Stick Sandwich Pattern:

Stick Sandwich ek aham candlestick pattern hai jo forex aur stocks market mein istemal hota hai. Yeh pattern traders ko market mein hone wale mawafiqat aur tabdiliyon ko samajhne mein madad karta hai. Is post mein, hum Stick Sandwich pattern ke bare mein tafseel se baat karenge aur samjheinge ke iska trading mein istemal kaise kiya ja sakta hai.

Stick Sandwich Pattern Kya Hai:

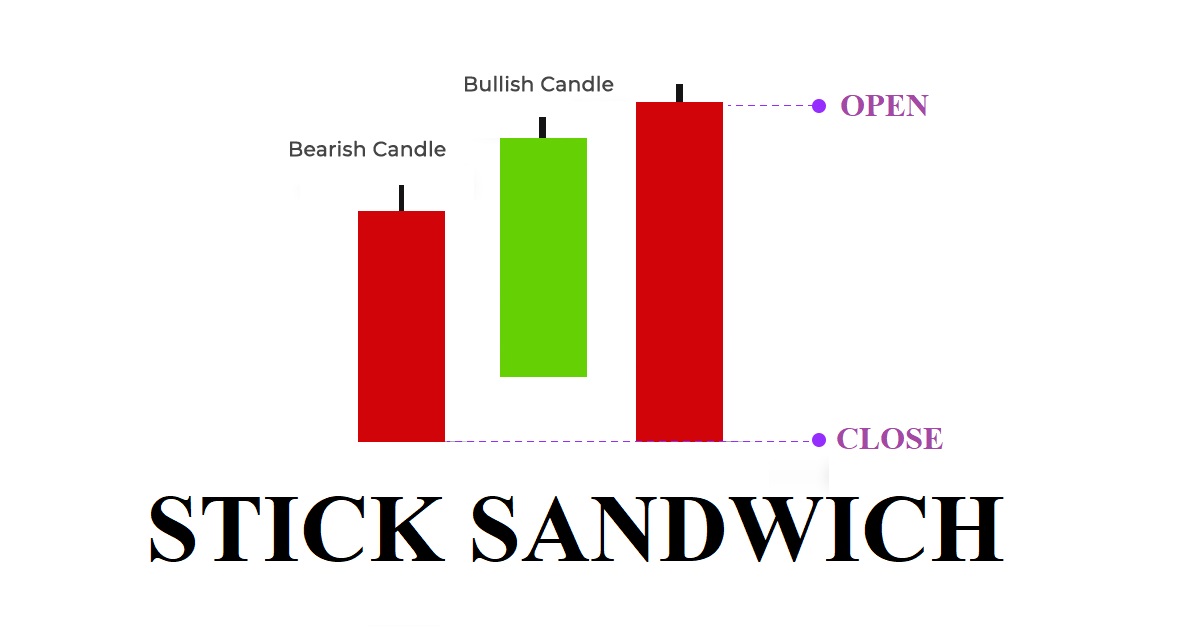

Stick Sandwich pattern ek reversal pattern hai, jo bearish trend ke baad aata hai aur bullish reversal ko darust karti hai. Is pattern mein teen consecutive candlesticks hote hain.

Pehli Candlestick (Bearish):

Stick Sandwich pattern ki shuruaat ek bearish candlestick se hoti hai. Yeh candlestick market mein selling pressure ko dikhata hai aur downtrend ko indicate karta hai.

Doosri Candlestick (Bullish):

Doosri candlestick ek small, bullish candlestick hoti hai, jo pehli ki range ke andar hoti hai. Yeh candlestick market mein confusion ya indecision ko represent karta hai.

Teessri Candlestick (Bearish):

Stick Sandwich pattern ki teessri candlestick phir se ek bearish candlestick hoti hai, jo pehli ki tarah selling pressure ko dikhata hai.

Trend Ki Pehchan:

Sabse pehle, trader ko market ke trend ko identify karna zaroori hai. Stick Sandwich pattern bearish trend ke baad aata hai, is liye pehle confirm karein ke market mein downtrend hai.

Stick Sandwich Ki Pehchan:

Phir, trader ko Stick Sandwich pattern ki pehchan karni chahiye. Pehli candlestick bearish hoti hai, doosri bullish aur teessri phir se bearish. Doosri candlestick ki range pehli ki andar hoti hai, jo ke indecision ko darust karti hai.

