Pin Bar Candlestick pattern, forex trading mein ek significant reversal indicator hai jo traders ko market dynamics aur potential trend changes ke bare mein insights dene mein madad karta hai. Is pattern ka formation single candlestick par based hota hai aur iski pehchan market mein trend reversal hone ke signals ke liye ki jati hai. Pin Bar ko samajhne se pehle, candlestick charts aur unke basic elements par dhyan dena zaroori hai.

Pin Bar Candlestick Pattern Kya Hota Hai?

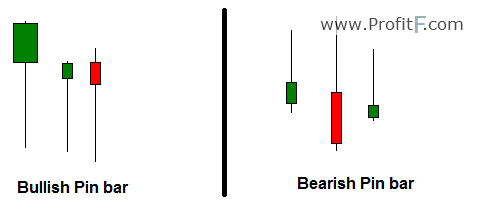

Pin Bar ek single candlestick pattern hai jo do distinctive parts se compose hota hai: ek small body aur ek long wick (ya shadow). Is pattern ko dekhne par lagta hai jaise ek pin ke head ke saath ho, isliye ise "Pin Bar" kehte hain.

Pin Bar Ki Key Characteristics:

Small Body: Pin Bar ka body chota hota hai, jo indicate karta hai ke opening aur closing prices mein kam farq hai.

Long Wick (Shadow): Is pattern ki sabse prominent feature hai uski lambi wick (shadow). Wicks ka length body se kai zyada hota hai, jo price ka significant rejection darust karta hai.

Small or No Wick on the Opposite Side: Pin Bar ke opposite side par wick chota hota hai ya bilkul nahi hota, jo ek strong rejection ko show karta hai.

Pin Bar Ki Types:

Bullish Pin Bar: Bullish Pin Bar market mein potential reversal ko indicate karta hai. Isme small bearish body hoti hai aur lambi upper wick hoti hai, jo ke neeche rejection darust karti hai.

Bearish Pin Bar: Bearish Pin Bar bhi market mein reversal ko indicate karta hai. Isme small bullish body hoti hai aur lambi lower wick hoti hai, jo ke upar rejection darust karti hai.

Pin Bar Ka Interpretation:

Reversal Signal:

Bullish Pin Bar market mein potential uptrend ka sign hai, jabki Bearish Pin Bar potential downtrend ka indication deta hai.

Yeh reversal signals hote hain jab market mein strong buying ya selling pressure ke baad price mein sudden change hota hai.

Price Rejection:

Pin Bar ki wick ki lambai, opposite side ke price levels ko reject karne ki intensity ko darust karti hai. Lambi wick neeche indicate karta hai ke sellers neeche wale price levels ko reject kar rahe hain aur vice versa.

Market Sentiment:

Bullish Pin Bar dekh kar traders samajh sakte hain ke buyers ne control liya hua hai aur potential uptrend shuru hone wala hai.

Bearish Pin Bar dekh kar traders samajh sakte hain ke sellers control mein hain aur potential downtrend shuru hone wala hai.

Pin Bar Trading Strategies:

Confirmation with Other Indicators:

Pin Bar signals ko confirm karne ke liye, traders doosre technical indicators ya price patterns ke saath combine kar sakte hain, jaise ke support/resistance levels, moving averages, ya trendlines.

Entry Points:

Bullish Pin Bar dekh kar traders long positions le sakte hain, jabki Bearish Pin Bar dekh kar short positions le sakte hain. Entry points ko confirm karne ke liye breakout ka wait kiya ja sakta hai.

Stop-Loss and Take-Profit Levels:

Stop-loss orders ko strategic levels par place karna important hai taki traders apne positions ko protect kar sakein.

Take-profit levels ko bhi set karna crucial hai. Yeh levels Pin Bar ki height ko consider karke tay kiye ja sakte hain.

Pin Bar Ka Dhyan Rakhein:

Context of the Market:

Pin Bar signals ko hamesha market context ke saath dekha jana chahiye. Agar market strong trend mein hai, toh Pin Bar signals ka impact kam ho sakta hai.

False Signals:

Market mein volatility ke dauran ya choppy conditions mein, Pin Bar signals false signals bhi generate kar sakta hai. Isliye confirmatory factors ka istemal zaroori hai.

