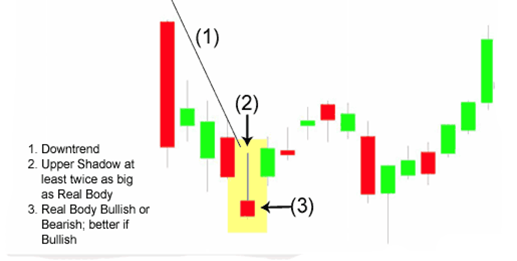

Long shadow candlestick ka matlab hai ke ek candlestick chart mein candle ki body choti hoti hai lekin uski shadow (yaani woh line jo candle se bahar extend hoti hai) lambi hoti hai. Yeh indicate kar sakta hai ke market mein strong price movement tha, lekin phir price mein kisi reason se reversal hua.

Long shadow candles ko interpret karne ke liye kuch general rules hote hain:

Long Upper Shadow (Upar ki Lambi Shadow): Agar candle ki upper shadow lambi hai, toh yeh indicate kar sakta hai ke buyers initially active thay lekin phir price mein decline hui.

Long Lower Shadow (Niche ki Lambi Shadow): Agar candle ki lower shadow lambi hai, toh yeh suggest kar sakta hai ke sellers initially control mein thay lekin phir price mein increase hui.

Small Body: Long shadow candles ke bodies choti hoti hain, jo show karti hai ke opening price aur closing price mein kam farq tha.

Reversal Signal: Long shadow candles reversal signals bhi ho sakti hain, matlab ke market direction mein change hone ka indication ho sakta hai.

Yeh rules general hain aur har situation unique hoti hai, isliye ek comprehensive analysis ke liye doosre technical indicators aur market conditions bhi consider karna important hai.

Long shadow candles ka tajzia market ke mood aur potential reversals ko samajhne mein madadgar ho sakta hai. Yeh kuch tajaweezat provide kar sakte hain:

Price Reversal Indication: Agar long upper shadow hai, toh yeh suggest kar sakta hai ke market mein initial buying tha, lekin phir price mein decline hui. Long lower shadow ke case mein, initial selling ke baad price mein recovery ho sakti hai.

Market Sentiment: Long shadow candles market sentiment ko reflect kar sakti hain. For example, agar long upper shadow ke sath market mein selling pressure dikhe, toh yeh bearish sentiment ko indicate kar sakta hai.

Support/Resistance Levels: Long shadow candles ke positions, especially jab woh near support ya resistance levels hote hain, indicate kar sakte hain ke market mein kis tarah ka reaction ho sakta hai.

Confirmation with Other Indicators: Long shadow candles ka analysis doosre technical indicators ke sath combine karke karna important hai. Isse aapko confirmatory signals mil sakte hain.Yeh sab tajziaat market analysis ke ek hisse hain, lekin yaad rahe ke kisi bhi indicator ki 100% guarantee nahi hoti. Always risk management aur doosre analysis tools ka bhi istemal karein.

Long shadow candles ko interpret karne ke liye kuch general rules hote hain:

Long Upper Shadow (Upar ki Lambi Shadow): Agar candle ki upper shadow lambi hai, toh yeh indicate kar sakta hai ke buyers initially active thay lekin phir price mein decline hui.

Long Lower Shadow (Niche ki Lambi Shadow): Agar candle ki lower shadow lambi hai, toh yeh suggest kar sakta hai ke sellers initially control mein thay lekin phir price mein increase hui.

Small Body: Long shadow candles ke bodies choti hoti hain, jo show karti hai ke opening price aur closing price mein kam farq tha.

Reversal Signal: Long shadow candles reversal signals bhi ho sakti hain, matlab ke market direction mein change hone ka indication ho sakta hai.

Yeh rules general hain aur har situation unique hoti hai, isliye ek comprehensive analysis ke liye doosre technical indicators aur market conditions bhi consider karna important hai.

Long shadow candles ka tajzia market ke mood aur potential reversals ko samajhne mein madadgar ho sakta hai. Yeh kuch tajaweezat provide kar sakte hain:

Price Reversal Indication: Agar long upper shadow hai, toh yeh suggest kar sakta hai ke market mein initial buying tha, lekin phir price mein decline hui. Long lower shadow ke case mein, initial selling ke baad price mein recovery ho sakti hai.

Market Sentiment: Long shadow candles market sentiment ko reflect kar sakti hain. For example, agar long upper shadow ke sath market mein selling pressure dikhe, toh yeh bearish sentiment ko indicate kar sakta hai.

Support/Resistance Levels: Long shadow candles ke positions, especially jab woh near support ya resistance levels hote hain, indicate kar sakte hain ke market mein kis tarah ka reaction ho sakta hai.

Confirmation with Other Indicators: Long shadow candles ka analysis doosre technical indicators ke sath combine karke karna important hai. Isse aapko confirmatory signals mil sakte hain.Yeh sab tajziaat market analysis ke ek hisse hain, lekin yaad rahe ke kisi bhi indicator ki 100% guarantee nahi hoti. Always risk management aur doosre analysis tools ka bhi istemal karein.

تبصرہ

Расширенный режим Обычный режим