INTRODUCTION TO THE STICK SANDWICH PATTERN IN FOREX:

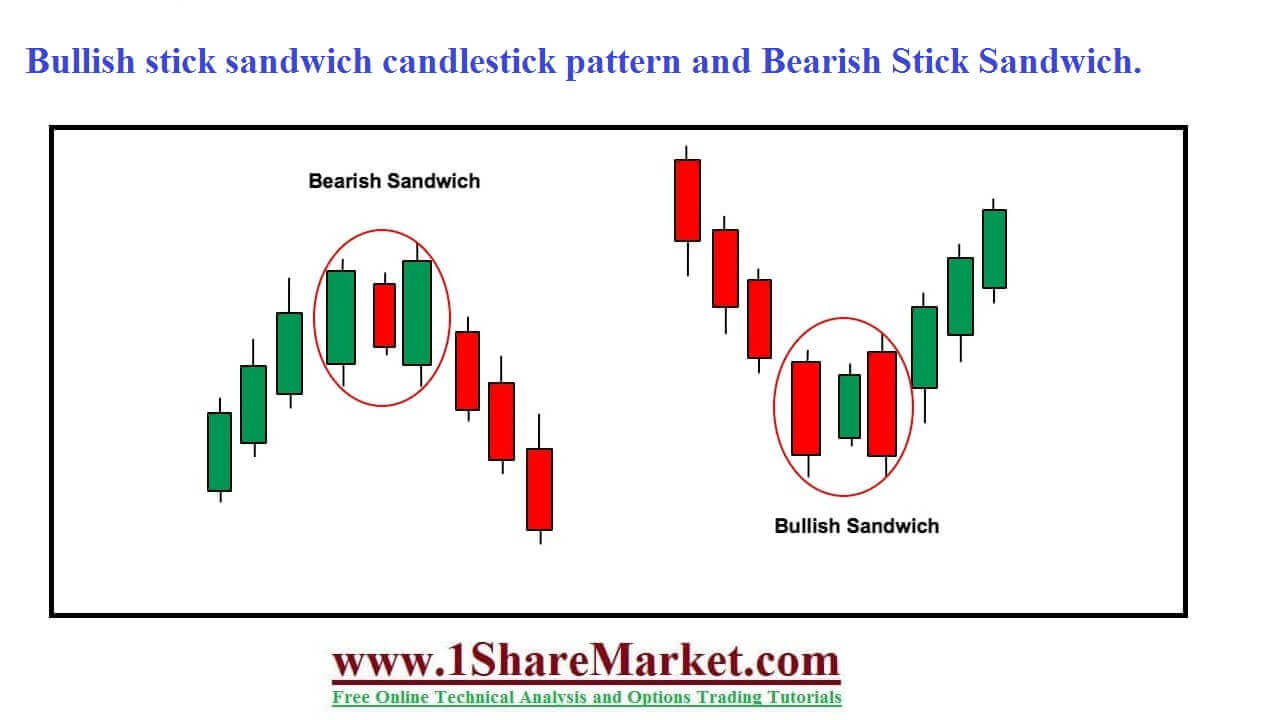

Forex market mein Stick Sandwich Pattern ek popular candlestick reversal pattern hai jise traders potential trends ko identify karne ke liye istemal karte hain. Is pattern mein teen candlesticks hote hain, jisme do chote candlesticks ek bade candlestick ke beech hote hain. Isko "sandwich" isliye kaha jata hai kyunki do chote candlesticks bade candlestick ke beech ki price action ko represent karte hain.

Stick Sandwich Pattern zyadatar market consolidations ya trend reversals ke waqt dekha jata hai. Jab ye pattern downtrend ke baad banega to ise bullish reversal pattern mana jata hai, jisse market sentiment bearish se bullish ki taraf change hone ka potential show hota hai.

IDENTIFYING THE STICK SANDWICH PATTERN:

Stick Sandwich Pattern ko identify karne ke liye traders ko nimnlikhit characteristics par dhyan dena chahiye:

1. Downtrend: Ye pattern zyadatar ek prolonged downtrend ke baad banega, jisse market direction mein potential reversal ka indication hota hai.

2. Pehla candlestick: Pattern mein pehla candlestick bearish candle hota hai jo ongoing downtrend ko continue karta hai.

3. Beech wala candlestick: Beech wala candlestick bullish candle hota hai jo pehle candlestick ke high se upar open hota hai lekin pehle candlestick ke high se upar close nahi hota hai.

