Rail Candlestick Pattern In Forex

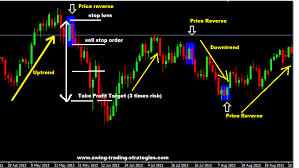

Rail candlestick pattern, forex trading mein ek important technical analysis tool hai jo traders ke liye trend reversal ke signals provide karta hai. Is pattern ko samajhne ke liye, pehle candlestick kaafi bullish ya bearish hota hai aur doosra candlestick iske range mein hota hai, lekin iska direction opposite hota hai.

Yeh pattern kuchh situations mein kaafi reliable hota hai, lekin hamesha ek confirmatory indicator ke saath istemal kiya jana chahiye. Aam taur par, traders doosre technical indicators jaise ki moving averages, RSI (Relative Strength Index), ya MACD (Moving Average Convergence Divergence) ka istemal karte hain, taake confirm karein ke trend reversal ka koi aur signal nahi hai.

Ek bullish rail pattern ko samajhne ke liye, pehla candlestick ki closing price open price se zyada hoti hai aur doosra candlestick iske range mein hota hai, lekin iska direction down ki taraf hota hai. Iska matlab hai ke pehla candlestick ke baad market mein buying pressure zyada hai, lekin doosre candlestick mein selling pressure aa gaya hai aur market mein bearish sentiment aane wali hai. Is situation mein traders ko long positions ko close karke ya short positions ko open karke profit kama sakte hain.

Ek bearish rail pattern ko samajhne ke liye, pehla candlestick ki closing price open price se kam hoti hai aur doosra candlestick iske range mein hota hai, lekin iska direction up ki taraf hota hai. Iska matlab hai ke pehla candlestick ke baad market mein selling pressure zyada hai, lekin doosre candlestick mein buying pressure aa gaya hai aur market mein bullish sentiment aane wali hai. Is situation mein traders ko short positions ko close karke ya long positions ko open karke profit kama sakte hain.

Rail pattern ka istemal karne se pehle, traders ko market conditions ko bhi consider karna zaroori hai, jaise ki trend direction, market volatility, aur news events. Iske alawa, stop loss aur take profit levels ka bhi tay karna important hai taake risk management maintain kiya ja sake. Overall, rail candlestick pattern ek powerful tool hai jo traders ko market trends ka pata lagane mein madad karta hai, lekin iska istemal karte waqt caution aur diligence ki zaroorat hoti hai.

Rail candlestick pattern, forex trading mein ek important technical analysis tool hai jo traders ke liye trend reversal ke signals provide karta hai. Is pattern ko samajhne ke liye, pehle candlestick kaafi bullish ya bearish hota hai aur doosra candlestick iske range mein hota hai, lekin iska direction opposite hota hai.

Yeh pattern kuchh situations mein kaafi reliable hota hai, lekin hamesha ek confirmatory indicator ke saath istemal kiya jana chahiye. Aam taur par, traders doosre technical indicators jaise ki moving averages, RSI (Relative Strength Index), ya MACD (Moving Average Convergence Divergence) ka istemal karte hain, taake confirm karein ke trend reversal ka koi aur signal nahi hai.

Ek bullish rail pattern ko samajhne ke liye, pehla candlestick ki closing price open price se zyada hoti hai aur doosra candlestick iske range mein hota hai, lekin iska direction down ki taraf hota hai. Iska matlab hai ke pehla candlestick ke baad market mein buying pressure zyada hai, lekin doosre candlestick mein selling pressure aa gaya hai aur market mein bearish sentiment aane wali hai. Is situation mein traders ko long positions ko close karke ya short positions ko open karke profit kama sakte hain.

Ek bearish rail pattern ko samajhne ke liye, pehla candlestick ki closing price open price se kam hoti hai aur doosra candlestick iske range mein hota hai, lekin iska direction up ki taraf hota hai. Iska matlab hai ke pehla candlestick ke baad market mein selling pressure zyada hai, lekin doosre candlestick mein buying pressure aa gaya hai aur market mein bullish sentiment aane wali hai. Is situation mein traders ko short positions ko close karke ya long positions ko open karke profit kama sakte hain.

Rail pattern ka istemal karne se pehle, traders ko market conditions ko bhi consider karna zaroori hai, jaise ki trend direction, market volatility, aur news events. Iske alawa, stop loss aur take profit levels ka bhi tay karna important hai taake risk management maintain kiya ja sake. Overall, rail candlestick pattern ek powerful tool hai jo traders ko market trends ka pata lagane mein madad karta hai, lekin iska istemal karte waqt caution aur diligence ki zaroorat hoti hai.

تبصرہ

Расширенный режим Обычный режим