Tweezer Bottom Double Candlestick kai hai

Tweezer Bottom Double Candlestick Pattern:

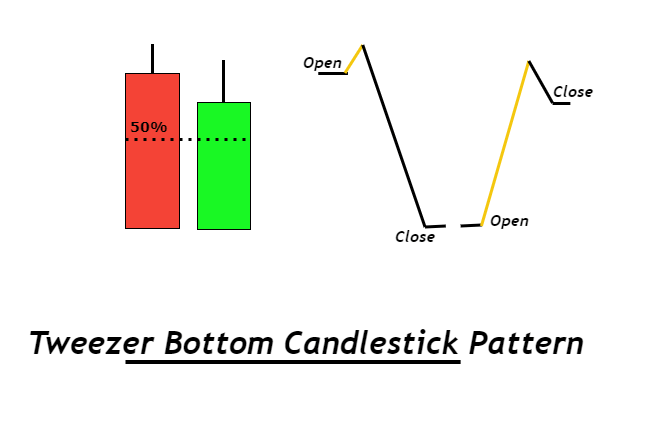

Tweezer Bottom ek bullish reversal candlestick pattern hai jo market mein potential trend change ko indicate karta hai. Yeh pattern downtrend ke baad aata hai aur bullish reversal ko suggest karta hai. Ismein do consecutive candles hote hain, jo ki neeche diye gaye hain:

- Pehla Candle (Bearish):

- Pehla candle downtrend ke dauran aata hai aur ek downward movement ko represent karta hai. Is candle ka closing price neeche hota hai.

- Dusra Candle (Bullish):

- Dusra candle bhi downtrend ke dauran aata hai, lekin iski opening price pehle candle ke closing price ke paas hoti hai ya use neeche hoti hai. Dusra candle bullish hota hai aur upward movement ko represent karta hai. Iski closing price pehle candle ke opening price ke paas ya usse upar hoti hai.

Key Characteristics of Tweezer Bottom:

- Consecutive Candles:

- Tweezer Bottom pattern mein do consecutive candles hote hain - pehla bearish aur doosra bullish.

- Equal or Near Equal Lows:

- Is pattern mein dono candles ke lows lagbhag barabar hote hain ya phir bahut karib hote hain, jise "equal lows" kehte hain.

- Bullish Reversal Signal:

- Tweezer Bottom pattern bullish reversal ko signal karta hai. Is pattern ke appearance ke baad traders expect karte hain ki market mein trend change hone ke chances hain aur prices mein upar ki taraf movement hone wala hai.

- Volume Confirmation:

- Trading decisions ko aur bhi strong banane ke liye, traders volume ko bhi confirm karte hain. Agar tweezer bottom pattern ke sath achhi trading volume dikhe, toh ye pattern aur bhi powerful ho jata hai.

Interpretation and Trading Strategies:

- Tweezer Bottom pattern ke appearance ke baad traders long positions le sakte hain, expecting ki bullish reversal hoga aur prices upar ki taraf jaayenge.

- Stop-loss orders ko tight rakha jata hai taki nuksan control mein rahe.

- Target levels ko set karte waqt, traders recent swing highs ya resistance levels ko consider karte hain.

Limitations of Tweezer Bottom:

- Jaise ki har technical pattern mein hota hai, tweezer bottom bhi false signals de sakta hai, isliye confirmation ke liye aur indicators ka istemal karna important hai.

- Market conditions, overall trend, aur doji candlestick ke characteristics ko bhi dhyan mein rakhna important hai.

Tweezer Bottom ek powerful reversal signal ho sakta hai, lekin traders ko hamesha apne trading plan aur risk management rules ko follow karna chahiye.

تبصرہ

Расширенный режим Обычный режим