?Long Shadow Candlestick

The "long shadow candlestick" ek ahem pattern hai jise technical analysis mein istemal kiya jata hai, jise aam taur par traders istemal karte hain taake woh maaliyat ke markets mein keemat ke harkaton ko samajh sakein. Ye candlestick pattern market ki jazbat aur mumkin trend reversals ke bare mein malumat farahem karta hai.

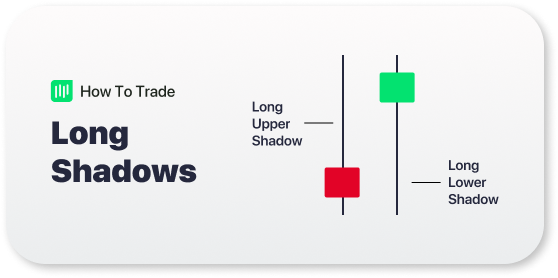

Candlestick chart apne asal mein kisi asset ki keemat ke harkat ko darust karta hai ek makhsoos waqt mein. Har candlestick mein aik jism aur do lambi chhatiyon, jo ke shadows ke naam se bhi jaani jati hain, shamil hoti hain. Jism opening aur closing keemat ko darust karta hai, jabke chhatiyan waqt ke diye gaye douran hone wali buland aur kam keemat ko darust karti hain.

Long shadow candlestick ko lambi upper ya lower chhati ke saath paish kia jata hai, jisse zyada keemat ki hilchul hoti hai. Ye lambi chhati ishara karta hai ke market ne session ke enteha ya nichayi par bare paimane par qeemat ka inkaar kia. Traders aksar in patterns ko mumkin trend reversals ya continuation ke signals ke tor par samajhte hain.

Jab lambi upper shadow maujood hoti hai, toh is ka matlab hai ke bechne walay ne session ke douran qeemat ko buland karnay ki koshish ki, lekin aakhir mein kharidne walay ne ye buland qeemat ko inkaar kar dia. Ye inkaar bearish reversal ke ishara ho sakta hai, jo ke market ki jazbat ko negative hone ki taraf ishara karta hai. Umadwari, lambi lower shadow ye ishara karti hai ke kharidne walay ne qeemat ko kam karnay ki koshish ki, lekin bechne walay ne is inkaar kar dia. Ye manzar ek bullish reversal ki taraf ishara kar sakta hai.

Ye zaroori hai ke in long shadow candlesticks ke paish hone wale context ko mad-e-nazar rakha jaye. Misal ke tor par, agar lambi upper shadow ek lambay uptrend ke baad aaye, toh ye bearish momentum ki kamzori aur ek possible trend reversal ka ishara ho sakta hai. Dusri taraf, agar lambi lower shadow ek lambe downtrend ke baad aaye, toh ye bearish pressure mein kami aur ek mumkin uptrend ki taraf ishara kar sakta hai.

Traders aksar long shadow candlesticks ke signals ko tasdeeq karne ke liye mazeed technical indicators aur chart patterns ka istemal karte hain. Moving averages, support aur resistance levels, aur doosre technical tools market ki overall sehat aur mumkin mustaqbil ke harkaton ke baray mein mazeed malumat farahem kar sakte hain.

"Hammer" ya "shooting star" pattern ek variation hai long shadow candlestick ka. Hammer mein candlestick ke ooper ek chhota jism hota hai, lambi lower shadow ke saath, jo ek possible bullish reversal ka ishara karta hai. Ulta, shooting star mein candlestick ke neeche ek chhota jism hota hai, lambi upper shadow ke saath, jo ek mumkin bearish reversal ko darust karta hai.

Akhiri mein, long shadow candlesticks ke asarat ko samajhna traders ke liye ahem hai jo maaliyat ke markets mein sahi faislay lene ki koshish kar rahe hain. Ye patterns market ki jazbat, mumkin reversals, aur trend continuation ke bare mein qeemati malumat farahem karte hain. Lekin, inhe doosre technical analysis tools ke saath istemal karna bhi zaroori hai taake market ke dynamics ka mukammal tasawwur mil sake.

The "long shadow candlestick" ek ahem pattern hai jise technical analysis mein istemal kiya jata hai, jise aam taur par traders istemal karte hain taake woh maaliyat ke markets mein keemat ke harkaton ko samajh sakein. Ye candlestick pattern market ki jazbat aur mumkin trend reversals ke bare mein malumat farahem karta hai.

Candlestick chart apne asal mein kisi asset ki keemat ke harkat ko darust karta hai ek makhsoos waqt mein. Har candlestick mein aik jism aur do lambi chhatiyon, jo ke shadows ke naam se bhi jaani jati hain, shamil hoti hain. Jism opening aur closing keemat ko darust karta hai, jabke chhatiyan waqt ke diye gaye douran hone wali buland aur kam keemat ko darust karti hain.

Long shadow candlestick ko lambi upper ya lower chhati ke saath paish kia jata hai, jisse zyada keemat ki hilchul hoti hai. Ye lambi chhati ishara karta hai ke market ne session ke enteha ya nichayi par bare paimane par qeemat ka inkaar kia. Traders aksar in patterns ko mumkin trend reversals ya continuation ke signals ke tor par samajhte hain.

Jab lambi upper shadow maujood hoti hai, toh is ka matlab hai ke bechne walay ne session ke douran qeemat ko buland karnay ki koshish ki, lekin aakhir mein kharidne walay ne ye buland qeemat ko inkaar kar dia. Ye inkaar bearish reversal ke ishara ho sakta hai, jo ke market ki jazbat ko negative hone ki taraf ishara karta hai. Umadwari, lambi lower shadow ye ishara karti hai ke kharidne walay ne qeemat ko kam karnay ki koshish ki, lekin bechne walay ne is inkaar kar dia. Ye manzar ek bullish reversal ki taraf ishara kar sakta hai.

Ye zaroori hai ke in long shadow candlesticks ke paish hone wale context ko mad-e-nazar rakha jaye. Misal ke tor par, agar lambi upper shadow ek lambay uptrend ke baad aaye, toh ye bearish momentum ki kamzori aur ek possible trend reversal ka ishara ho sakta hai. Dusri taraf, agar lambi lower shadow ek lambe downtrend ke baad aaye, toh ye bearish pressure mein kami aur ek mumkin uptrend ki taraf ishara kar sakta hai.

Traders aksar long shadow candlesticks ke signals ko tasdeeq karne ke liye mazeed technical indicators aur chart patterns ka istemal karte hain. Moving averages, support aur resistance levels, aur doosre technical tools market ki overall sehat aur mumkin mustaqbil ke harkaton ke baray mein mazeed malumat farahem kar sakte hain.

"Hammer" ya "shooting star" pattern ek variation hai long shadow candlestick ka. Hammer mein candlestick ke ooper ek chhota jism hota hai, lambi lower shadow ke saath, jo ek possible bullish reversal ka ishara karta hai. Ulta, shooting star mein candlestick ke neeche ek chhota jism hota hai, lambi upper shadow ke saath, jo ek mumkin bearish reversal ko darust karta hai.

Akhiri mein, long shadow candlesticks ke asarat ko samajhna traders ke liye ahem hai jo maaliyat ke markets mein sahi faislay lene ki koshish kar rahe hain. Ye patterns market ki jazbat, mumkin reversals, aur trend continuation ke bare mein qeemati malumat farahem karte hain. Lekin, inhe doosre technical analysis tools ke saath istemal karna bhi zaroori hai taake market ke dynamics ka mukammal tasawwur mil sake.

تبصرہ

Расширенный режим Обычный режим