Trading ki duniya mein do aham istilahaat, bid price aur ask price, har tarah ke market transaction ke buniyaadi pillars hain. Yeh dono prices market ke demand aur supply ka zahir karte hain aur kisi bhi transaction ke liye guide ka kaam karte hain. Chahay aap forex, stocks, commodities, ya cryptocurrencies mein trading karte hain, in dono ko samajhna har trader ke liye zaroori hai.

Bid Price Kya Hai

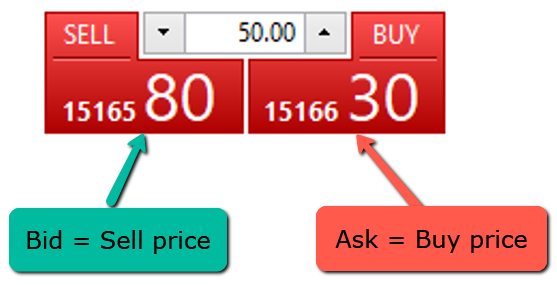

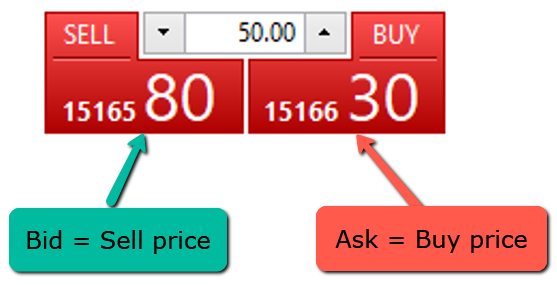

Bid price wo price hai jo ek buyer kisi asset ko kharidne ke liye tayar hota hai. Yeh asal mein demand ka indicator hota hai, yani buyer ka interest is price par us asset ko kharidne mein hai. Bid price buyer ki taraf se ek offer hota hai, jo aksar seller ko attract karne ke liye market mein dikhaya jata hai. Bid price market ki liquidity aur buyer ki willingness ka izhar karta hai.

Agar ek example diya jaye, to maan lijiye ke ek stock market mein ek stock ka bid price ₹100 hai. Iska matlab hai ke kisi buyer ne apni taraf se 100 ka offer diya hai ke wo is stock ko is price par kharidna chahta hai. Agar koi seller is offer ko accept karta hai, to deal ho jati hai. Lekin yeh price aksar ask price se kam hoti hai, kyun ke buyer kam se kam price par kharidne ki koshish karta hai.

Bid price ka market par asar bohot aham hota hai. Zyada buyers ka hona ya unka zyada aggressive bid lagana, kisi asset ki value ko barhane ka sabab ban sakta hai. Is wajah se, jo traders demand ko samajhna chahte hain, unke liye bid prices ka close analysis zaroori hai.

Ask Price Kya Hai

Ask price wo price hai jo ek seller apne asset ko bechne ke liye tayar hota hai. Yeh supply ka indicator hota hai aur yeh batata hai ke seller ko is price par apne asset ko sell karne mein dilchaspi hai. Ask price aksar bid price se zyada hoti hai, kyun ke seller ki koshish hoti hai ke wo apne asset ko zyada se zyada price par beche.

Agar example diya jaye, to maan lijiye ke ek stock ka ask price ₹102 hai. Iska matlab hai ke ek seller ne yeh decide kiya hai ke wo apne stock ko ₹102 par bechne ke liye tayar hai. Agar koi buyer is price par kharidne ke liye razi hota hai, to transaction complete ho jati hai. Yeh price aksar market ke conditions par depend karti hai, jaise ke liquidity, demand, aur economic conditions.

Ask price seller ki priorities aur market conditions ka bhi pata deti hai. Low ask price ka matlab yeh ho sakta hai ke market mein sellers ki supply zyada hai ya kisi specific asset ki demand kam hai. On the other hand, agar ask price high ho, to yeh market ke bullish trend ya kisi specific asset ki high demand ka indicator ho sakta hai.

Bid aur Ask Price ke Darmiyan ka Farq: Spread

Bid aur ask price ke darmiyan ka jo farq hota hai, usay spread kehte hain. Spread har market ke liye alag hota hai aur aksar liquidity par depend karta hai. Spread jitna kam hota hai, utni hi market zyada liquid hoti hai. Iska matlab yeh hai ke zyada buyers aur sellers market mein available hain aur transactions fast hoti hain. Spread ka buniadi kaam market maker aur broker ka munafa tay karna hai.

