Pin bar candlestick pattern kai hy

"Pin Bar" ya "Pinocchio Bar" ek popular candlestick pattern hai jo market mein trend reversal ya trend continuation ko indicate karta hai. Ye pattern ek single candlestick se bana hota hai aur traders ke liye significant information provide karta hai. Chaliye is pattern ko detail mein samajhte hain:

Pin Bar Candlestick Pattern ki Khasoosiyat:

- Formation (Banawat):

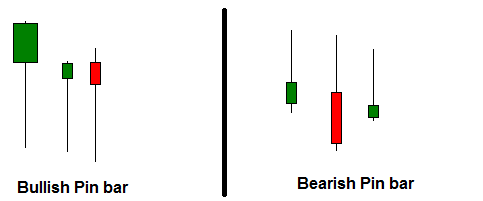

- Pin bar ek single candlestick pattern hai jo do main parts se milta hai: body aur wicks (ya shadows).

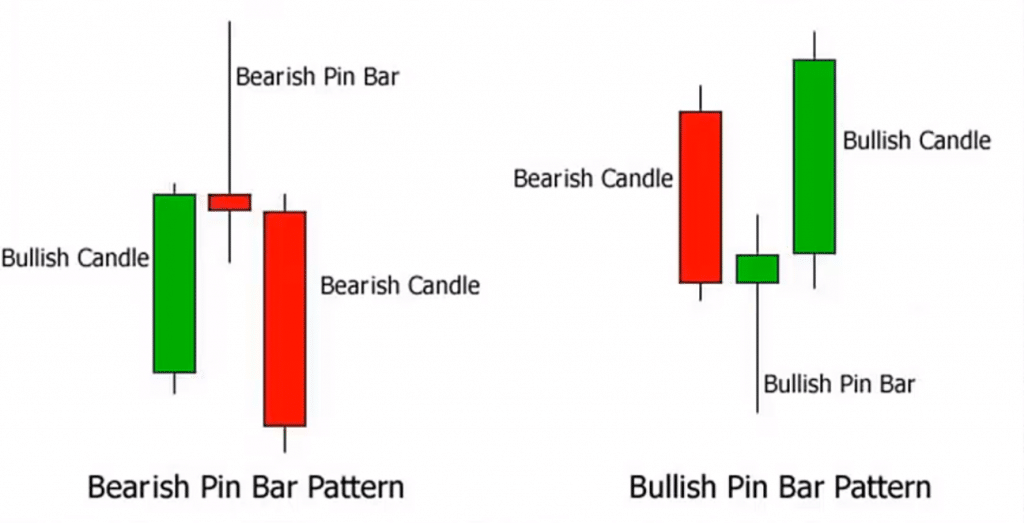

- Is pattern mein candle ki body chhoti hoti hai aur uski wicks lambe hoti hain. Body ke ek side par lambi wick hoti hai aur doosri side par chhoti wick hoti hai.

- Agar pin bar bullish reversal ke liye form hota hai, toh lambi wick candle ki bottom (neeche) hoti hai aur chhoti wick top (ooper) hoti hai. Agar pin bar bearish reversal ke liye form hota hai, toh lambi wick candle ki top hoti hai aur chhoti wick bottom hoti hai.

- Signal (Ishara):

