INTRODUCTION TO THE HIGH TIGHT FLAG CHART PATTERN :

High Tight Flag Chart Pattern forex market mein paya jane wala aik powerful continuation pattern hai. Iska khasosiyat hai ke ismein pehle taiz aur tezi se price rally hoti hai, phir ek consolidation phase hoti hai, jis se flag ki tarah structure banti hai. Yeh pattern apni darusti aur saaf taqreban hone ki wajah se mashoor hai, jis se price movement ki direction ko consolidation period ke baad sahi tariqe se predict kiya ja sakta hai.

High Tight Flag Chart Pattern ke initial stage mein, aik significant price rally hoti hai, jisay amooman mazbut market sentiment aur ziada buying pressure ke wajah se taraqqi milti hai. Yeh rally pattern ka pole banati hai, jis mein prices tezi se ooncha chadte hain. Yeh pole buying aur selling pressure ke beech ki beech bhavna ka natija hai, jis se strong bullish sentiment market mein zahir hoti hai.

Rally ke baad, market consolidation phase mein jata hai, jahan prices pull back karte hain aur aik tight price channel ke andar range karte hain. Yeh consolidation pattern ka flag hissa banati hai, jise kam trading volumes aur kam volatility ki pehchan hoti hai. Flag aik price equilibrium period hai, jahan market lambi saans lete hue apni upward trend jari rakhti hai.

IDENTIFYING THE HIGH TIGHT FLAG CHART PATTERN :

High Tight Flag Chart Pattern ki pehchan ke liye, traders price chart mein kuch khasosiyat dekhte hain. Pehle toh, aik significant upward rally honi chahiye, jisay consolidation period follow karta hai. Yeh rally pattern ka pole banati hai. Consolidation phase tight aur well-defined price channel ki tarah hona chahiye, jisay pattern ka flag banata hai.

Pattern ko confirm karne ke liye, traders kuch technical indicators ka istemal kar sakte hain. Misal ke tor par, Relative Strength Index (RSI) price rally mein overbought conditions aur consolidation phase mein oversold conditions ko identify karne ke liye istemal kiya ja sakta hai. Iske alawa, volume analysis bhi helpful ho sakti hai, jabki consolidation phase mein trading volumes kam hojate hain.

TRADING THE HIGH TIGHT FLAG CHART PATTERN :

