Butterfly candlestick pattern

Butterfly candlestick pattern ek technical analysis concept hai jo traders ko market ke potential reversals ya trend changes ko identify karne mein madad karta hai. Yeh pattern harmonics trading theory ka hissa hai aur Fibonacci levels ka use karke market movements ko analyze karta hai.

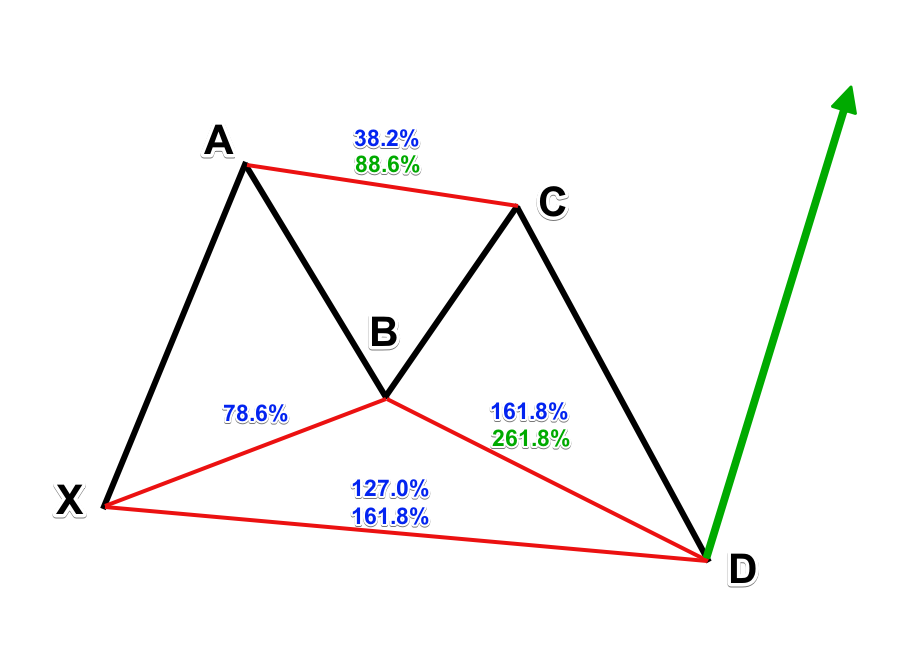

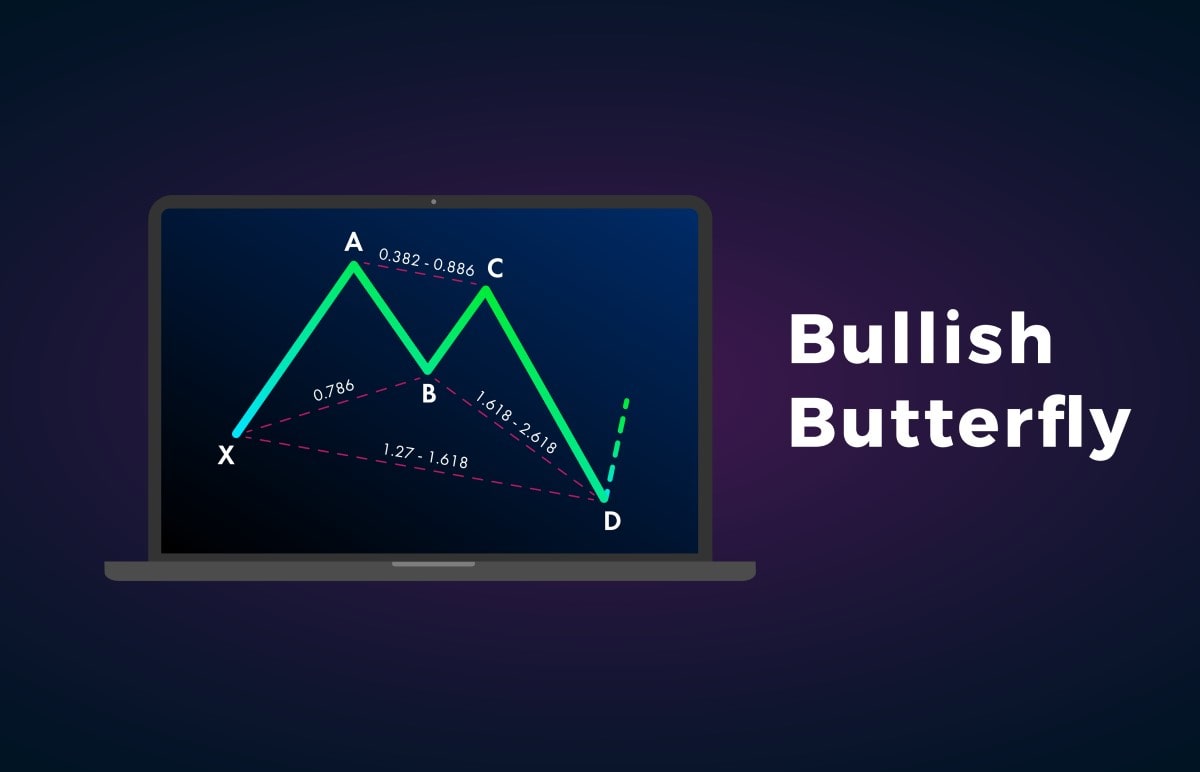

Butterfly pattern ka formation ABCD structure par mabni hota hai, jismein XA leg, AB leg, BC leg, aur CD leg shamil hote hain. Yeh structure Fibonacci retracement aur extension levels par based hota hai. Har leg specific Fibonacci ratios ka use karte hue calculate ki jati hai.

