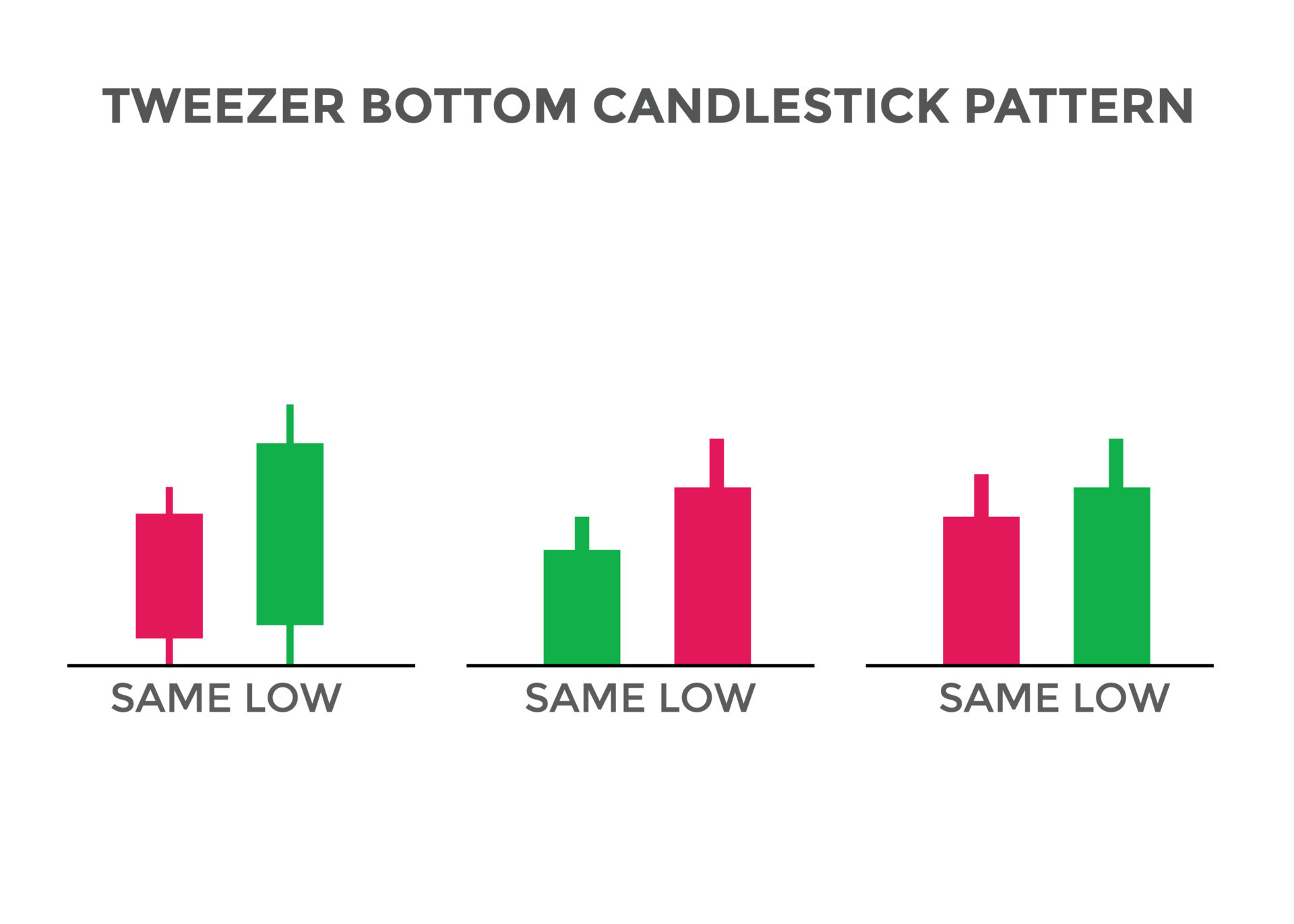

Formation and Definition of Tweezer bottom pattern :

