ASalam O Alaikum Dears

What is shark Chart Pattern

Introduction

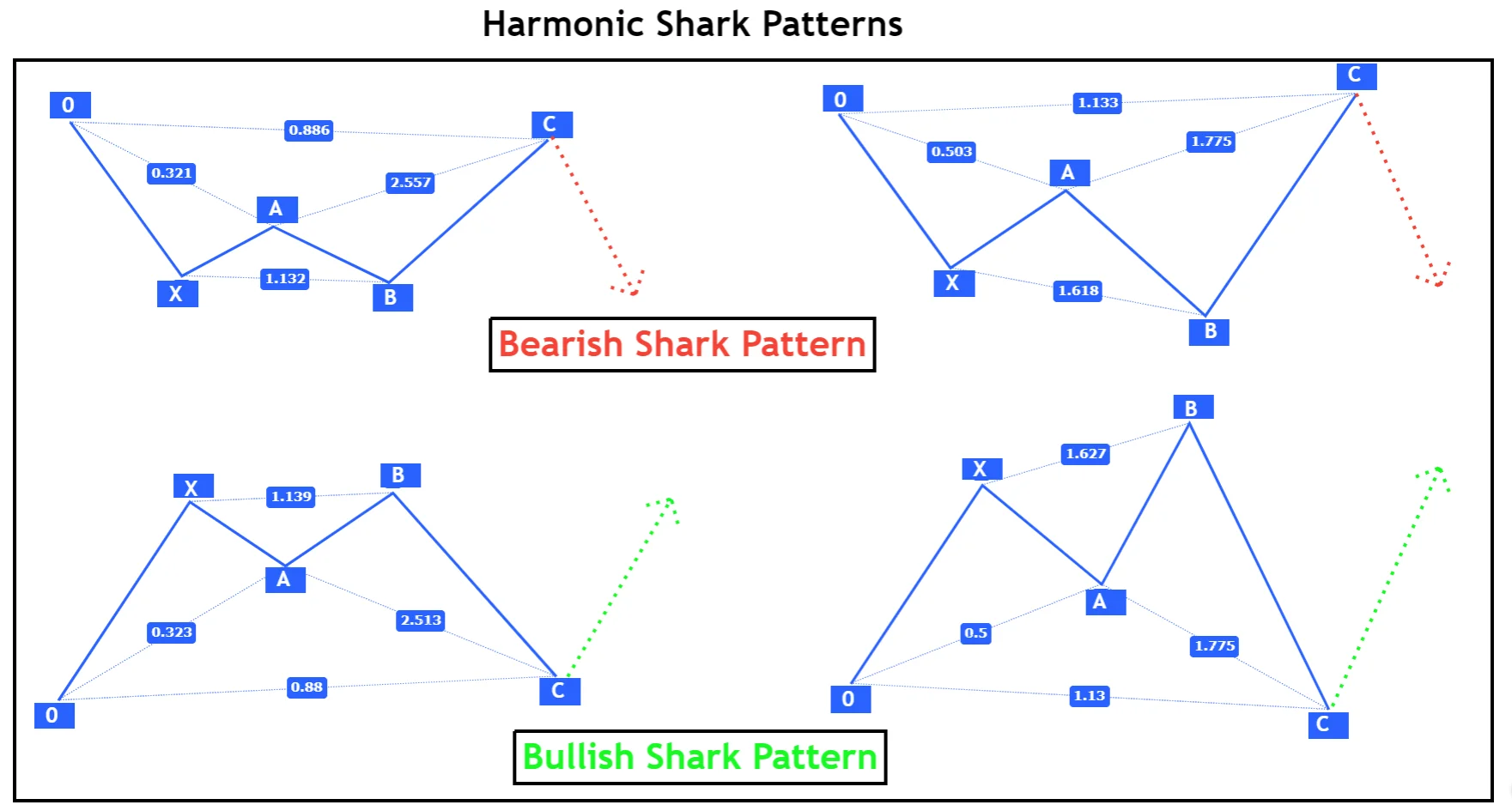

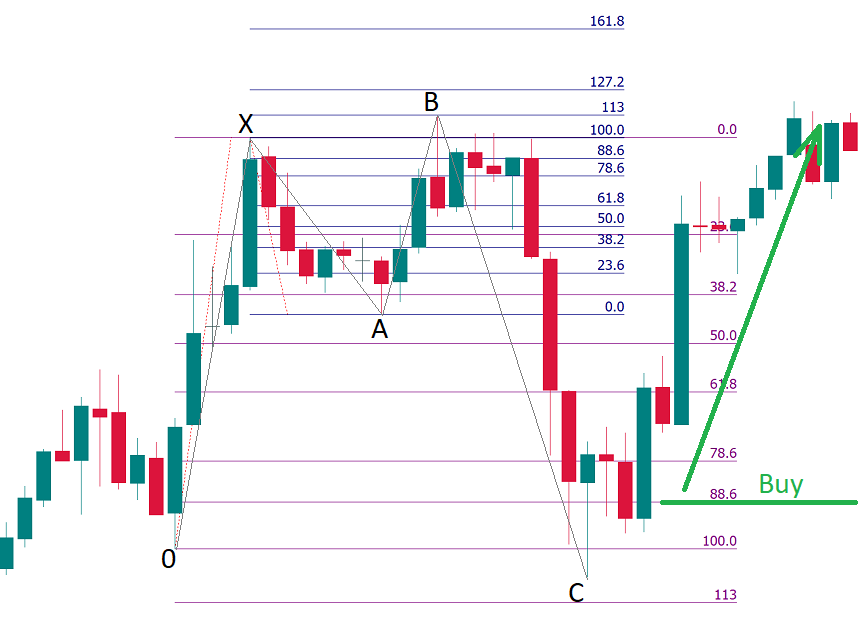

Yeh pattern market ke trend ko identify karne mein madad karta hai aur traders ko potential price reversal ke bare mein hint deta hai. Shark pattern ek complex pattern hai jo Fibonacci retracement levels par based hota hai.