Agar ek example diya jaye, to maan lijiye ek stock ka bid price ₹100 hai aur ask price ₹102 hai. Iska matlab hai ke spread ₹2 hai. Is spread ko brokers aur market makers apne operations ka kharcha recover karne aur profit banane ke liye use karte hain. Zyada liquid markets jaise ke forex mein spread aksar bohot kam hota hai, jabke low-liquid markets jaise commodities ya cryptocurrencies mein spread zyada ho sakta hai.

Bid Price aur Ask Price Trading Decisions Par Kis Tarah Asar Andaz Hote Hain

Trading karte waqt bid price aur ask price dono ka asar har deal par hota hai. Agar aap ek buyer hain, to aapko aksar ask price par apna transaction complete karna hoga, kyun ke seller ki demand wahi hai. Isi tarah, agar aap seller hain, to aap apna asset bid price par bechein ge, kyun ke buyer usi price par kharidne ke liye tayar hai.

Aksar traders bid aur ask prices ko samajhne ke baad apni buying aur selling strategies banate hain. For example, agar aap scalping ya day trading karte hain, to aapko bid aur ask price ke farq ko bohot closely dekhna hoga. Aapki profit aur loss calculations bhi inse directly mutasir hoti hain, kyun ke jo price aap kharidne ya bechne ke liye dekhte hain wo inhi prices par depend karta hai.

Long-term investors ke liye bid aur ask prices ka asar itna zyada nahi hota, kyun ke wo aksar bade time frames par invest karte hain aur inka focus price trends par hota hai. Lekin short-term traders ke liye yeh prices bohot important hote hain, kyun ke unka profit aksar chhoti price movements par depend karta hai.

Forex Trading Mein Bid aur Ask Price ka Kirdar

Forex trading mein bid aur ask price ka kirdar bohot prominent hota hai. Jab aap ek currency pair trade karte hain, to aapko hamesha do prices dikhayi deti hain: ek bid price aur ek ask price. For example, agar EUR/USD ka bid price 1.1000 hai aur ask price 1.1002 hai, to iska matlab hai ke aap yeh currency pair 1.1002 par kharid sakte hain aur 1.1000 par bech sakte hain.

Forex markets mein spreads aksar bohot chhote hote hain, jaise ke 1 pip ya 2 pips. Yeh is wajah se hota hai ke forex markets bohot zyada liquid hoti hain aur har waqt buyers aur sellers available hote hain. Lekin jab market volatile ho, jaise ke economic news ke waqt, to spreads zyada barh jate hain.

Stock Trading Mein Bid aur Ask Price ka Asar

Stock trading mein bid aur ask price har deal ka buniyaadi hissa hote hain. Jab aap kisi stock ko buy ya sell karte hain, to aapko inhi prices par deal karni hoti hai. Aksar stocks mein bid aur ask prices ke darmiyan farq, yani spread, bohot kam hota hai, lekin low-volume stocks mein yeh farq zyada ho sakta hai.

Agar ek trader kisi stock ko market price par buy karna chahta hai, to usay aksar ask price par kharidna hoga. Isi tarah, agar koi seller market price par sell karna chahta hai, to usay bid price par bechna hoga. Limit orders ke zariye aap apni desired price set kar sakte hain, lekin ismein aapko wait karna padta hai jab tak koi aapki offer ko accept nahi karta.

Commodities aur Cryptocurrencies Mein Bid aur Ask Price

Commodities aur cryptocurrencies jaise markets mein bid aur ask price ke darmiyan farq aksar zyada hota hai, khas kar jab liquidity kam ho. For example, ek rare commodity ya ek low-volume cryptocurrency mein spread aksar barh jata hai, jo buyers aur sellers ke liye ek challenge ban sakta hai.

Cryptocurrency markets mein volatility zyada hone ki wajah se bid aur ask prices bar-bar badalte hain. Is wajah se traders ko real-time monitoring aur fast decision-making ki zarurat hoti hai. Commodities mein, jaise ke gold aur oil, bid aur ask prices aksar global economic factors, demand-supply dynamics, aur geopolitical situations par depend karte hain.

Bid aur Ask Price Ko Samajhne ke Faide

Agar aap bid aur ask price ko acche se samajhte hain, to aap apni trading mein bohot behtari la sakte hain. Yeh dono prices aapko market ke mood ka idea dete hain aur aapko yeh samajhne mein madad karte hain ke aap kis waqt aur kis price par entry ya exit karein. Bid aur ask prices ko samajhne se aap spread ke zariye market maker ka profit bhi dekh sakte hain aur apne transactions ke liye best prices ka intekhab kar sakte hain.

Bid aur ask price ka samajhna sirf traders ke liye nahi, balki long-term investors ke liye bhi zaroori hai. Yeh prices aapko market ke liquidity level ka idea dete hain, jo aapki buying aur selling strategies par asar dal sakte hain. Trading ke liye risk management ka ek aham hissa yeh bhi hai ke aap bid aur ask price ke darmiyan farq ko samajh kar apni strategies banayein.