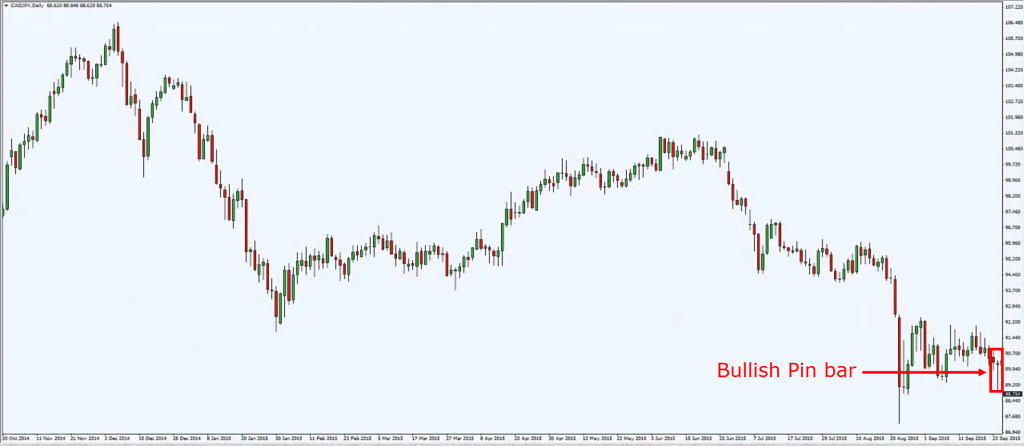

- Bullish pin bar (jab lambi wick neeche hoti hai) bullish reversal ko indicate karta hai aur bearish trend ke end ya reversal ko suggest karta hai.

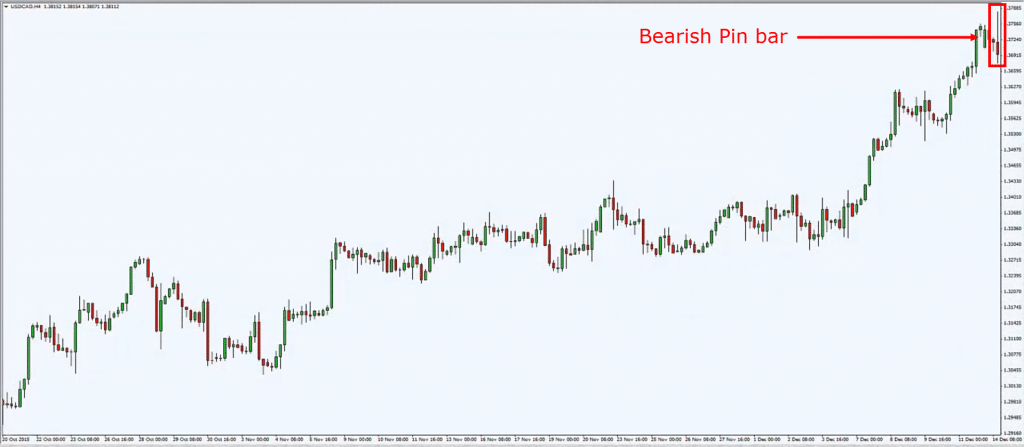

- Bearish pin bar (jab lambi wick ooper hoti hai) bearish reversal ko indicate karta hai aur bullish trend ke end ya reversal ko suggest karta hai.

- Pin bar ko confirm karne ke liye, traders doosre technical indicators ka istemal karte hain aur market context ko bhi dekhte hain.

- Volume Analysis (Mawad Tahlil):

- Pin bar ke saath volume analysis bhi important hai. Agar pin bar ke sath high volume hai, toh ye pattern ki authenticity ko badha sakta hai.

- Confirmation (Tasdeeq):

- Pin bar ko confirm karne ke liye, traders ko doosre technical indicators ka bhi istemal karna chahiye, jaise ki moving averages, RSI, ya MACD.

Pin Bar Candlestick Pattern Trading Guide:

- Identify the Pattern:

- Pehle toh traders ko pin bar pattern ko identify karna hota hai. Is pattern ko aasani se candlestick charts par dekha ja sakta hai.

- Wait for Confirmation:

- Pattern ko confirm karne ke liye, traders ko doosre technical indicators ka istemal karna chahiye aur market ke overall context ko bhi dekhna chahiye.

- Entry Point aur Stop Loss:

- Agar pin bar ko confirm kiya gaya hai, toh traders entry point par trade kar sakte hain, ideally wicks ke high ya low ke near.

- Stop loss order ko thayati tarah se set karna chahiye, jisse ki nuksan ka risk minimize ho sake.

- Target Setting:

- Target setting ke liye, traders previous support aur resistance levels ko dekh sakte hain, jahan price ko rukawat milti hai.

- Risk Management:

- Har trade mein risk management ka dhyan rakhna zaroori hai. Position size aur stop loss ka sahi istemal karna chahiye.

Pin bar ek powerful candlestick pattern hai jo traders ko potential trend reversals ya continuations ke bare mein important information deta hai. Lekin hamesha yaad rahe ke kisi bhi pattern ko trading decision mein istemal karte waqt, market context aur doosre factors ko bhi madde nazar rakhein.

تبصرہ

Расширенный режим Обычный режим