Rising Wedge Chart Pattern kai hy

Rising Wedge Chart Pattern

Urooj Wala Wedge Chart Pattern ek bearish reversal pattern hai jo uptrend ke dauran dikhai deta hai. Ye pattern typically ek consolidation phase ke baad form hota hai aur downward price movement ko indicate karta hai. Is article mein hum Rising Wedge Chart Pattern ke roman Urdu mein tafseel se baat karenge.

Rising Wedge Chart Pattern Kya Hai?

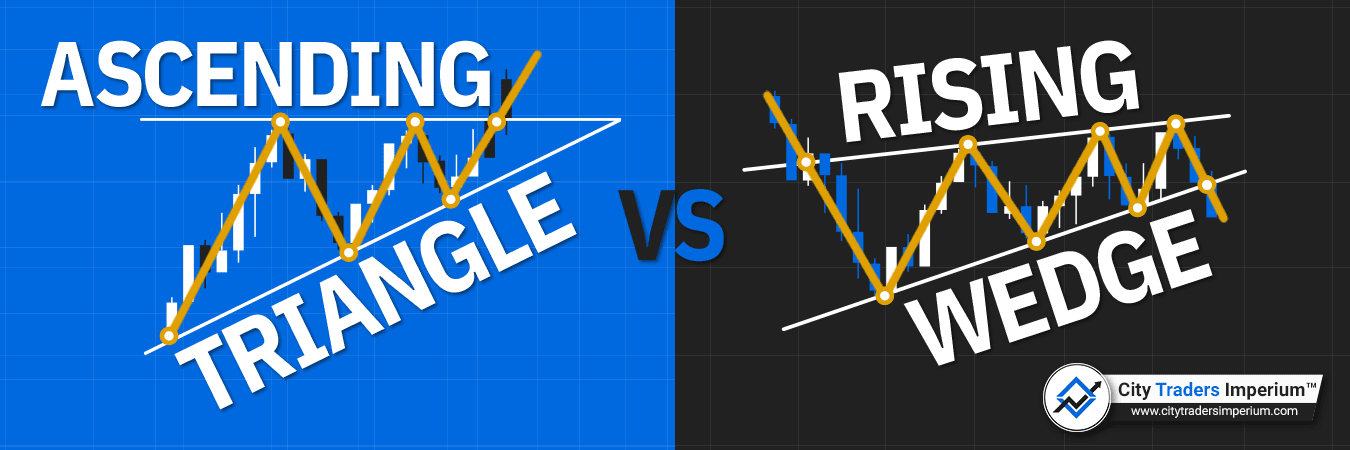

Rising Wedge Chart Pattern ek technical analysis tool hai jo traders ko potential trend reversals aur price movements ko anticipate karne mein madad karta hai. Is pattern mein price ek wedge ya triangle ke andar consolidate hoti hai, jahan price ke highs aur lows dono ek upward slope ke saath move karte hain.

Rising Wedge Chart Pattern Ke Khasiyat:

- Consolidation Phase: Rising Wedge pattern typically ek consolidation phase ke baad form hota hai, jab price ek range mein trade karta hai.

- Upward Sloping Trendlines: Pattern mein ek upper trendline aur lower trendline hote hain jo dono upward slope karte hain.

- Decreasing Volume: Rising Wedge pattern ke formation ke saath volume usually decrease hota hai, indicating ke market mein interest kamzor ho raha hai.

Rising Wedge Chart Pattern Ka Tafsili Jaiza:

- Market Context: Rising Wedge pattern ka tafsili jaiza karte waqt market context ko samajhna zaroori hai. Agar ye pattern uptrend ke dauran dikhai deta hai, to ye bearish reversal signal ke taur par samjha jata hai.

- Trendlines: Upper aur lower trendlines ko draw karke pattern ko confirm karna zaroori hai. Breakout ke baad, trendlines ko validate karna bhi zaroori hai.

- Volume: Rising Wedge pattern ke formation ke saath volume ka bhi analysis karna zaroori hai. Decreasing volume pattern ke validity ko aur zyada darust karta hai.

Rising Wedge Chart Pattern Ka Istemal:

- Entry Point: Agar Rising Wedge pattern break hota hai neeche ki taraf, traders short positions enter kar sakte hain.

- Stop Loss: Stop loss ko set karte waqt, traders upper trendline ke paar set kar sakte hain ya breakout ke neeche set kar sakte hain.

- Target Price: Target price ko set karte waqt, traders lower trendline ya support level ke qareeb set kar sakte hain.

Nateeja:

Rising Wedge Chart Pattern ek important bearish reversal pattern hai jo traders ko potential downward price movement ke baare mein suchit karta hai. Lekin, har ek trading decision ko carefully analyze karna zaroori hai aur risk management ko hamesha priority dena chahiye. Rising Wedge pattern ko confirm karne ke liye doosre technical tools ka istemal kiya jana chahiye aur trading strategy ko sahi tarah se implement kiya jana chahiye.

تبصرہ

Расширенный режим Обычный режим