Bullish Flag Pattern Kia Ha?

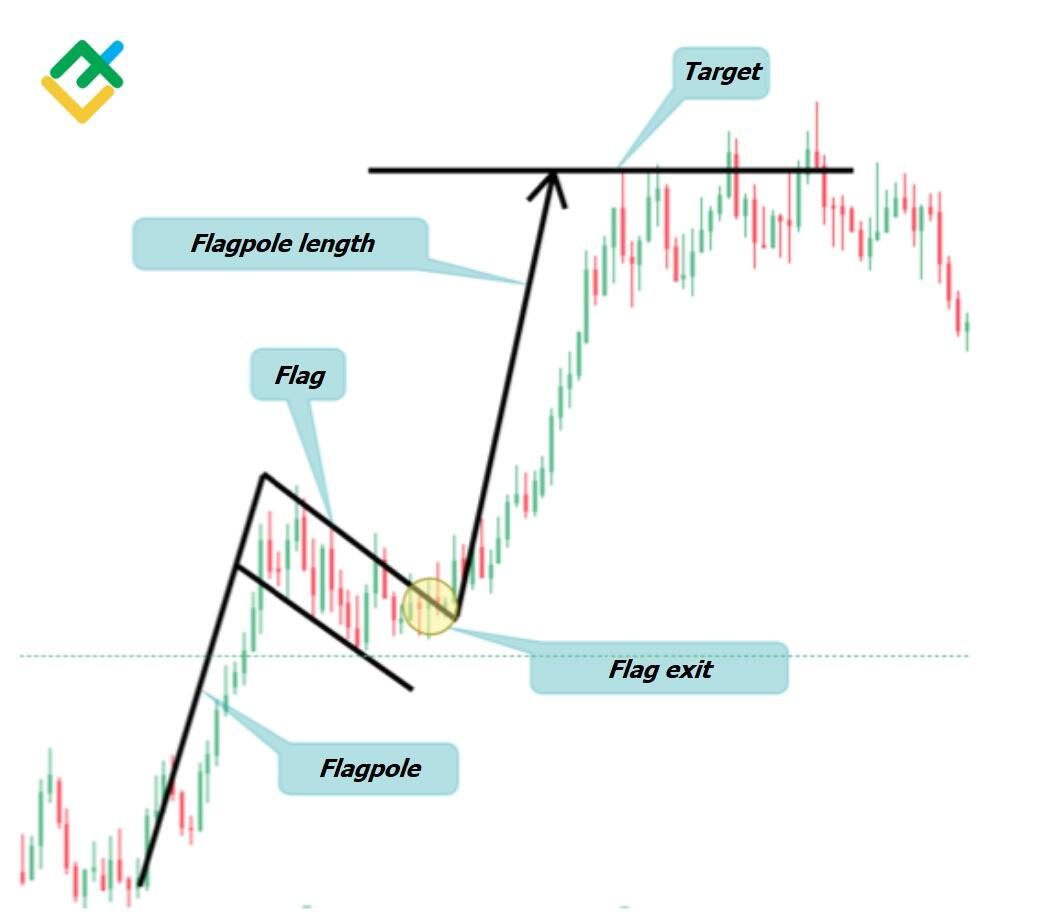

Bullish flag patterns strong uptrends wale forex market mein paye jate hain aur ye continuation patterns consider kiye jate hain. Inhe bull flags isliye kaha jata hai kyunki ye pattern ek pole par flag ki tarah dikhte hain. Pole forex market ki vertical rise ka result hota hai aur flag consolidation period ka result hota hai. Flag ek horizontal rectangle ho sakta hai lekin aksar prevailing trend se alag tarike se downward angled hota hai. Flag ka shape utna important nahi hai jitna pattern ke piche wali psychology hai. Basically, ek strong vertical rally ke bawajood forex market main appreciably drop nahi karta kyunki bulls har share ko acquire kar lete hain. Flag se breakout karne se often ek powerful move higher hota hai, jiska length previous flag pole ka measurement hota hai.

Bullish Flag Pattern Identify Karna:

Bullish flag pattern ko identify karne ke liye aap price chart par ghor se dekhey. Is pattern mein aap ko do cheezein dikhai dengi. Fist ek strong upward movement (pole) aur phir ek consolidation phase (flag). Flag usually ek sideways ya downward movement hota hai. Agar aapko price chart par aise pattern dikhte hain toh ye ek indication ho sakta hai ki forex market ka price phir se upward move karega.

Bullish Flag Pattern components:

Bullish flag kay 5 components hain.

1. Rising Flagpole:

Yeh ek uptrend line hai jo market ke price ki strong bullish direction ko illustrate karti hai. Isse "flagpole" component of the bull flag bhi kaha jata hai.

2. Flag:

Flag ek rectangular ya channel-shaped consolidation area hai jisme price narrow range mein move karta hai. Ye phase market ke bullish activity mein temporary pause ko signify karta hai.

3. Declining Support Level:

Yeh ek downtrending support level hai jo swing lows ko connect karta hai. Jab trader bull flag pattern trade karta hai, tab yeh line stop-loss place karne ke liye use hoti hai.

4. Declining Resistance Level:

Yeh bull flag ka downtrend resistance level hai jo swing highs ko connect karta hai. Jab price is level se break karke upar badhta hai, tab trader buy order place karta hai. Ye support trendline ke parallel trendline hai.

5. Price Breakout:

Price breakout component mein market price pattern ke resistance point se upar badhti hai, sath hi sath bullish volume bhi increase hota hai. Ye bullish flag pattern traders ke liye price entry point mark karta hai.

