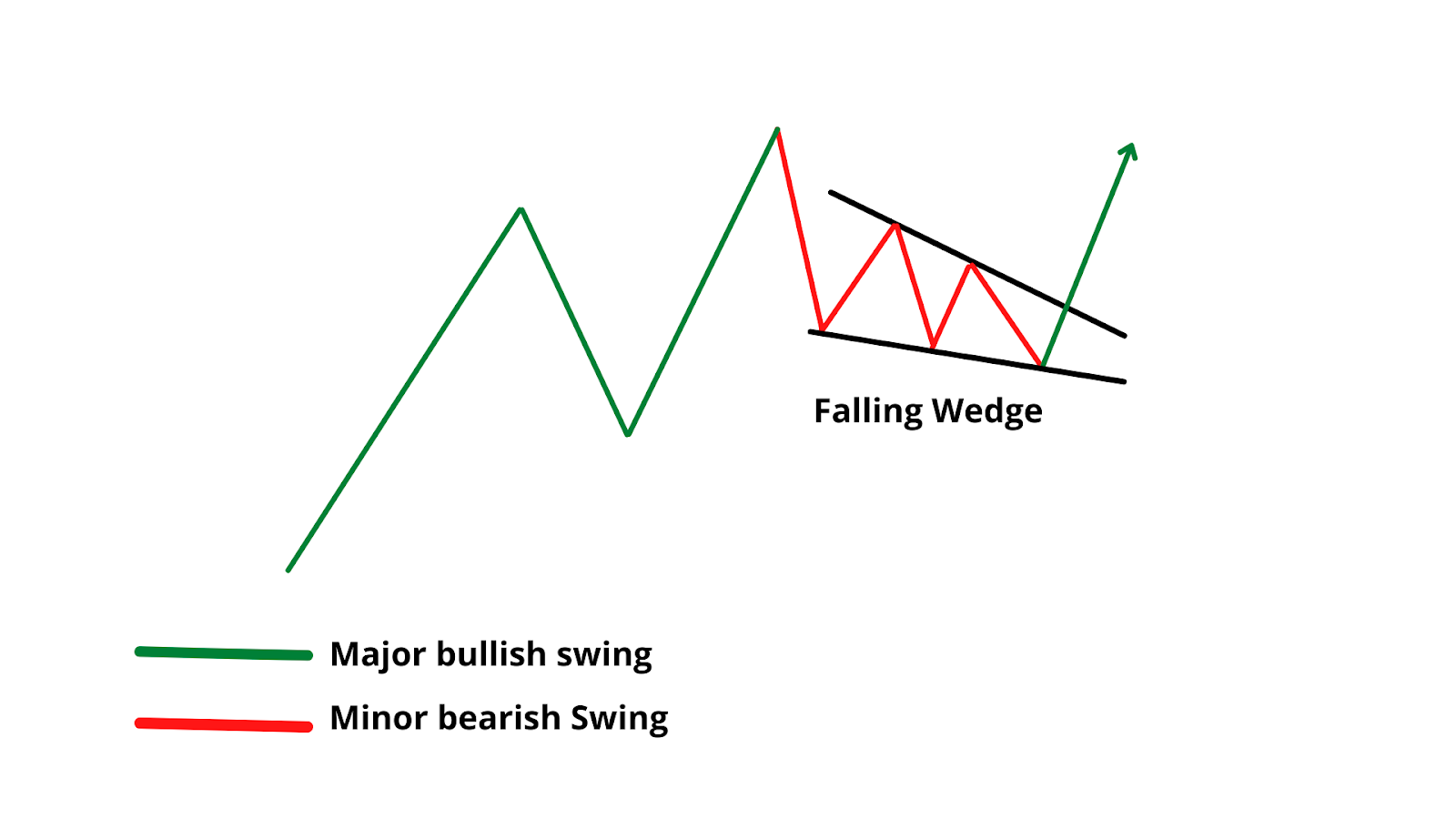

DEFINITION OF THE FALLING WEDGE PATTERN :

Forex trading mein, Falling Wedge Pattern hai jab price action do trendlines ke beech consolidate hoti hai, jisse ek neeche ki taraf mudne wala wedge shape banta hai. Upper trendline ek neeche ki aur slope wali resistance line hoti hai, jabki lower trendline ek tezi se oopar ki taraf slope wali support line hoti hai. Is pattern mein bechne wala dabav kam hota hai aur buyers apna control badha rahe hote hain, isliye ye ek bullish indication hai.

