Hello,

Dosto kaise hain aap umeed hay ke aap khyryat se hongay aur trading enjoy kar rahe hongay aj ka hamara topic hay counter Attack pattern kis ko ham aaj detail ke sat discus karenge

Forex main counter attack pattern kya hota hay?

Forex main counter attack pattern ek do candle ka reversal pattern hay jo downtrend ya uptrend main ho sakta hay. Is pattern main first candle trend ke sath hota hay aur second candle trend ke khilaf hota hay.

Counter attack pattern ko chart main kaise find kiya jata hay?

Counter attack pattern ko chart main find karne ke liye aapko yeh steps follow karne chahiye:

Pehli baat to yeh dekhen ki market trend main hai ya nahi.

Agar market trend main hai to fir pehli candle ka trend dekhen.

Agar pehli candle trend ke sath hai to fir second candle ka trend dekhen.

Agar second candle trend ke khilaf hai to fir yeh counter attack pattern ho sakta hay.

Counter attack pattern ko market main kaise use kiya jata hay?

Counter attack pattern ko market main use karne ke liye aapko yeh steps follow karne chahiye:

Pehli baat to yeh dekhen ki pattern complete ho gaya hai ya nahi.

Agar pattern complete ho gaya hai to fir second candle ke close ke baad trade karna start kar sakte hain.Trade ka direction trend ke khilaf hota hay.

Bullish counter attack patt

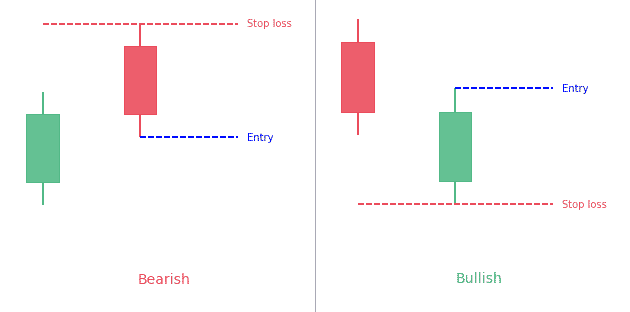

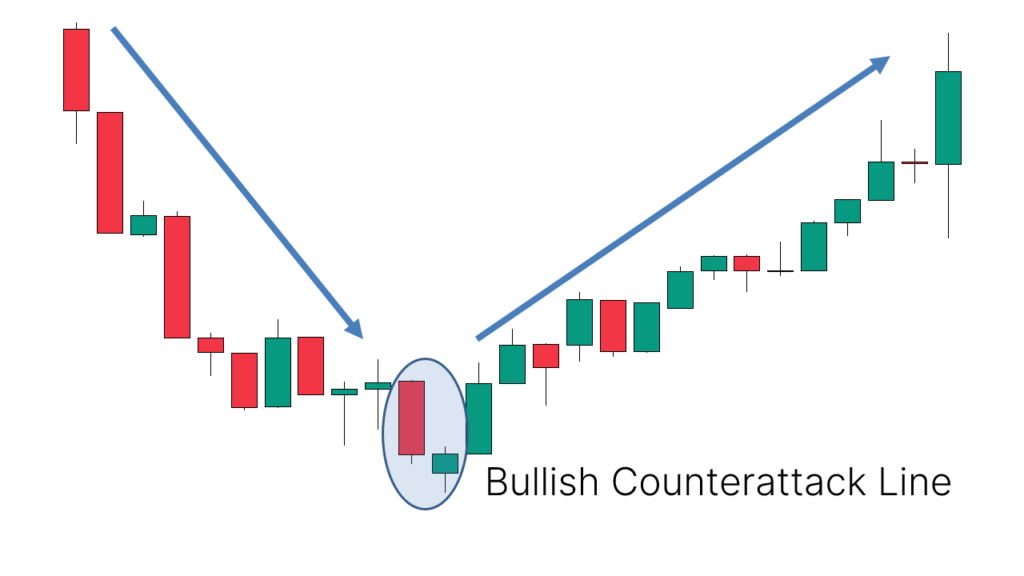

Bullish counter attack pattern downtrend main hota hay. Is pattern main first candle ek long black candle hota hay aur second candle ek long white candle hota hay. Second candle first candle ke gap ko close karta hay aur first candle ke close ke paas close hota hay.

Bearish counter attack pattern

Bearish counter attack pattern uptrend main hota hay. Is pattern main first candle ek long white candle hota hay aur second candle ek long black candle hota hay. Second candle first candle ke gap ko close karta hay aur first candle ke close ke paas close hota hay.

Counter attack pattern ki strength

Counter attack pattern ek strong reversal pattern hota hay. Is pattern ka success rate bahut zyada hota hay.

Counter attack pattern ke liye risk management

Counter attack pattern ka use karne ke liye risk management bahut important hota hay. Aap stop loss ko first candle ke low se set kar sakte hain.

Dosto kaise hain aap umeed hay ke aap khyryat se hongay aur trading enjoy kar rahe hongay aj ka hamara topic hay counter Attack pattern kis ko ham aaj detail ke sat discus karenge

Forex main counter attack pattern kya hota hay?

Forex main counter attack pattern ek do candle ka reversal pattern hay jo downtrend ya uptrend main ho sakta hay. Is pattern main first candle trend ke sath hota hay aur second candle trend ke khilaf hota hay.

Counter attack pattern ko chart main kaise find kiya jata hay?

Counter attack pattern ko chart main find karne ke liye aapko yeh steps follow karne chahiye:

Pehli baat to yeh dekhen ki market trend main hai ya nahi.

Agar market trend main hai to fir pehli candle ka trend dekhen.

Agar pehli candle trend ke sath hai to fir second candle ka trend dekhen.

Agar second candle trend ke khilaf hai to fir yeh counter attack pattern ho sakta hay.

Counter attack pattern ko market main kaise use kiya jata hay?

Counter attack pattern ko market main use karne ke liye aapko yeh steps follow karne chahiye:

Pehli baat to yeh dekhen ki pattern complete ho gaya hai ya nahi.

Agar pattern complete ho gaya hai to fir second candle ke close ke baad trade karna start kar sakte hain.Trade ka direction trend ke khilaf hota hay.

Bullish counter attack patt

Bullish counter attack pattern downtrend main hota hay. Is pattern main first candle ek long black candle hota hay aur second candle ek long white candle hota hay. Second candle first candle ke gap ko close karta hay aur first candle ke close ke paas close hota hay.

Bearish counter attack pattern

Bearish counter attack pattern uptrend main hota hay. Is pattern main first candle ek long white candle hota hay aur second candle ek long black candle hota hay. Second candle first candle ke gap ko close karta hay aur first candle ke close ke paas close hota hay.

Counter attack pattern ki strength

Counter attack pattern ek strong reversal pattern hota hay. Is pattern ka success rate bahut zyada hota hay.

Counter attack pattern ke liye risk management

Counter attack pattern ka use karne ke liye risk management bahut important hota hay. Aap stop loss ko first candle ke low se set kar sakte hain.

تبصرہ

Расширенный режим Обычный режим