Bid price aur ask price har market transaction ka buniyaadi hissa hain. Inko samajhna aur inka analysis karna har trader ke liye zaroori hai, chahe wo short-term trading karta ho ya long-term investing. In prices ke darmiyan ka farq, yani spread, market ke liquidity aur volatility ka indicator hota hai. Har successful trader in prices ka close analysis karta hai aur apni buying aur selling strategies inhi par banata hai. Trading mein kamyabi ke liye bid aur ask price ka knowledge aur unka proper utilization bohot ahmiyat rakhta hai.

Bid Price Kya Hai

Bid price wo price hai jo ek buyer kisi asset ko kharidne ke liye tayar hota hai. Yeh asal mein demand ka indicator hota hai, yani buyer ka interest is price par us asset ko kharidne mein hai. Bid price buyer ki taraf se ek offer hota hai, jo aksar seller ko attract karne ke liye market mein dikhaya jata hai. Bid price market ki liquidity aur buyer ki willingness ka izhar karta hai.

Agar ek example diya jaye, to maan lijiye ke ek stock market mein ek stock ka bid price ₹100 hai. Iska matlab hai ke kisi buyer ne apni taraf se 100 ka offer diya hai ke wo is stock ko is price par kharidna chahta hai. Agar koi seller is offer ko accept karta hai, to deal ho jati hai. Lekin yeh price aksar ask price se kam hoti hai, kyun ke buyer kam se kam price par kharidne ki koshish karta hai.

Bid price ka market par asar bohot aham hota hai. Zyada buyers ka hona ya unka zyada aggressive bid lagana, kisi asset ki value ko barhane ka sabab ban sakta hai. Is wajah se, jo traders demand ko samajhna chahte hain, unke liye bid prices ka close analysis zaroori hai.

Ask Price Kya Hai

Ask price wo price hai jo ek seller apne asset ko bechne ke liye tayar hota hai. Yeh supply ka indicator hota hai aur yeh batata hai ke seller ko is price par apne asset ko sell karne mein dilchaspi hai. Ask price aksar bid price se zyada hoti hai, kyun ke seller ki koshish hoti hai ke wo apne asset ko zyada se zyada price par beche.

Agar example diya jaye, to maan lijiye ke ek stock ka ask price ₹102 hai. Iska matlab hai ke ek seller ne yeh decide kiya hai ke wo apne stock ko ₹102 par bechne ke liye tayar hai. Agar koi buyer is price par kharidne ke liye razi hota hai, to transaction complete ho jati hai. Yeh price aksar market ke conditions par depend karti hai, jaise ke liquidity, demand, aur economic conditions.

Ask price seller ki priorities aur market conditions ka bhi pata deti hai. Low ask price ka matlab yeh ho sakta hai ke market mein sellers ki supply zyada hai ya kisi specific asset ki demand kam hai. On the other hand, agar ask price high ho, to yeh market ke bullish trend ya kisi specific asset ki high demand ka indicator ho sakta hai.

Bid aur Ask Price ke Darmiyan ka Farq: Spread

Bid aur ask price ke darmiyan ka jo farq hota hai, usay spread kehte hain. Spread har market ke liye alag hota hai aur aksar liquidity par depend karta hai. Spread jitna kam hota hai, utni hi market zyada liquid hoti hai. Iska matlab yeh hai ke zyada buyers aur sellers market mein available hain aur transactions fast hoti hain. Spread ka buniadi kaam market maker aur broker ka munafa tay karna hai.

Agar ek example diya jaye, to maan lijiye ek stock ka bid price ₹100 hai aur ask price ₹102 hai. Iska matlab hai ke spread ₹2 hai. Is spread ko brokers aur market makers apne operations ka kharcha recover karne aur profit banane ke liye use karte hain. Zyada liquid markets jaise ke forex mein spread aksar bohot kam hota hai, jabke low-liquid markets jaise commodities ya cryptocurrencies mein spread zyada ho sakta hai.

Bid Price aur Ask Price Trading Decisions Par Kis Tarah Asar Andaz Hote Hain

Trading karte waqt bid price aur ask price dono ka asar har deal par hota hai. Agar aap ek buyer hain, to aapko aksar ask price par apna transaction complete karna hoga, kyun ke seller ki demand wahi hai. Isi tarah, agar aap seller hain, to aap apna asset bid price par bechein ge, kyun ke buyer usi price par kharidne ke liye tayar hai.