Experience and Practice:

Pin Bar signals ka sahi taur par interpret karne ke liye experience aur practice ki zarurat hoti hai. Beginners ko demo accounts par isey samajhne mein waqt lag sakta hai.

Conclusion:

Pin Bar Candlestick pattern, forex trading mein ek powerful reversal indicator hai. Iska sahi taur par interpret karke, traders market trends ko samajh sakte hain aur informed trading decisions le sakte hain.

Pin Bar Candlestick Pattern Kya Hota Hai?

Pin Bar ek single candlestick pattern hai jo do distinctive parts se compose hota hai: ek small body aur ek long wick (ya shadow). Is pattern ko dekhne par lagta hai jaise ek pin ke head ke saath ho, isliye ise "Pin Bar" kehte hain.

Pin Bar Ki Key Characteristics:

Small Body: Pin Bar ka body chota hota hai, jo indicate karta hai ke opening aur closing prices mein kam farq hai.

Long Wick (Shadow): Is pattern ki sabse prominent feature hai uski lambi wick (shadow). Wicks ka length body se kai zyada hota hai, jo price ka significant rejection darust karta hai.

Small or No Wick on the Opposite Side: Pin Bar ke opposite side par wick chota hota hai ya bilkul nahi hota, jo ek strong rejection ko show karta hai.

Pin Bar Ki Types:

Bullish Pin Bar: Bullish Pin Bar market mein potential reversal ko indicate karta hai. Isme small bearish body hoti hai aur lambi upper wick hoti hai, jo ke neeche rejection darust karti hai.

Bearish Pin Bar: Bearish Pin Bar bhi market mein reversal ko indicate karta hai. Isme small bullish body hoti hai aur lambi lower wick hoti hai, jo ke upar rejection darust karti hai.

Pin Bar Ka Interpretation:

Reversal Signal:

Bullish Pin Bar market mein potential uptrend ka sign hai, jabki Bearish Pin Bar potential downtrend ka indication deta hai.

Yeh reversal signals hote hain jab market mein strong buying ya selling pressure ke baad price mein sudden change hota hai.

Price Rejection:

Pin Bar ki wick ki lambai, opposite side ke price levels ko reject karne ki intensity ko darust karti hai. Lambi wick neeche indicate karta hai ke sellers neeche wale price levels ko reject kar rahe hain aur vice versa.

Market Sentiment:

Bullish Pin Bar dekh kar traders samajh sakte hain ke buyers ne control liya hua hai aur potential uptrend shuru hone wala hai.

Bearish Pin Bar dekh kar traders samajh sakte hain ke sellers control mein hain aur potential downtrend shuru hone wala hai.

Pin Bar Trading Strategies:

Confirmation with Other Indicators:

Pin Bar signals ko confirm karne ke liye, traders doosre technical indicators ya price patterns ke saath combine kar sakte hain, jaise ke support/resistance levels, moving averages, ya trendlines.

Entry Points:

Bullish Pin Bar dekh kar traders long positions le sakte hain, jabki Bearish Pin Bar dekh kar short positions le sakte hain. Entry points ko confirm karne ke liye breakout ka wait kiya ja sakta hai.

Stop-Loss and Take-Profit Levels:

Stop-loss orders ko strategic levels par place karna important hai taki traders apne positions ko protect kar sakein.

Take-profit levels ko bhi set karna crucial hai. Yeh levels Pin Bar ki height ko consider karke tay kiye ja sakte hain.

Pin Bar Ka Dhyan Rakhein:

Context of the Market:

Pin Bar signals ko hamesha market context ke saath dekha jana chahiye. Agar market strong trend mein hai, toh Pin Bar signals ka impact kam ho sakta hai.

False Signals:

Market mein volatility ke dauran ya choppy conditions mein, Pin Bar signals false signals bhi generate kar sakta hai. Isliye confirmatory factors ka istemal zaroori hai.

Experience and Practice:

Pin Bar signals ka sahi taur par interpret karne ke liye experience aur practice ki zarurat hoti hai. Beginners ko demo accounts par isey samajhne mein waqt lag sakta hai.

Conclusion:

Pin Bar Candlestick pattern, forex trading mein ek powerful reversal indicator hai. Iska sahi taur par interpret karke, traders market trends ko samajh sakte hain aur informed trading decisions le sakte hain.

تبصرہ

Расширенный режим Обычный режим