Traders often Falling Wedge pattern ko ek potential bullish opportunity ke signal ke roop mein dekhte hain. Jab price upper trendline se bahar nikalti hai, to ye bullish trend aur long positions ke liye potential entry point ki tasdiq samjhi jati hai. Isko confirm karne ke liye breakout mein trading volume ka bhi badhna chahiye.

CHARACTERISTICS AND FORMATION OF THE FALLING WEDGE PATTERN :

Is pattern ka formation kuchh weeks se lekar kuchh months ka time period tak ho sakta hai, jisse timeframe par depend karta hai. Is dauran, price action trendlines ke beech consolidate hoti hai, jisse wedge shape ban jata hai.

Ek characteristic of the Falling Wedge pattern yeh hai ki har successive high aur low kam hona chahiye. Isse pata chalta hai ki range narrow ho rahi hai aur selling pressure kam ho rahi hai. Upward sloping support line dikhata hai ki buyers dominant ho rahe hain aur gradual tarike se price ko upar push kar rahe hain.

Falling Wedge pattern ki ek important characteristic hai ki volume pattern ke formation ke sath-sath kam hoti hai. Ye trader ki kam ruchi ya participation ka sanket hai aur breakout ka potential signal bhi ho sakta hai. Pattern ko analyze karte samay traders ko volume par dhyan dena chahiye, kyunki breakout ideally trading activity mein badhne ke sath hona chahiye.

IMPORTANCE OF VOLUME CONFIRMATION IN THE FALLING WEDGE PATTERN :

Jaisa ki pehle bhi kaha gaya hai, volume confirmation Falling Wedge pattern ko analyze karte samay dhyan dene ki zaroorat hai. Upper trendline se breakout hone par trading volume ka increase dekhna bahut zaroori hai.

Volume traders ko breakout ki strength aur bullish move ke potential follow-through ka indication deta hai. High volume ke saath breakout strong buyers ki interest ka signal hai aur sustained uptrend ki probability ko badhata hai.

Dusri taraf, agar breakout low volume par hota hai ya volume mein koi increase na ho, toh ye false breakout ya buyers ki conviction ki kami ka sanket ho sakta hai. Traders ko Falling Wedge pattern par base karke position lete samay volume confirmation ka intezar karna chahiye.

TARGET AND STOP LEVELS IN THE FALLING WEDGE PATTERN :

Falling Wedge pattern ko trade karte samay, target aur stop levels ke establish karna risk aur potential rewards manage karne ke liye zaroori hai.

Target level usually breakout point se wedge pattern ki height ka measurement karke aur use breakout ki direction mein project karke determine kiya jata hai. Traders is measurement ko use karke profit targets set kar sakte hain aur trade se bahar nikal sakte hain jab price projected target tak pahunchti hai.

Stop levels lower trendline ya recent swing low se neeche set kiye jana chahiye. Isse traders potential false breakouts aur reversals se protect ho sakte hain. Stop level ko bahut tight set karne se premature exits ho sakte hain, jabki bahut wide set karne se bade nuksan ka exposure ho sakta hai.

TRADING STRATEGIES FOR THE FALLING WEDGE PATTERN :

Falling Wedge pattern ko trade karte samay traders kuchh alag strategies use kar sakte hain. Ek strategy ye hai ki price upper trendline se breakout hone par long position le. Ismein confirmation ke liye trading volume ka increase hona chahiye. Traders profit targets set kar sakte hain wedge pattern ki projected height par aur stop ko lower trendline ya recent swing low ke neeche rakhsakte hain.

Dusri strategy ye hai ki breakout level ki retest pe trade me enter hona. Kuch traders breakout level pe pullback ka wait karte hain, phir long position me enter hote hain. Isse trade ke success ke chances badh sakte hain aur risk-to-reward ratio bhi improve ho sakta hai. Lekin agar price significant pullback ke bina rally karti hai, to initial move miss karne ka risk hota hai.

Overall, Falling Wedge pattern ek bullish chart pattern hai jo uptrend ka continuation signal karta hai. Traders ke liye mahatvapurna hai ki pattern ko caution se analyze kare aur volume se confirmation ka wait kare, phir position enter kare. Target aur stop levels establish karna trading ke risk aur potential rewards ko manage karne ke liye crucial hota hai jab is pattern ko trade kiya ja raha hai.

Forex trading mein, Falling Wedge Pattern hai jab price action do trendlines ke beech consolidate hoti hai, jisse ek neeche ki taraf mudne wala wedge shape banta hai. Upper trendline ek neeche ki aur slope wali resistance line hoti hai, jabki lower trendline ek tezi se oopar ki taraf slope wali support line hoti hai. Is pattern mein bechne wala dabav kam hota hai aur buyers apna control badha rahe hote hain, isliye ye ek bullish indication hai.