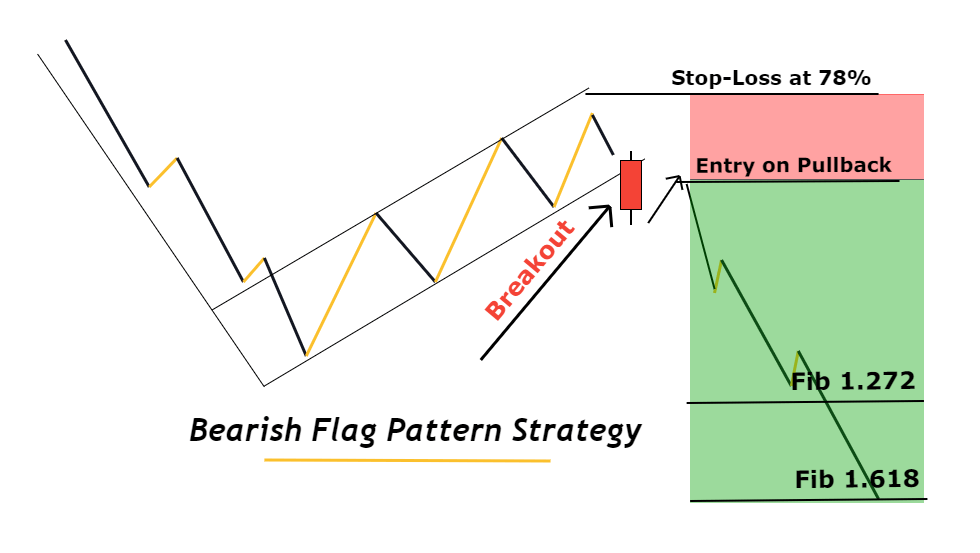

Traders High Tight Flag Chart Pattern ka istemal apni faiday ke liye kar sakte hain, pattern ke khasosiyat par based trading strategies banakar. Aik common approach yeh hoti hai ke breakout ki wait ki jaati hai consolidation phase se, aur phir continuation ki direction mein trade enter ki jati hai. Traders iss mein high of the flag ke upar buy order lagate hain ya low of the flag ke neechay sell order lagate hain, stop loss swing low ke neechay ya swing high ke upar lagaya jata hai.

Dusra trading strategy yeh hoti hai ke flag ke andar pullback ki wait ki jati hai aur phir trend ki direction mein trade enter kiya jata hai. Traders Fibonacci retracement levels ya moving averages ka istemal kar sakte hain, support ya resistance levels identify karne ke liye trade enter karne ke liye.

POTENTIAL PITFALLS AND CHALLENGES :

High Tight Flag Chart Pattern bahut effective ho sakti hai, lekin traders ko iss pattern ke saath judi mumkinati pareshaniyon aur challenges ke bare mein bhi pata hona chahiye. False breakouts aur whipsaws amooman hoti hain, khas kar bazaar ki volatility ke samay mein. Traders ko strict risk management techniques ko implement karna chahiye, jaise ki sahi stop losses aur position sizing ka istemal, taaki nuksan ki sambhavna ko kam kiya ja sake.

Iske saath hi bazaar ki hali aur dusre factors ko bhi ghor se dekhna zaroori hai, jinhone pattern ki kefiyat ko asar andaz karna hai. Khabar mulakaat, maali deta jaari hone aur siyasi masail bhi bazaar ki rawayat par asar andaaz kar saktay hain aur pattern ko batil kar saktay hain.

EXAMPLES OF THE HIGH TIGHT FLAG CHART PATTERN :

High Tight Flag Chart Pattern ko aur behtar samajhne ke liye, ek kalpanik udaaharan par chalte hain. Soch lijiye ek currency pair mein taiz tareen bhaari upswings hoti hai, jis mein keval chand dinon mein 200 pips upar jata hai. Iske baad bazaar consolidation phase mein dakhil hota hai aur ek 50 pips ki range mein flag banata hai. Kuch dino ki consolidation ke baad keemat flag se bahar nikal jati hai aur upar ki taraf jaari rehti hai, jis se 150 pips ka upswing hasil hota hai.

Ikhtetam mein, High Tight Flag Chart Pattern forex market mein taqatwar continuation pattern hai. Traders iss pattern ka istemal kar ke market mein maujood prevailing trend ki taraf trades ke liye mumkin maqaamat pehchan saktay hain. Pattern ke khasosiyat aur potenial masail ko samajh kar, traders apni trading strategies ko behtar banakar aur kamiyabi ke chances ko barha saktay hain.

High Tight Flag Chart Pattern forex market mein paya jane wala aik powerful continuation pattern hai. Iska khasosiyat hai ke ismein pehle taiz aur tezi se price rally hoti hai, phir ek consolidation phase hoti hai, jis se flag ki tarah structure banti hai. Yeh pattern apni darusti aur saaf taqreban hone ki wajah se mashoor hai, jis se price movement ki direction ko consolidation period ke baad sahi tariqe se predict kiya ja sakta hai.

High Tight Flag Chart Pattern ke initial stage mein, aik significant price rally hoti hai, jisay amooman mazbut market sentiment aur ziada buying pressure ke wajah se taraqqi milti hai. Yeh rally pattern ka pole banati hai, jis mein prices tezi se ooncha chadte hain. Yeh pole buying aur selling pressure ke beech ki beech bhavna ka natija hai, jis se strong bullish sentiment market mein zahir hoti hai.

