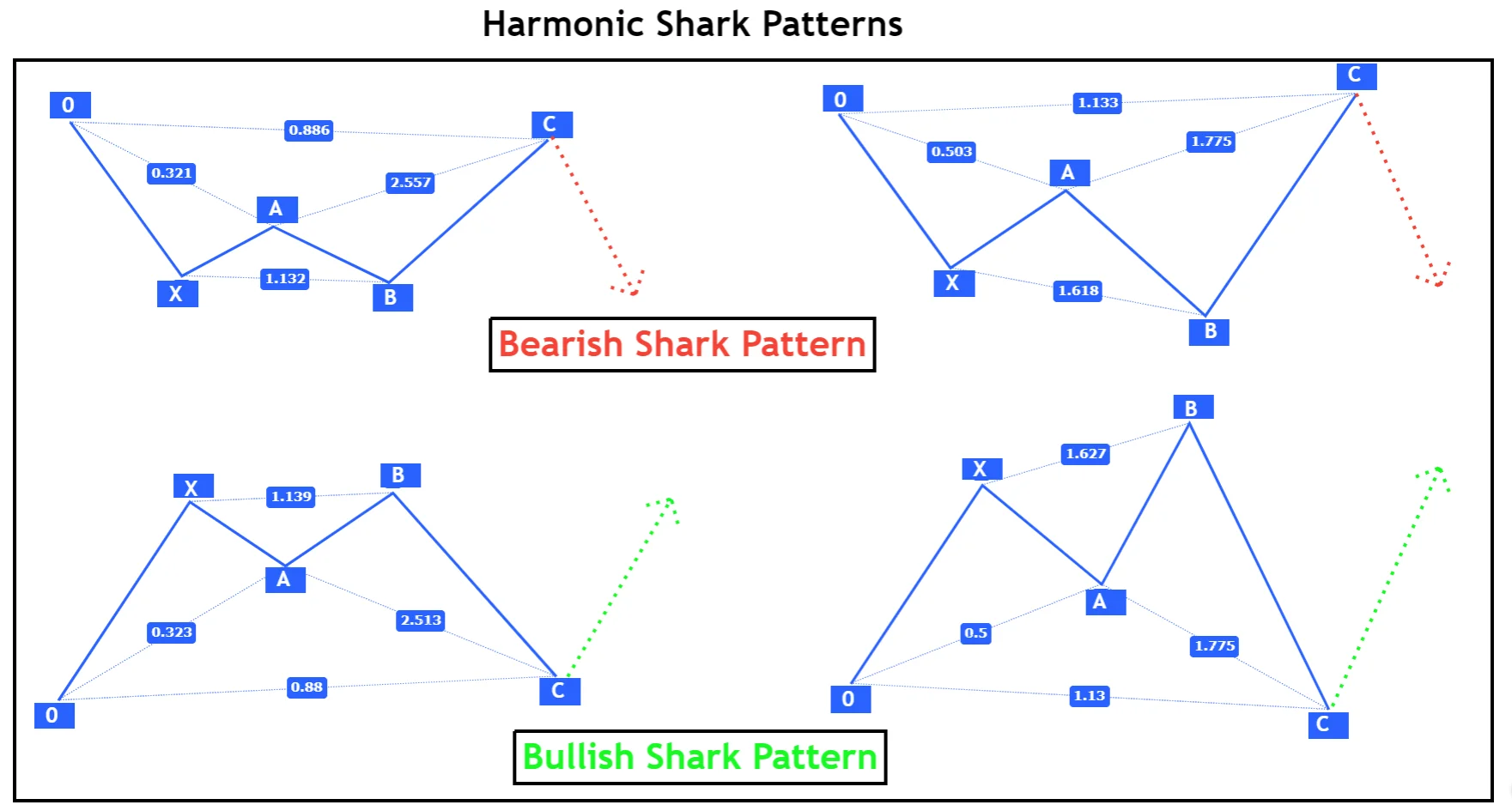

Shark Chart Pattern" ek technical analysis term hai jo market charts mein paya jata hai. Yeh pattern market mein potential trend reversal ko represent karta hai. Shark pattern Fibonacci retracement levels ka istemal karta hai. Is pattern mein kuch specific points hote hain jo market ke movements ko darust karte hain.Shark pattern ka basic structure kuch is tarah hota hai:

XA Leg:

Yeh market ka initial move hota hai, either up or down.

AB Leg:

Yeh retracement hota hai, jo XA leg ke against hota hai.

BC Leg:

Yeh move AB leg ke opposite direction mein hota hai aur Fibonacci retracement levels ko touch karta hai.

CD Leg:

Yeh leg market ke original direction mein hota hai aur Fibonacci extension levels ko touch karta hai.Shark pattern ek specific ratio, usually 0.886, ka istemal karta hai Fibonacci retracement aur extension levels ke liye.

Yeh pattern traders ko market movements ka pattern samajhne mein madad karta hai, aur woh is information ka istemal karke trend reversals ka pata lagane aur sahi trading decisions lene mein kaam karte hain. Keep in mind that technical analysis patterns, including the Shark pattern, should be used along with other indicators and analysis tools for more comprehensive decision-making.

Shark Chart Pattern ka istemal traders aur investors ke liye ahmiyat ka hamil hota hai, kyun ke isse market trends aur possible reversals ko identify karna mumkin hota hai. Yahan kuch points hain jo Shark Chart Pattern ki ahmiyat ko darust karte hain:

Trend Reversals Ka Pata Lagana:

Shark pattern, market mein hone wale trend reversals ko detect karne mein madad karta hai. Jab XA, AB, BC, aur CD legs ke specific ratios aur levels ko observe kiya jata hai, toh yeh indicate karta hai ke market mein trend reversal hone ka chance hai.

Fibonacci Levels Ka Istemal:

Shark pattern Fibonacci retracement aur extension levels ka istemal karta hai. Yeh levels market ke natural movements ko represent karte hain, aur isse traders ko potential entry aur exit points ka pata lagane mein madad milti hai.

Risk aur Reward Ka Balance:

Traders Shark pattern ka istemal karke apne trades ka risk aur reward ka balance karte hain. Pattern ke diye gaye levels par based trading decisions lene se, traders apne trades ko manage kar sakte hain aur sahi samay par entry aur exit kar sakte hain.

Technical Analysis Ka Hissa:

Shark pattern, technical analysis ka ek hissa hai jise traders market trends aur

تبصرہ

Расширенный режим Обычный режим