Bullish Flag Pattern breakout Identify:

Bullish flag pattern ka breakout identify karne ke liye aapko price chart ko dekhay. Breakout tab hota hai jab price flag pattern se bahar nikal jata hai aur ek strong upward movement shuru karta hai. Aap breakout ko identify karne ke liye flag pattern ke upper resistance level ko dekheyen. Agar price us level ko cross karke upar badhta hai, toh ye breakout ki indication ho sakti hai.

Bullish Flag Pattern Failure:

Bull flag pattern ko "failed bullish flag" ke naam se bhi jana jata hai ye tab hota hai jab bull flag toh ban jata hai magar price mein further higher movement nahi hota hai. Bull flag pattern invalidate ho jata hai aur fail ho jata hai jab asset price upar badhti hai aur breakout entry price se bahar nikal jati hai bullish movement mein, lekin jaldi se resistance area se neeche trend karke pattern ke support level se neeche bearish direction mein girti hai. Failed bull flag ek bearish signal hai.

Bullish Flage Pattern Example:

Agar forex market ka price uptrend mein ja raha hai. Fir price ek consolidation phase mein aata hai aur ek flag shape banata hai. Is flag ke andar price range limited hoti hai. Fir ek breakout hota hai aur price upar badhne lagta hai. Yeh breakout entry point hota hai. Jab price breakout ke baad upar badhkar flag pattern ke bahar nikal jata hai, tab traders ko buy signal milta hai. Yeh ek example hai jahan bull flag pattern dekhkar traders entry point aur price target decide kar sakte hain.

Bullish flag patterns strong uptrends wale forex market mein paye jate hain aur ye continuation patterns consider kiye jate hain. Inhe bull flags isliye kaha jata hai kyunki ye pattern ek pole par flag ki tarah dikhte hain. Pole forex market ki vertical rise ka result hota hai aur flag consolidation period ka result hota hai. Flag ek horizontal rectangle ho sakta hai lekin aksar prevailing trend se alag tarike se downward angled hota hai. Flag ka shape utna important nahi hai jitna pattern ke piche wali psychology hai. Basically, ek strong vertical rally ke bawajood forex market main appreciably drop nahi karta kyunki bulls har share ko acquire kar lete hain. Flag se breakout karne se often ek powerful move higher hota hai, jiska length previous flag pole ka measurement hota hai.

Bullish Flag Pattern Identify Karna:

Bullish flag pattern ko identify karne ke liye aap price chart par ghor se dekhey. Is pattern mein aap ko do cheezein dikhai dengi. Fist ek strong upward movement (pole) aur phir ek consolidation phase (flag). Flag usually ek sideways ya downward movement hota hai. Agar aapko price chart par aise pattern dikhte hain toh ye ek indication ho sakta hai ki forex market ka price phir se upward move karega.

Bullish Flag Pattern components:

Bullish flag kay 5 components hain.

1. Rising Flagpole:

Yeh ek uptrend line hai jo market ke price ki strong bullish direction ko illustrate karti hai. Isse "flagpole" component of the bull flag bhi kaha jata hai.

2. Flag:

Flag ek rectangular ya channel-shaped consolidation area hai jisme price narrow range mein move karta hai. Ye phase market ke bullish activity mein temporary pause ko signify karta hai.

3. Declining Support Level:

Yeh ek downtrending support level hai jo swing lows ko connect karta hai. Jab trader bull flag pattern trade karta hai, tab yeh line stop-loss place karne ke liye use hoti hai.

4. Declining Resistance Level:

Yeh bull flag ka downtrend resistance level hai jo swing highs ko connect karta hai. Jab price is level se break karke upar badhta hai, tab trader buy order place karta hai. Ye support trendline ke parallel trendline hai.

5. Price Breakout:

Price breakout component mein market price pattern ke resistance point se upar badhti hai, sath hi sath bullish volume bhi increase hota hai. Ye bullish flag pattern traders ke liye price entry point mark karta hai.

Bullish Flag Pattern breakout Identify:

Bullish flag pattern ka breakout identify karne ke liye aapko price chart ko dekhay. Breakout tab hota hai jab price flag pattern se bahar nikal jata hai aur ek strong upward movement shuru karta hai. Aap breakout ko identify karne ke liye flag pattern ke upper resistance level ko dekheyen. Agar price us level ko cross karke upar badhta hai, toh ye breakout ki indication ho sakti hai.

Bullish Flag Pattern Failure:

Bull flag pattern ko "failed bullish flag" ke naam se bhi jana jata hai ye tab hota hai jab bull flag toh ban jata hai magar price mein further higher movement nahi hota hai. Bull flag pattern invalidate ho jata hai aur fail ho jata hai jab asset price upar badhti hai aur breakout entry price se bahar nikal jati hai bullish movement mein, lekin jaldi se resistance area se neeche trend karke pattern ke support level se neeche bearish direction mein girti hai. Failed bull flag ek bearish signal hai.

Bullish Flage Pattern Example:

Agar forex market ka price uptrend mein ja raha hai. Fir price ek consolidation phase mein aata hai aur ek flag shape banata hai. Is flag ke andar price range limited hoti hai. Fir ek breakout hota hai aur price upar badhne lagta hai. Yeh breakout entry point hota hai. Jab price breakout ke baad upar badhkar flag pattern ke bahar nikal jata hai, tab traders ko buy signal milta hai. Yeh ek example hai jahan bull flag pattern dekhkar traders entry point aur price target decide kar sakte hain.

تبصرہ

Расширенный режим Обычный режим