Tweezer bottom pattern ek candlestick pattern hai jo ek downtrend ke ant mein hota hai aur bazaar ke ehsasat mein mukhtalif mawqe par mohabbat ke inteqal ka ishara deta hai. Is pattern ka jama hona do mared candlesticks se hota hai, jahan pehla candlestick ek bearish candlestick hota hai jo ek naya kam par hota hai aur doosra candlestick ek bullish candlestick hota hai jo pehle candlestick ke barabar kam par hota hai. Is tashkeel ka banawat tweezers ki shakl mein hota hai, is liye isay "tweezer bottom" kehte hain. Is pattern ka matlab hai ke bikro ko apni bikri dabane ki koshish tamam kar chuke hain aur khareedne wale control hasil kar rahe hain.

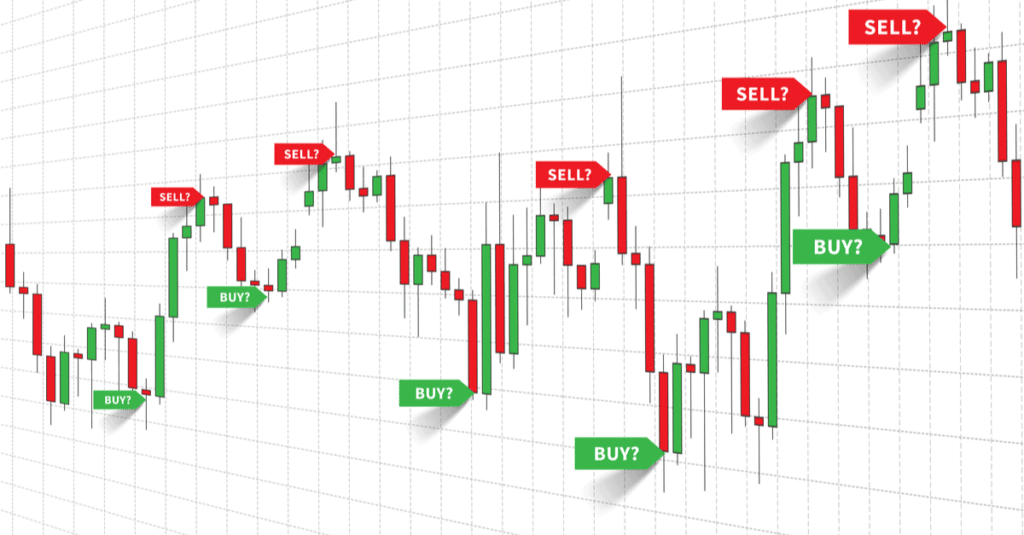

Tweezer bottom pattern ki tasdeeq ke liye, traders aksar mazeed signs ki talaash karte hain. Aik aam tasdeeq ka sign ziada volume wala bar ya eenhi tweezer bottom ke baad ek bullish candlestick pattern hota hai. Is se yeh samajhaya jata hai ke kharidari mein izafa hua hai aur mogheeb reversal ko mazeed support milraha hai. Traders bullish candlestick ke band hone par ya phir kisi bhi point par jahan par qeemat ka reverse honay ka ishara ho, long position le sakte hain.

Price Targets and Stop Losses in tweezer bottom pattern :

Tweezer bottom pattern ki trading karte waqt, risk ka control karne ke liye qeemat ke saaf hadaf aur stop-loss levels ka khayal rakhna ahem hai. Traders apna pahla profit hadaf moojoda swing high ya kisi ahem sarhad level par set kar sakte hain. Woh Fibonacci retracement levels ka bhi istemal karke qeemat ke hadaf tay kar sakte hain. Stop-loss, waise hi, tweezer bottom pattern ki kam se kam qeemat tak ya phir kisi moojoda swing low tak rakh sakte hain takay nuqsaan ka imkaan kam ho.

Trading Strategy for tweezer bottom pattern :

Tweezer bottom pattern ka aik maamooli trading strategy ye hai ke tasdeeq ke signs ka intezar karen aur tight stop loss ke sath long position le len. Traders tweezer bottom pattern ko mazeed imkaan ke liye dusre technical indicators ya chart patterns ke saath combine bhi kar sakte hain. For example, woh oscillators par bullish divergence ya hammer ya bullish engulfing pattern jaise bullish reversal patterns ko bhi dekh sakte hain.