Shark pattern ki pehchaan chart par specific points par hone wale price movements ke zariye ki jaati hai. Is pattern mein kuch key points hote hain jo traders ko market ke future movements ke bare mein anumaan lagaane mein madad karte hain.

Points

1. **XA Leg:**

Pehla leg, yaani XA leg, initial price movement ko represent karta hai. Is leg mein price ka sudden increase hota hai.

2. **AB Leg:**

Dusra leg, yaani AB leg, XA leg ke opposite direction mein hota hai. Isme price mein decline hota hai.

3. **BC Leg:**

Tisra leg, yaani BC leg, AB leg ke opposite direction mein hota hai. Isme bhi price mein decline hota hai, lekin AB leg se kam intensity ke saath.

4. **CD Leg:**

Choutha leg, yaani CD leg, BC leg ke opposite direction mein hota hai. Isme price mein phir se increase hota hai.

5. **Point D:**

Yeh point CD leg ke end point ko represent karta hai. Is point par price mein phir se reversal hota hai.

Importance of Shark chart pattern in Trading

Shark pattern ka main aim hota hai market ke reversal ko predict karna. Jab traders ko lagta hai ke market ek certain trend follow kar raha hai aur ab us trend mein reversal hone wala hai, toh woh shark pattern ka istemal karte hain.

Fibonacci retracement levels shark pattern mein bhi important role play karte hain. In levels ki madad se traders determine karte hain ke price kis level tak gir sakta hai aur phir se kis level tak rise kar sakta hai.

How To Use The Shark Chart Pattern In Trading

Shark pattern ka istemal karne ke liye traders ko technical analysis ke concepts ko acche se samajhna zaroori hai. Is pattern ki complexity ke chalte, beginners ko isey samajhne mein thoda waqt lag sakta hai.

Yeh pattern market volatility ke liye bhi sensitive hota hai. Agar market mein sudden changes hote hain, toh shark pattern ki accuracy mein farq aa sakta hai.

Is pattern ka istemal karte waqt traders ko hamesha market ke overall conditions ko bhi madhyan mein rakhna chahiye. Kuch aur indicators aur tools ka bhi sahayog liya ja sakta hai shark pattern ke saath for a more comprehensive analysis.

Summary

shark chart pattern ek advanced level ka technical analysis tool hai jo traders ko market ke reversal points ko identify karne mein madad karta hai. Is pattern ka istemal karne se pehle, traders ko market ke dynamics aur technical analysis ke fundamental concepts ko acche se samajhna zaroori hai.

What is shark Chart Pattern

Introduction

Yeh pattern market ke trend ko identify karne mein madad karta hai aur traders ko potential price reversal ke bare mein hint deta hai. Shark pattern ek complex pattern hai jo Fibonacci retracement levels par based hota hai.

Shark pattern ki pehchaan chart par specific points par hone wale price movements ke zariye ki jaati hai. Is pattern mein kuch key points hote hain jo traders ko market ke future movements ke bare mein anumaan lagaane mein madad karte hain.

Points

1. **XA Leg:**

Pehla leg, yaani XA leg, initial price movement ko represent karta hai. Is leg mein price ka sudden increase hota hai.

2. **AB Leg:**

Dusra leg, yaani AB leg, XA leg ke opposite direction mein hota hai. Isme price mein decline hota hai.

3. **BC Leg:**

Tisra leg, yaani BC leg, AB leg ke opposite direction mein hota hai. Isme bhi price mein decline hota hai, lekin AB leg se kam intensity ke saath.

4. **CD Leg:**

Choutha leg, yaani CD leg, BC leg ke opposite direction mein hota hai. Isme price mein phir se increase hota hai.

5. **Point D:**

Yeh point CD leg ke end point ko represent karta hai. Is point par price mein phir se reversal hota hai.

Importance of Shark chart pattern in Trading

Shark pattern ka main aim hota hai market ke reversal ko predict karna. Jab traders ko lagta hai ke market ek certain trend follow kar raha hai aur ab us trend mein reversal hone wala hai, toh woh shark pattern ka istemal karte hain.

Fibonacci retracement levels shark pattern mein bhi important role play karte hain. In levels ki madad se traders determine karte hain ke price kis level tak gir sakta hai aur phir se kis level tak rise kar sakta hai.

How To Use The Shark Chart Pattern In Trading

Shark pattern ka istemal karne ke liye traders ko technical analysis ke concepts ko acche se samajhna zaroori hai. Is pattern ki complexity ke chalte, beginners ko isey samajhne mein thoda waqt lag sakta hai.

Yeh pattern market volatility ke liye bhi sensitive hota hai. Agar market mein sudden changes hote hain, toh shark pattern ki accuracy mein farq aa sakta hai.

Is pattern ka istemal karte waqt traders ko hamesha market ke overall conditions ko bhi madhyan mein rakhna chahiye. Kuch aur indicators aur tools ka bhi sahayog liya ja sakta hai shark pattern ke saath for a more comprehensive analysis.

Summary

shark chart pattern ek advanced level ka technical analysis tool hai jo traders ko market ke reversal points ko identify karne mein madad karta hai. Is pattern ka istemal karne se pehle, traders ko market ke dynamics aur technical analysis ke fundamental concepts ko acche se samajhna zaroori hai.

تبصرہ

Расширенный режим Обычный режим