XA leg: Yeh market ke initial move ko represent karta hai, jisse X se A tak labeled hota hai.

AB leg: Yeh XA leg ke opposite direction mein hota hai aur Fibonacci retracement level se related hota hai.

BC leg: Yeh AB leg ke direction mein hota hai aur Fibonacci extension level se related hota hai.

CD leg: Yeh BC leg ke opposite direction mein hota hai aur Fibonacci retracement level se related hota hai.

Butterfly pattern ki pehchan ke liye, traders ko specific Fibonacci ratios ka istemal karna hota hai. ABCD structure mein, commonly istemal hone wale ratios 0.786, 0.618, 1.272, aur 1.618 hote hain.

Butterfly pattern ka key point yeh hai ke BC leg 0.786 retracement level tak pahunchti hai, aur CD leg 1.618 extension level tak pahunchti hai. Agar yeh conditions meet hoti hain, to butterfly pattern ko confirm karte hain.

Jab butterfly pattern complete hota hai, to traders ko price reversal hone ke possibilities ka indication milta hai. Yeh pattern downtrend ke baad bullish reversal aur uptrend ke baad bearish reversal ko indicate kar sakta hai.

Butterfly pattern trading mein risk management ka bhi ahem hissa hai. Stop-loss orders ka istemal karke traders apne positions ko protect kar sakte hain. Lekin, hamesha yaad rahe ke kisi bhi pattern ya indicator par pura bharosa na karein aur doosre confirmatory signals ka bhi dhyan rakhein.

Is pattern ko samajhne ke liye traders ko Fibonacci retracement aur extension levels ko samajhna zaroori hai. Butterfly pattern ke istemal mein patience aur discipline bhi zaroori hai, kyun ki market conditions hamesha changing rehti hain.

In conclusion, butterfly candlestick pattern harmonic trading theory ka ek important part hai jo Fibonacci levels ka use karke market reversals ko predict karne mein madad karta hai. Traders ko is pattern ko samajhne ke liye Fibonacci ratios ka istemal karna sikhna chahiye aur market context ko bhi madde nazar rakhna important hai.

Butterfly candlestick pattern ek technical analysis concept hai jo traders ko market ke potential reversals ya trend changes ko identify karne mein madad karta hai. Yeh pattern harmonics trading theory ka hissa hai aur Fibonacci levels ka use karke market movements ko analyze karta hai.

Butterfly pattern ka formation ABCD structure par mabni hota hai, jismein XA leg, AB leg, BC leg, aur CD leg shamil hote hain. Yeh structure Fibonacci retracement aur extension levels par based hota hai. Har leg specific Fibonacci ratios ka use karte hue calculate ki jati hai.

XA leg: Yeh market ke initial move ko represent karta hai, jisse X se A tak labeled hota hai.

AB leg: Yeh XA leg ke opposite direction mein hota hai aur Fibonacci retracement level se related hota hai.

BC leg: Yeh AB leg ke direction mein hota hai aur Fibonacci extension level se related hota hai.

CD leg: Yeh BC leg ke opposite direction mein hota hai aur Fibonacci retracement level se related hota hai.

Butterfly pattern ki pehchan ke liye, traders ko specific Fibonacci ratios ka istemal karna hota hai. ABCD structure mein, commonly istemal hone wale ratios 0.786, 0.618, 1.272, aur 1.618 hote hain.

Butterfly pattern ka key point yeh hai ke BC leg 0.786 retracement level tak pahunchti hai, aur CD leg 1.618 extension level tak pahunchti hai. Agar yeh conditions meet hoti hain, to butterfly pattern ko confirm karte hain.

Jab butterfly pattern complete hota hai, to traders ko price reversal hone ke possibilities ka indication milta hai. Yeh pattern downtrend ke baad bullish reversal aur uptrend ke baad bearish reversal ko indicate kar sakta hai.

Butterfly pattern trading mein risk management ka bhi ahem hissa hai. Stop-loss orders ka istemal karke traders apne positions ko protect kar sakte hain. Lekin, hamesha yaad rahe ke kisi bhi pattern ya indicator par pura bharosa na karein aur doosre confirmatory signals ka bhi dhyan rakhein.

Is pattern ko samajhne ke liye traders ko Fibonacci retracement aur extension levels ko samajhna zaroori hai. Butterfly pattern ke istemal mein patience aur discipline bhi zaroori hai, kyun ki market conditions hamesha changing rehti hain.

In conclusion, butterfly candlestick pattern harmonic trading theory ka ek important part hai jo Fibonacci levels ka use karke market reversals ko predict karne mein madad karta hai. Traders ko is pattern ko samajhne ke liye Fibonacci ratios ka istemal karna sikhna chahiye aur market context ko bhi madde nazar rakhna important hai.

تبصرہ

Расширенный режим Обычный режим