Importance of Risk Management:

Jaise kisi bhi trading strategy mein, jab tweezer bottom pattern ko trade karte hain toh sahe risk management ka istemal karna bohat zaroori hai. Is mein sahi position size tay karna, stop-loss orders ka istemal karna aur leverage management karna shamil hai. Traders ko bazaar ke halaat aur mogheeb risks se bhi waqif hona chahiye jo pattern ko naqis kar sakte hain. Taaqatwar risk management techniques ka istemal karke, traders nuqsaan ka imkaan kam kar sakte hain aur apne overal trading results ko behtar bana sakte hain.

Tweezer bottom pattern ek candlestick pattern hai jo ek downtrend ke ant mein hota hai aur bazaar ke ehsasat mein mukhtalif mawqe par mohabbat ke inteqal ka ishara deta hai. Is pattern ka jama hona do mared candlesticks se hota hai, jahan pehla candlestick ek bearish candlestick hota hai jo ek naya kam par hota hai aur doosra candlestick ek bullish candlestick hota hai jo pehle candlestick ke barabar kam par hota hai. Is tashkeel ka banawat tweezers ki shakl mein hota hai, is liye isay "tweezer bottom" kehte hain. Is pattern ka matlab hai ke bikro ko apni bikri dabane ki koshish tamam kar chuke hain aur khareedne wale control hasil kar rahe hain.

Confirmation and Entry Signals in tweezer bottom pattern :Tweezer bottom pattern ki tasdeeq ke liye, traders aksar mazeed signs ki talaash karte hain. Aik aam tasdeeq ka sign ziada volume wala bar ya eenhi tweezer bottom ke baad ek bullish candlestick pattern hota hai. Is se yeh samajhaya jata hai ke kharidari mein izafa hua hai aur mogheeb reversal ko mazeed support milraha hai. Traders bullish candlestick ke band hone par ya phir kisi bhi point par jahan par qeemat ka reverse honay ka ishara ho, long position le sakte hain.

Price Targets and Stop Losses in tweezer bottom pattern :

Tweezer bottom pattern ki trading karte waqt, risk ka control karne ke liye qeemat ke saaf hadaf aur stop-loss levels ka khayal rakhna ahem hai. Traders apna pahla profit hadaf moojoda swing high ya kisi ahem sarhad level par set kar sakte hain. Woh Fibonacci retracement levels ka bhi istemal karke qeemat ke hadaf tay kar sakte hain. Stop-loss, waise hi, tweezer bottom pattern ki kam se kam qeemat tak ya phir kisi moojoda swing low tak rakh sakte hain takay nuqsaan ka imkaan kam ho.

Trading Strategy for tweezer bottom pattern :

Tweezer bottom pattern ka aik maamooli trading strategy ye hai ke tasdeeq ke signs ka intezar karen aur tight stop loss ke sath long position le len. Traders tweezer bottom pattern ko mazeed imkaan ke liye dusre technical indicators ya chart patterns ke saath combine bhi kar sakte hain. For example, woh oscillators par bullish divergence ya hammer ya bullish engulfing pattern jaise bullish reversal patterns ko bhi dekh sakte hain.

Importance of Risk Management:

Jaise kisi bhi trading strategy mein, jab tweezer bottom pattern ko trade karte hain toh sahe risk management ka istemal karna bohat zaroori hai. Is mein sahi position size tay karna, stop-loss orders ka istemal karna aur leverage management karna shamil hai. Traders ko bazaar ke halaat aur mogheeb risks se bhi waqif hona chahiye jo pattern ko naqis kar sakte hain. Taaqatwar risk management techniques ka istemal karke, traders nuqsaan ka imkaan kam kar sakte hain aur apne overal trading results ko behtar bana sakte hain.

تبصرہ

Расширенный режим Обычный режим