4. Antim candlestick: Antim candlestick bearish candle hota hai jo beech wale candlestick ke close se niche open hota hai lekin pehle candlestick ke high se upar close hota hai.

5. Confirmation: Stick Sandwich Pattern ko confirm karne ke liye traders ko ek bullish candle ka wait karna chahiye jo pattern ke baad form hoti hai aur potential trend reversal ka indication karta hai.

TRADING THE STICK SANDWICH PATTERN:

Stick Sandwich Pattern identify hone ke baad, traders potential trend reversal ka faayda utha sakte hain aur long position enter kar sakte hain. Yahaan par bataya gaya hai ki kaise:

1. Entry: Traders Stick Sandwich Pattern ke baad form hone wali bullish candle ke high ke upar long position enter kar sakte hain. Ye potential trend reversal ko confirm karta hai aur ek favorable entry point offer karta hai.

2. Stop loss: Risk ko manage karne ke liye, traders ko Stick Sandwich Pattern ke low ke niche stop loss place karna chahiye. Isse pattern trend reversal result na hone ki surat mein nuksan limit mein rahega.

3. Target: Traders target set kar sakte hain previous resistance level ko identify karke ya trailing stop ka istemal karke potential uptrend ko ride karne ke liye.

STICK SANDWICH PATTERN VARIATIONS:

Stick Sandwich Pattern ki basic form teen candlesticks se define hoti hai jaisa ki upar bataya gaya hai, lekin traders apne trading strategies ko enhance karne ke liye variations ko bhi dekh sakte hain. Ye variations include karte hain:

1. Multiple Stick Sandwich: Ye variation do ya usse zyada Stick Sandwich Patterns ke consecutive form hone ko represent karta hai, jisse strong potential reversal ka indication hota hai.

2. High-Volume Stick Sandwich: Agar Stick Sandwich Pattern higher-than-average trading volume ke saath form hota hai, to ye strong market participation ko suggest karta hai aur pattern ki reliability ko increase karta hai.

STICK SANDWICH PATTERN CONSIDERATIONS:

Stick Sandwich Pattern potential trend reversals ko identify karne mein useful tool ho sakta hai, lekin kuch key points ko consider karna important hai:

1. Confirmation: Traders ko hamesha pattern ke baad form hone wali bullish candle jaise confirmation signal ka wait karna chahiye. Isse false signals se bacha ja sakta hai aur pattern ki reliability ko increase kiya ja sakta hai.

2. Market Context: Traders ko overall market context ko consider karna chahiye, jisme higher timeframes, support and resistance levels aur fundamental factors shamil hote hain, Stick Sandwich Pattern ki validity ko determine karne ke liye.

3. Risk Prabandhan: Kisi bhi pattern ki trading karte waqt sahi risk prabandhan bahut mahatvapurna hai. Traders ko hamesha surakshit stop losses ka upyog karna chahiye aur unke risk sehne ki shamta ke anusar position size ka prabandhan karna chahiye.

Saransh mein, Stick Sandwich pattern forex trading mein ek lokpriya candlestick reversal pattern hai. Iske gun aur alagavon ko samajhkar, traders sambhav trend badlavon ko sahi tarike se pehchaan sakte hai aur upyogi trading avasar ka fayda utha sakte hai. Halaanki, Stick Sandwich pattern ke saath saavdhani baratna aur dusre takneeki aur moolbhavnaatmak tatvon ko bhi dhyan mein rakhna mahatvapurna hai, jisse samajhdaar trading nirnay liya ja sake.

Forex market mein Stick Sandwich Pattern ek popular candlestick reversal pattern hai jise traders potential trends ko identify karne ke liye istemal karte hain. Is pattern mein teen candlesticks hote hain, jisme do chote candlesticks ek bade candlestick ke beech hote hain. Isko "sandwich" isliye kaha jata hai kyunki do chote candlesticks bade candlestick ke beech ki price action ko represent karte hain.

Stick Sandwich Pattern zyadatar market consolidations ya trend reversals ke waqt dekha jata hai. Jab ye pattern downtrend ke baad banega to ise bullish reversal pattern mana jata hai, jisse market sentiment bearish se bullish ki taraf change hone ka potential show hota hai.