Confirmation Signals:

Stick Sandwich pattern ko confirm karne ke liye, trader ko doosre technical indicators aur tools ka bhi istemal karna chahiye. Jaise ke RSI (Relative Strength Index) ya MACD (Moving Average Convergence Divergence).

Entry Aur Exit Points:

Agar Stick Sandwich pattern confirm ho jata hai, toh trader entry aur exit points decide kar sakte hain. Agar yeh pattern uptrend ka indication deta hai, toh trader long position le sakta hai. Wahi agar downtrend ka indication hai, toh short position lena ek option ho sakta hai.

Risk Management:

Stick Sandwich pattern ke istemal mein risk management ka khayal rakhna zaroori hai. Stop-loss orders ka istemal karke trader apni position ko hifazati taur par handle kar sakte hain.

Reversal Signals:

Stick Sandwich pattern bearish trend ke reversal ko darust karta hai. Iske zariye, trader ko pata chalta hai ke market mein trend change hone ka khatra hai aur woh apne trading strategy ko adjust kar sakte hain.

Confidence Building:

Stick Sandwich pattern ki confirmation ke baad, trader apne decisions par ziada bharosa karta hai. Is pattern ka istemal karke, trader market ke mawafiqat ko samajhne mein mahir ho jata hai.

Short-Term Trading:

Stick Sandwich pattern ko short-term trading ke liye bhi istemal kiya ja sakta hai. Is pattern ka asar tez hota hai aur isse short-term traders ko bhi faida ho sakta hai.

Combining with Other Patterns:

Stick Sandwich pattern ko doosre technical analysis tools aur patterns ke sath combine karke bhi istemal kiya ja sakta hai. Isse trading signals aur strong ho sakte hain.

Stick Sandwich pattern ek powerful reversal signal hai jo traders ko market ke mawafiqat aur tabdiliyon ko samajhne mein madad karta hai. Lekin, har trading decision se pehle, trader ko doosre factors aur market conditions ka bhi khayal rakhna zaroori hai. Stick Sandwich pattern ke sath hifazati tijarat aur sahi risk management ke sath, traders is pattern ka behtareen istemal kar sakte hain.

Stick Sandwich ek aham candlestick pattern hai jo forex aur stocks market mein istemal hota hai. Yeh pattern traders ko market mein hone wale mawafiqat aur tabdiliyon ko samajhne mein madad karta hai. Is post mein, hum Stick Sandwich pattern ke bare mein tafseel se baat karenge aur samjheinge ke iska trading mein istemal kaise kiya ja sakta hai.

Stick Sandwich Pattern Kya Hai:

