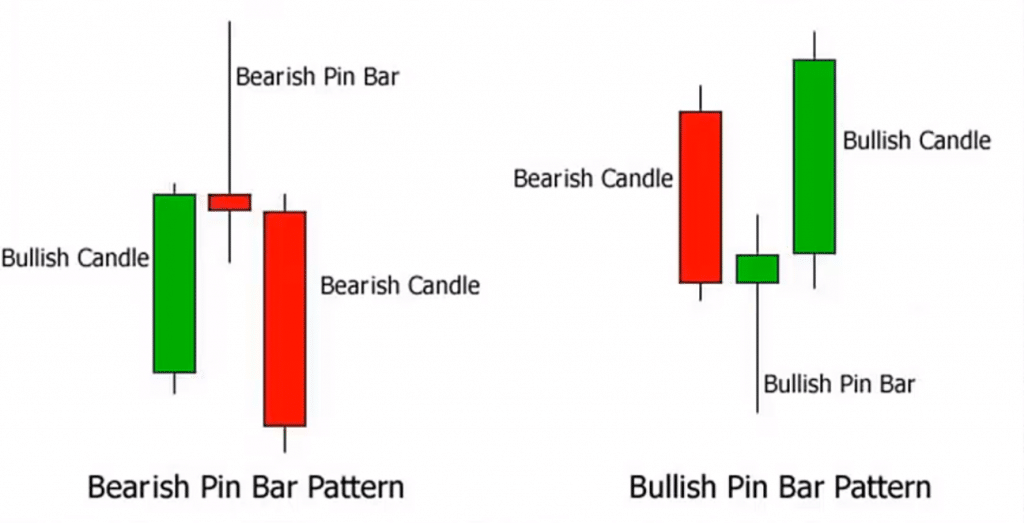

The Bullish Pin Bar, also known as the hammer, is characterized by a single candle with a small body, a long lower shadow, and little to no upper shadow. The small body is usually at the top of the candle, and the long lower shadow extends below the body, resembling a pin. This formation typically appears after a downtrend

Market Sentiment

The Bullish Pin Bar suggests a rejection of lower prices. The long lower shadow signifies that sellers attempted to push the price lower but faced strong resistance, leading to a reversal and a potential shift in control from bears to bulls. This pattern indicates that buyers have gained momentum, stepping in to drive prices higher

Psychological Aspect

The rationalization lies in understanding market psychology. During a downtrend, sellers dominate, pushing the prices lower. However, when a Bullish Pin Bar forms, it reflects a struggle between sellers and buyers, with buyers ultimately gaining control. Traders who missed the initial downtrend may see this pattern as an opportunity to enter the market, anticipating a reversal and potential upward movement. The Bullish Pin Bar is a visual representation of the tug-of-war between bulls and bears, providing valuable insights into potential trend changes

Market Sentiment

Definition

The Bullish Pin Bar, also known as the hammer, is characterized by a single candle with a small body, a long lower shadow, and little to no upper shadow. The small body is usually at the top of the candle, and the long lower shadow extends below the body, resembling a pin. This formation typically appears after a downtrend

Market Sentiment

The Bullish Pin Bar suggests a rejection of lower prices. The long lower shadow signifies that sellers attempted to push the price lower but faced strong resistance, leading to a reversal and a potential shift in control from bears to bulls. This pattern indicates that buyers have gained momentum, stepping in to drive prices higher

Psychological Aspect

The rationalization lies in understanding market psychology. During a downtrend, sellers dominate, pushing the prices lower. However, when a Bullish Pin Bar forms, it reflects a struggle between sellers and buyers, with buyers ultimately gaining control. Traders who missed the initial downtrend may see this pattern as an opportunity to enter the market, anticipating a reversal and potential upward movement. The Bullish Pin Bar is a visual representation of the tug-of-war between bulls and bears, providing valuable insights into potential trend changes

Market Sentiment

The Bullish Pin Bar suggests a rejection of lower prices. The long lower shadow signifies that sellers attempted to push the price lower but faced strong resistance, leading to a reversal and a potential shift in control from bears to bulls. This pattern indicates that buyers have gained momentum, stepping in to drive prices higher

تبصرہ

Расширенный режим Обычный режим