IDENTIFYING THE STICK SANDWICH PATTERN:

Stick Sandwich Pattern ko identify karne ke liye traders ko nimnlikhit characteristics par dhyan dena chahiye:

1. Downtrend: Ye pattern zyadatar ek prolonged downtrend ke baad banega, jisse market direction mein potential reversal ka indication hota hai.

2. Pehla candlestick: Pattern mein pehla candlestick bearish candle hota hai jo ongoing downtrend ko continue karta hai.

3. Beech wala candlestick: Beech wala candlestick bullish candle hota hai jo pehle candlestick ke high se upar open hota hai lekin pehle candlestick ke high se upar close nahi hota hai.

4. Antim candlestick: Antim candlestick bearish candle hota hai jo beech wale candlestick ke close se niche open hota hai lekin pehle candlestick ke high se upar close hota hai.

5. Confirmation: Stick Sandwich Pattern ko confirm karne ke liye traders ko ek bullish candle ka wait karna chahiye jo pattern ke baad form hoti hai aur potential trend reversal ka indication karta hai.

TRADING THE STICK SANDWICH PATTERN:

Stick Sandwich Pattern identify hone ke baad, traders potential trend reversal ka faayda utha sakte hain aur long position enter kar sakte hain. Yahaan par bataya gaya hai ki kaise:

1. Entry: Traders Stick Sandwich Pattern ke baad form hone wali bullish candle ke high ke upar long position enter kar sakte hain. Ye potential trend reversal ko confirm karta hai aur ek favorable entry point offer karta hai.

2. Stop loss: Risk ko manage karne ke liye, traders ko Stick Sandwich Pattern ke low ke niche stop loss place karna chahiye. Isse pattern trend reversal result na hone ki surat mein nuksan limit mein rahega.

3. Target: Traders target set kar sakte hain previous resistance level ko identify karke ya trailing stop ka istemal karke potential uptrend ko ride karne ke liye.

STICK SANDWICH PATTERN VARIATIONS:

Stick Sandwich Pattern ki basic form teen candlesticks se define hoti hai jaisa ki upar bataya gaya hai, lekin traders apne trading strategies ko enhance karne ke liye variations ko bhi dekh sakte hain. Ye variations include karte hain:

1. Multiple Stick Sandwich: Ye variation do ya usse zyada Stick Sandwich Patterns ke consecutive form hone ko represent karta hai, jisse strong potential reversal ka indication hota hai.

2. High-Volume Stick Sandwich: Agar Stick Sandwich Pattern higher-than-average trading volume ke saath form hota hai, to ye strong market participation ko suggest karta hai aur pattern ki reliability ko increase karta hai.

STICK SANDWICH PATTERN CONSIDERATIONS:

Stick Sandwich Pattern potential trend reversals ko identify karne mein useful tool ho sakta hai, lekin kuch key points ko consider karna important hai:

1. Confirmation: Traders ko hamesha pattern ke baad form hone wali bullish candle jaise confirmation signal ka wait karna chahiye. Isse false signals se bacha ja sakta hai aur pattern ki reliability ko increase kiya ja sakta hai.

2. Market Context: Traders ko overall market context ko consider karna chahiye, jisme higher timeframes, support and resistance levels aur fundamental factors shamil hote hain, Stick Sandwich Pattern ki validity ko determine karne ke liye.

3. Risk Prabandhan: Kisi bhi pattern ki trading karte waqt sahi risk prabandhan bahut mahatvapurna hai. Traders ko hamesha surakshit stop losses ka upyog karna chahiye aur unke risk sehne ki shamta ke anusar position size ka prabandhan karna chahiye.

Saransh mein, Stick Sandwich pattern forex trading mein ek lokpriya candlestick reversal pattern hai. Iske gun aur alagavon ko samajhkar, traders sambhav trend badlavon ko sahi tarike se pehchaan sakte hai aur upyogi trading avasar ka fayda utha sakte hai. Halaanki, Stick Sandwich pattern ke saath saavdhani baratna aur dusre takneeki aur moolbhavnaatmak tatvon ko bhi dhyan mein rakhna mahatvapurna hai, jisse samajhdaar trading nirnay liya ja sake.

:max_bytes(150000):strip_icc():format(webp)/dotdash-INV-final-Stick-Sandwich-Mar-2021-01-0c123474b86a42528a609eb08d5f3700.jpg)

تبصرہ

Расширенный режим Обычный режим