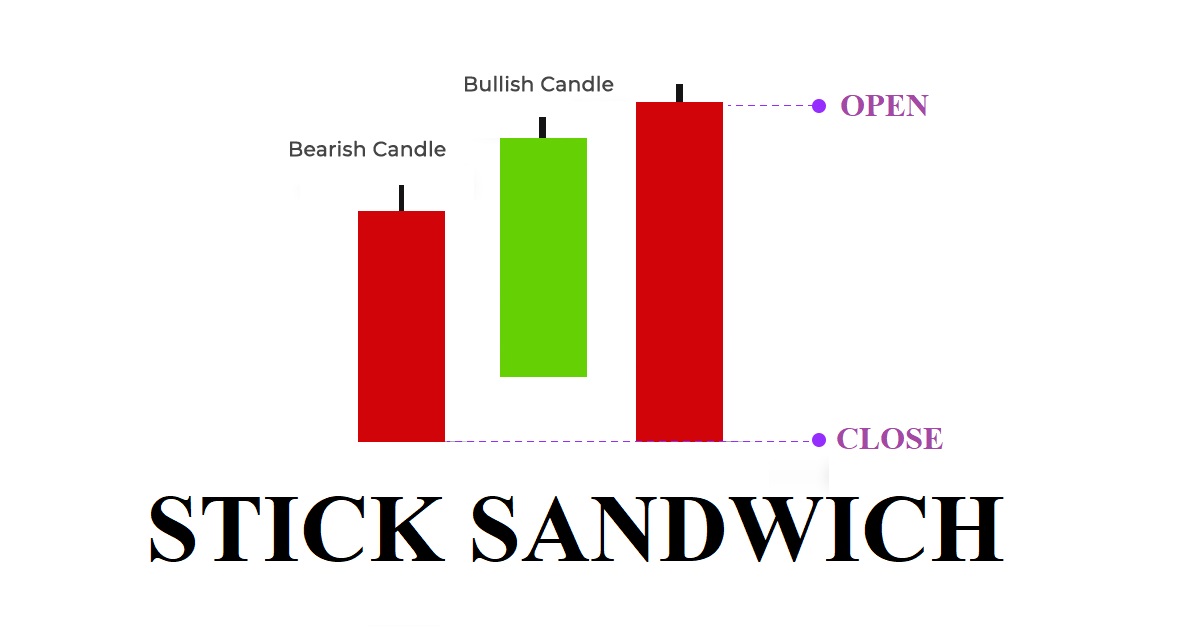

Stick Sandwich pattern ek reversal pattern hai, jo bearish trend ke baad aata hai aur bullish reversal ko darust karti hai. Is pattern mein teen consecutive candlesticks hote hain.

Pehli Candlestick (Bearish):

Stick Sandwich pattern ki shuruaat ek bearish candlestick se hoti hai. Yeh candlestick market mein selling pressure ko dikhata hai aur downtrend ko indicate karta hai.

Doosri Candlestick (Bullish):

Doosri candlestick ek small, bullish candlestick hoti hai, jo pehli ki range ke andar hoti hai. Yeh candlestick market mein confusion ya indecision ko represent karta hai.

Teessri Candlestick (Bearish):

Stick Sandwich pattern ki teessri candlestick phir se ek bearish candlestick hoti hai, jo pehli ki tarah selling pressure ko dikhata hai.

Stick Sandwich Pattern Ka Tareeqa

Trend Ki Pehchan:

Sabse pehle, trader ko market ke trend ko identify karna zaroori hai. Stick Sandwich pattern bearish trend ke baad aata hai, is liye pehle confirm karein ke market mein downtrend hai.

Stick Sandwich Ki Pehchan:

Phir, trader ko Stick Sandwich pattern ki pehchan karni chahiye. Pehli candlestick bearish hoti hai, doosri bullish aur teessri phir se bearish. Doosri candlestick ki range pehli ki andar hoti hai, jo ke indecision ko darust karti hai.

Confirmation Signals:

Stick Sandwich pattern ko confirm karne ke liye, trader ko doosre technical indicators aur tools ka bhi istemal karna chahiye. Jaise ke RSI (Relative Strength Index) ya MACD (Moving Average Convergence Divergence).

Entry Aur Exit Points:

Agar Stick Sandwich pattern confirm ho jata hai, toh trader entry aur exit points decide kar sakte hain. Agar yeh pattern uptrend ka indication deta hai, toh trader long position le sakta hai. Wahi agar downtrend ka indication hai, toh short position lena ek option ho sakta hai.

Risk Management:

Stick Sandwich pattern ke istemal mein risk management ka khayal rakhna zaroori hai. Stop-loss orders ka istemal karke trader apni position ko hifazati taur par handle kar sakte hain.

Stick Sandwich Pattern Ka Istemal

Reversal Signals:

Stick Sandwich pattern bearish trend ke reversal ko darust karta hai. Iske zariye, trader ko pata chalta hai ke market mein trend change hone ka khatra hai aur woh apne trading strategy ko adjust kar sakte hain.

Confidence Building:

Stick Sandwich pattern ki confirmation ke baad, trader apne decisions par ziada bharosa karta hai. Is pattern ka istemal karke, trader market ke mawafiqat ko samajhne mein mahir ho jata hai.

Short-Term Trading:

Stick Sandwich pattern ko short-term trading ke liye bhi istemal kiya ja sakta hai. Is pattern ka asar tez hota hai aur isse short-term traders ko bhi faida ho sakta hai.

Combining with Other Patterns:

Stick Sandwich pattern ko doosre technical analysis tools aur patterns ke sath combine karke bhi istemal kiya ja sakta hai. Isse trading signals aur strong ho sakte hain.

Stick Sandwich pattern ek powerful reversal signal hai jo traders ko market ke mawafiqat aur tabdiliyon ko samajhne mein madad karta hai. Lekin, har trading decision se pehle, trader ko doosre factors aur market conditions ka bhi khayal rakhna zaroori hai. Stick Sandwich pattern ke sath hifazati tijarat aur sahi risk management ke sath, traders is pattern ka behtareen istemal kar sakte hain.

تبصرہ

Расширенный режим Обычный режим