Aksar traders bid aur ask prices ko samajhne ke baad apni buying aur selling strategies banate hain. For example, agar aap scalping ya day trading karte hain, to aapko bid aur ask price ke farq ko bohot closely dekhna hoga. Aapki profit aur loss calculations bhi inse directly mutasir hoti hain, kyun ke jo price aap kharidne ya bechne ke liye dekhte hain wo inhi prices par depend karta hai.

Long-term investors ke liye bid aur ask prices ka asar itna zyada nahi hota, kyun ke wo aksar bade time frames par invest karte hain aur inka focus price trends par hota hai. Lekin short-term traders ke liye yeh prices bohot important hote hain, kyun ke unka profit aksar chhoti price movements par depend karta hai.

Forex Trading Mein Bid aur Ask Price ka Kirdar

Forex trading mein bid aur ask price ka kirdar bohot prominent hota hai. Jab aap ek currency pair trade karte hain, to aapko hamesha do prices dikhayi deti hain: ek bid price aur ek ask price. For example, agar EUR/USD ka bid price 1.1000 hai aur ask price 1.1002 hai, to iska matlab hai ke aap yeh currency pair 1.1002 par kharid sakte hain aur 1.1000 par bech sakte hain.

Forex markets mein spreads aksar bohot chhote hote hain, jaise ke 1 pip ya 2 pips. Yeh is wajah se hota hai ke forex markets bohot zyada liquid hoti hain aur har waqt buyers aur sellers available hote hain. Lekin jab market volatile ho, jaise ke economic news ke waqt, to spreads zyada barh jate hain.

Stock Trading Mein Bid aur Ask Price ka Asar

Stock trading mein bid aur ask price har deal ka buniyaadi hissa hote hain. Jab aap kisi stock ko buy ya sell karte hain, to aapko inhi prices par deal karni hoti hai. Aksar stocks mein bid aur ask prices ke darmiyan farq, yani spread, bohot kam hota hai, lekin low-volume stocks mein yeh farq zyada ho sakta hai.

Agar ek trader kisi stock ko market price par buy karna chahta hai, to usay aksar ask price par kharidna hoga. Isi tarah, agar koi seller market price par sell karna chahta hai, to usay bid price par bechna hoga. Limit orders ke zariye aap apni desired price set kar sakte hain, lekin ismein aapko wait karna padta hai jab tak koi aapki offer ko accept nahi karta.

Commodities aur Cryptocurrencies Mein Bid aur Ask Price

Commodities aur cryptocurrencies jaise markets mein bid aur ask price ke darmiyan farq aksar zyada hota hai, khas kar jab liquidity kam ho. For example, ek rare commodity ya ek low-volume cryptocurrency mein spread aksar barh jata hai, jo buyers aur sellers ke liye ek challenge ban sakta hai.

Cryptocurrency markets mein volatility zyada hone ki wajah se bid aur ask prices bar-bar badalte hain. Is wajah se traders ko real-time monitoring aur fast decision-making ki zarurat hoti hai. Commodities mein, jaise ke gold aur oil, bid aur ask prices aksar global economic factors, demand-supply dynamics, aur geopolitical situations par depend karte hain.

Bid aur Ask Price Ko Samajhne ke Faide

Agar aap bid aur ask price ko acche se samajhte hain, to aap apni trading mein bohot behtari la sakte hain. Yeh dono prices aapko market ke mood ka idea dete hain aur aapko yeh samajhne mein madad karte hain ke aap kis waqt aur kis price par entry ya exit karein. Bid aur ask prices ko samajhne se aap spread ke zariye market maker ka profit bhi dekh sakte hain aur apne transactions ke liye best prices ka intekhab kar sakte hain.

Bid aur ask price ka samajhna sirf traders ke liye nahi, balki long-term investors ke liye bhi zaroori hai. Yeh prices aapko market ke liquidity level ka idea dete hain, jo aapki buying aur selling strategies par asar dal sakte hain. Trading ke liye risk management ka ek aham hissa yeh bhi hai ke aap bid aur ask price ke darmiyan farq ko samajh kar apni strategies banayein.

Bid price aur ask price har market transaction ka buniyaadi hissa hain. Inko samajhna aur inka analysis karna har trader ke liye zaroori hai, chahe wo short-term trading karta ho ya long-term investing. In prices ke darmiyan ka farq, yani spread, market ke liquidity aur volatility ka indicator hota hai. Har successful trader in prices ka close analysis karta hai aur apni buying aur selling strategies inhi par banata hai. Trading mein kamyabi ke liye bid aur ask price ka knowledge aur unka proper utilization bohot ahmiyat rakhta hai.

تبصرہ

Расширенный режим Обычный режим