Rally ke baad, market consolidation phase mein jata hai, jahan prices pull back karte hain aur aik tight price channel ke andar range karte hain. Yeh consolidation pattern ka flag hissa banati hai, jise kam trading volumes aur kam volatility ki pehchan hoti hai. Flag aik price equilibrium period hai, jahan market lambi saans lete hue apni upward trend jari rakhti hai.

IDENTIFYING THE HIGH TIGHT FLAG CHART PATTERN :

High Tight Flag Chart Pattern ki pehchan ke liye, traders price chart mein kuch khasosiyat dekhte hain. Pehle toh, aik significant upward rally honi chahiye, jisay consolidation period follow karta hai. Yeh rally pattern ka pole banati hai. Consolidation phase tight aur well-defined price channel ki tarah hona chahiye, jisay pattern ka flag banata hai.

Pattern ko confirm karne ke liye, traders kuch technical indicators ka istemal kar sakte hain. Misal ke tor par, Relative Strength Index (RSI) price rally mein overbought conditions aur consolidation phase mein oversold conditions ko identify karne ke liye istemal kiya ja sakta hai. Iske alawa, volume analysis bhi helpful ho sakti hai, jabki consolidation phase mein trading volumes kam hojate hain.

TRADING THE HIGH TIGHT FLAG CHART PATTERN :

Traders High Tight Flag Chart Pattern ka istemal apni faiday ke liye kar sakte hain, pattern ke khasosiyat par based trading strategies banakar. Aik common approach yeh hoti hai ke breakout ki wait ki jaati hai consolidation phase se, aur phir continuation ki direction mein trade enter ki jati hai. Traders iss mein high of the flag ke upar buy order lagate hain ya low of the flag ke neechay sell order lagate hain, stop loss swing low ke neechay ya swing high ke upar lagaya jata hai.

Dusra trading strategy yeh hoti hai ke flag ke andar pullback ki wait ki jati hai aur phir trend ki direction mein trade enter kiya jata hai. Traders Fibonacci retracement levels ya moving averages ka istemal kar sakte hain, support ya resistance levels identify karne ke liye trade enter karne ke liye.

POTENTIAL PITFALLS AND CHALLENGES :

High Tight Flag Chart Pattern bahut effective ho sakti hai, lekin traders ko iss pattern ke saath judi mumkinati pareshaniyon aur challenges ke bare mein bhi pata hona chahiye. False breakouts aur whipsaws amooman hoti hain, khas kar bazaar ki volatility ke samay mein. Traders ko strict risk management techniques ko implement karna chahiye, jaise ki sahi stop losses aur position sizing ka istemal, taaki nuksan ki sambhavna ko kam kiya ja sake.

Iske saath hi bazaar ki hali aur dusre factors ko bhi ghor se dekhna zaroori hai, jinhone pattern ki kefiyat ko asar andaz karna hai. Khabar mulakaat, maali deta jaari hone aur siyasi masail bhi bazaar ki rawayat par asar andaaz kar saktay hain aur pattern ko batil kar saktay hain.

EXAMPLES OF THE HIGH TIGHT FLAG CHART PATTERN :

High Tight Flag Chart Pattern ko aur behtar samajhne ke liye, ek kalpanik udaaharan par chalte hain. Soch lijiye ek currency pair mein taiz tareen bhaari upswings hoti hai, jis mein keval chand dinon mein 200 pips upar jata hai. Iske baad bazaar consolidation phase mein dakhil hota hai aur ek 50 pips ki range mein flag banata hai. Kuch dino ki consolidation ke baad keemat flag se bahar nikal jati hai aur upar ki taraf jaari rehti hai, jis se 150 pips ka upswing hasil hota hai.

Ikhtetam mein, High Tight Flag Chart Pattern forex market mein taqatwar continuation pattern hai. Traders iss pattern ka istemal kar ke market mein maujood prevailing trend ki taraf trades ke liye mumkin maqaamat pehchan saktay hain. Pattern ke khasosiyat aur potenial masail ko samajh kar, traders apni trading strategies ko behtar banakar aur kamiyabi ke chances ko barha saktay hain.

تبصرہ

Расширенный режим Обычный режим