Traders often Falling Wedge pattern ko ek potential bullish opportunity ke signal ke roop mein dekhte hain. Jab price upper trendline se bahar nikalti hai, to ye bullish trend aur long positions ke liye potential entry point ki tasdiq samjhi jati hai. Isko confirm karne ke liye breakout mein trading volume ka bhi badhna chahiye.

CHARACTERISTICS AND FORMATION OF THE FALLING WEDGE PATTERN :

Is pattern ka formation kuchh weeks se lekar kuchh months ka time period tak ho sakta hai, jisse timeframe par depend karta hai. Is dauran, price action trendlines ke beech consolidate hoti hai, jisse wedge shape ban jata hai.

Ek characteristic of the Falling Wedge pattern yeh hai ki har successive high aur low kam hona chahiye. Isse pata chalta hai ki range narrow ho rahi hai aur selling pressure kam ho rahi hai. Upward sloping support line dikhata hai ki buyers dominant ho rahe hain aur gradual tarike se price ko upar push kar rahe hain.

Falling Wedge pattern ki ek important characteristic hai ki volume pattern ke formation ke sath-sath kam hoti hai. Ye trader ki kam ruchi ya participation ka sanket hai aur breakout ka potential signal bhi ho sakta hai. Pattern ko analyze karte samay traders ko volume par dhyan dena chahiye, kyunki breakout ideally trading activity mein badhne ke sath hona chahiye.

IMPORTANCE OF VOLUME CONFIRMATION IN THE FALLING WEDGE PATTERN :

Jaisa ki pehle bhi kaha gaya hai, volume confirmation Falling Wedge pattern ko analyze karte samay dhyan dene ki zaroorat hai. Upper trendline se breakout hone par trading volume ka increase dekhna bahut zaroori hai.

Volume traders ko breakout ki strength aur bullish move ke potential follow-through ka indication deta hai. High volume ke saath breakout strong buyers ki interest ka signal hai aur sustained uptrend ki probability ko badhata hai.

Dusri taraf, agar breakout low volume par hota hai ya volume mein koi increase na ho, toh ye false breakout ya buyers ki conviction ki kami ka sanket ho sakta hai. Traders ko Falling Wedge pattern par base karke position lete samay volume confirmation ka intezar karna chahiye.

TARGET AND STOP LEVELS IN THE FALLING WEDGE PATTERN :

Falling Wedge pattern ko trade karte samay, target aur stop levels ke establish karna risk aur potential rewards manage karne ke liye zaroori hai.

Target level usually breakout point se wedge pattern ki height ka measurement karke aur use breakout ki direction mein project karke determine kiya jata hai. Traders is measurement ko use karke profit targets set kar sakte hain aur trade se bahar nikal sakte hain jab price projected target tak pahunchti hai.

Stop levels lower trendline ya recent swing low se neeche set kiye jana chahiye. Isse traders potential false breakouts aur reversals se protect ho sakte hain. Stop level ko bahut tight set karne se premature exits ho sakte hain, jabki bahut wide set karne se bade nuksan ka exposure ho sakta hai.

TRADING STRATEGIES FOR THE FALLING WEDGE PATTERN :

Falling Wedge pattern ko trade karte samay traders kuchh alag strategies use kar sakte hain. Ek strategy ye hai ki price upper trendline se breakout hone par long position le. Ismein confirmation ke liye trading volume ka increase hona chahiye. Traders profit targets set kar sakte hain wedge pattern ki projected height par aur stop ko lower trendline ya recent swing low ke neeche rakhsakte hain.

Dusri strategy ye hai ki breakout level ki retest pe trade me enter hona. Kuch traders breakout level pe pullback ka wait karte hain, phir long position me enter hote hain. Isse trade ke success ke chances badh sakte hain aur risk-to-reward ratio bhi improve ho sakta hai. Lekin agar price significant pullback ke bina rally karti hai, to initial move miss karne ka risk hota hai.

Overall, Falling Wedge pattern ek bullish chart pattern hai jo uptrend ka continuation signal karta hai. Traders ke liye mahatvapurna hai ki pattern ko caution se analyze kare aur volume se confirmation ka wait kare, phir position enter kare. Target aur stop levels establish karna trading ke risk aur potential rewards ko manage karne ke liye crucial hota hai jab is pattern ko trade kiya ja raha hai.

تبصرہ

Расширенный режим Обычный режим